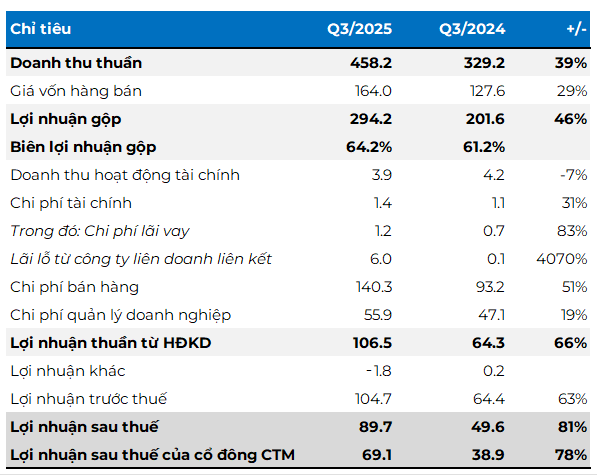

Airport service provider AST reported a remarkable Q3 2025 revenue of nearly VND 460 billion from its airport services, including lounges, duty-free shops, and restaurants, marking a 39% year-over-year increase.

This segment boasts an exceptionally high profit margin, which improved from 61.2% to 64.2% in Q3 2025.

Consequently, AST’s net profit surged by nearly 78% year-over-year, reaching over VND 69 billion.

AST’s Q3 2025 Financial Highlights

Unit: Billion VND

Source: VietstockFinance

|

These impressive results reflect the aviation industry’s post-pandemic recovery, driven by a significant increase in international visitors to Vietnam. In the first nine months of the year, Vietnam welcomed 15.4 million foreign tourists, a 21.5% increase, with China, South Korea, and the United States as the top source markets.

On the stock market, AST shares defied the downward trend, surging over 5% before settling at a nearly 3% gain, closing at VND 75,200 per share on October 30th, despite the VN-Index’s 16-point decline.

For the first nine months of 2025, AST recorded VND 1,236 billion in revenue and VND 186 billion in net profit, representing 26% and 75% year-over-year growth, respectively. These results translate to 77% of the annual revenue target and 93% of the pre-tax profit goal for 2025.

– 15:28 30/10/2025

Insider of HNA’s Board Chairman Registers Full Capital Withdrawal Following Company’s Significant Profit Announcement

Mr. Vo Dang Giap, the elder brother of Mr. Vo Trung Chinh, Chairman of the Board of Directors at Huana Hydropower Joint Stock Company (HOSE: HNA), has registered to sell his entire holding of 251,800 HNA shares. This transaction, representing 0.1% of the company’s charter capital, is scheduled to take place between November 3rd and 28th.

LIX Detergent Powder: Q3 Revenue Rises 9%, Yet Net Profit Declines, Prompting Full-Year Profit Target Revision

Lix Detergent JSC (HOSE: LIX) has released its Q3/2025 financial report, revealing a rise in revenue but a decline in net profit due to escalating cost pressures. Notably, the Board of Directors has revised downward the full-year profit target.

PAN Sets New Quarterly Revenue Record, Yet Profits Dip 16% Amid Sudden Revenue Loss

PAN Group (HOSE: PAN) concluded Q3/2025 with a record-breaking revenue of over 5,000 billion VND, yet net profit dipped 16% due to the absence of earnings from affiliated companies. Meanwhile, PAN shares surged more than 30% over the past year, aligning perfectly with Chairman Nguyen Duy Hung’s forecast of improved market pricing in 2025.