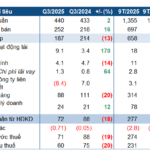

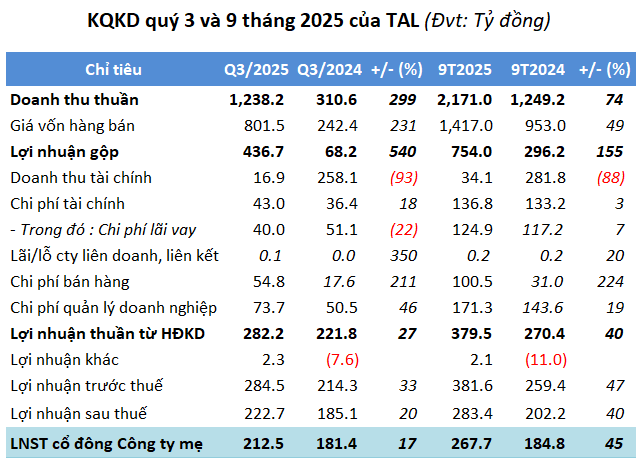

Taseco Land Joint Stock Company (Taseco Land, HOSE: TAL) concluded Q3/2025 with a remarkable surge in net revenue, reaching over 1.238 trillion VND, a fourfold increase year-over-year. With a modest rise in cost of goods sold, gross profit soared to nearly 437 billion VND, up 6.4 times. Gross profit margin expanded from 22% to 35%, marking the highest level since the company went public in 2023.

| TAL’s Business Results from Q1/2023 to Q3/2025 |

The primary driver behind TAL’s revenue growth was the first-time recognition of revenue from industrial zone (IZ) infrastructure leasing, totaling over 636 billion VND, accounting for more than 50% of total revenue.

In August of the previous year, Taseco Land commenced the construction and infrastructure development of the Dong Van 3 Supporting Industrial Zone (Taseco Dong Van 3 IZ), marking its entry into this segment.

The project spans 223 hectares with a total investment of over 2.3 trillion VND, located in Duy Tien town, Ha Nam province (now Ninh Binh province).

In March 2025, TAL approved a resolution to contribute 210 billion VND to establish Taseco Hai Phong Industrial Zone JSC, holding a 70% stake, for the Thuy Nguyen IZ – Phase 1 project. Covering 247.8 hectares in Bach Dang, Nam Trieu, and Hoa Binh wards of Hai Phong City, the project has a total investment of nearly 3.94 trillion VND.

Moving forward, Taseco Land plans to allocate resources to develop IZ infrastructure, aiming for this segment to contribute 20-30% of total revenue. By 2030, the company targets to develop 6-8 new IZs with a total land fund of over 2,500 hectares.

Returning to the report, financial revenue plummeted 93% to nearly 17 billion VND. Coupled with rising financial, selling, and administrative expenses, Q3 net profit reached just over 212 billion VND, up 20%.

In the first nine months, Taseco Land generated nearly 2.171 trillion VND in revenue and over 283 billion VND in after-tax profit, up 74% and 40% year-over-year, respectively. This performance represents 50% and 53% of the annual targets.

Source: VietstockFinance

|

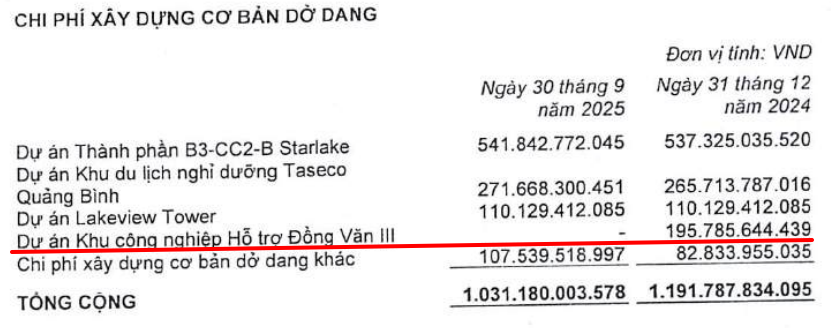

Total assets as of Q3 reached nearly 13.1 trillion VND, up 41% year-to-date. Inventory accounted for 56% of capital, totaling nearly 7.3 trillion VND, up 78%, primarily due to work-in-progress costs at real estate projects.

Construction in progress decreased 14% to over 1 trillion VND, as TAL no longer recognizes investment in the Taseco Dong Van 3 IZ project.

Source: TAL

|

Total liabilities reached nearly 6.952 trillion VND, up 36%, with financial debt at over 3.786 trillion VND, up 8%, comprising 55% of total debt. Customer advances and unearned revenue surged to nearly 1.249 trillion VND, up 7.4 times, accounting for 18% of total debt.

– 08:35 31/10/2025

REE Profits Surge 41%, Injects Hundreds of Billions into Stock Market Investments

According to the Q3/2025 financial report, Refrigeration Electrical Engineering Corporation (HOSE: REE) recorded a remarkable 41% surge in net profit, primarily driven by robust growth in its hydropower and refrigeration engineering segments.

DXS Q3 Profits Double Year-Over-Year, Secures Nearly 6 Trillion VND in Marketing and Project Distribution Deposits

Revised Introduction:

CTCP Dịch vụ Bất động sản Đất Xanh (HOSE: DXS) reported a remarkable surge in consolidated net profit for Q3, doubling year-over-year. Notably, short-term receivables reached approximately VND 10.5 trillion, with nearly VND 6 trillion attributed to deposits and advance payments for marketing and project distribution contracts.

Pharmaceutical Profits Dip: Binh Dinh Pharma’s Net Income Falls 20% Amid Rising Capital Costs and R&D Investments

Bidiphar (HOSE: DBD) has released its consolidated Q3 2025 financial report. Despite significant cost-cutting measures, the company experienced a decline in profits compared to the same period last year, primarily due to rising production costs and losses recorded from its joint ventures and associates.