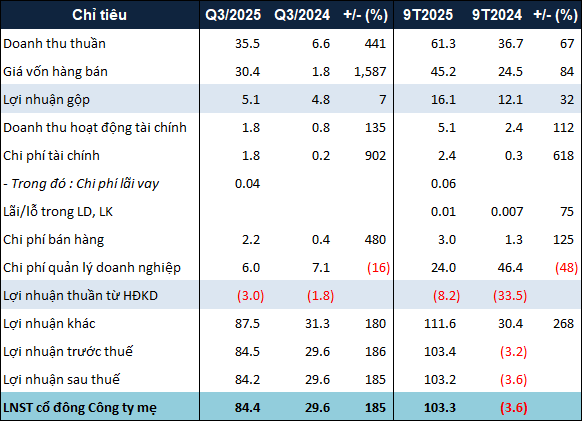

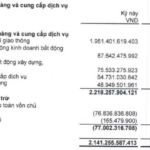

Specifically, TDH achieved a net revenue of less than 36 billion VND in Q3/2025, over five times higher than the same period last year. This includes 21.5 billion VND from the sale of goods and finished products, a category absent in the previous year.

Despite the significant revenue surge, the gross profit margin stood at only 14%, a notable decline from the 73% recorded in the same quarter of the previous year.

Just before the release of the financial statements, TDH announced its victory in an administrative lawsuit against the Ho Chi Minh City Tax Department (formerly known as Tax Agency Zone II). The case involved the company’s challenge against administrative decisions that led to the suspension of invoice usage, customs clearance for imports and exports, and the forced withdrawal of funds from the company’s bank accounts. As a result, TDH secured an additional income of 91 billion VND, contributing to a pre-tax profit of 87.5 billion VND by the end of Q3.

The net operating profit for the quarter was slightly negative at over 3 billion VND, compared to a loss of nearly 2 billion VND in the same period last year. Thanks to the substantial non-operating profit, TDH turned a profit, reporting a net profit of over 84 billion VND in Q3, nearly triple the previous year’s figure.

For the first nine months of the year, cumulative net revenue exceeded 61 billion VND, a 67% increase. However, the net operating loss was over 8 billion VND. The non-operating profit enabled TDH to achieve a net profit of more than 103 billion VND, surpassing the consolidated annual plan by 56%.

|

Consolidated business results for Q3 and the first 9 months of 2025 for TDH. Unit: Billion VND

Source: VietstockFinance

|

Despite the profit, the operating cash flow for the period was negative at over 24 billion VND, due to a pre-tax accounting loss of more than 103 billion VND in the first nine months. Investment cash flow also revealed that TDH had 30 billion VND in loans.

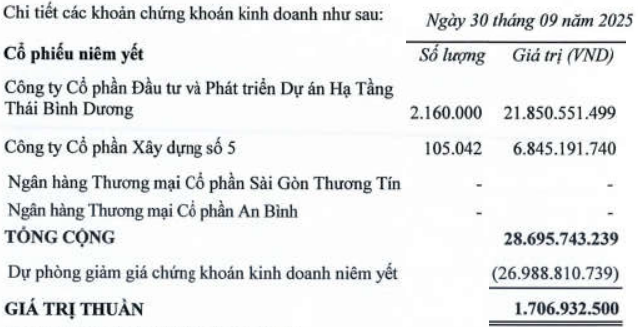

As of September 30, 2025, TDH had accumulated losses of 952.8 billion VND. Total assets remained stable at nearly 692 billion VND compared to the beginning of the year. Cash on hand decreased by almost 90%, falling to less than 5.7 billion VND. TDH also held listed equity securities worth nearly 28.7 billion VND, but with a depreciation provision of up to 27 billion VND, consistent with the beginning of the year.

Source: TDH

|

Accounts receivable remained largely unchanged from the beginning of the year, totaling nearly 70 billion VND after a bad debt provision of over 167.2 billion VND.

In Q3, TDH lent 8.5 billion VND to QT Distribution LLC. Previously, in Q2, TDH had lent 20 billion VND to HCT Express Logistics JSC.

Inventory increased by 11%, reaching nearly 254 billion VND, due to an additional inventory of over 27 billion VND from household electrical appliances and approximately 23 million VND from fruit products.

Conversely, total liabilities decreased by 16%, to over 515 billion VND. This reduction was primarily due to the decrease in late payment interest related to VAT payable to the Ho Chi Minh City Tax Department, from 91 billion VND at the beginning of the year to nearly 5 billion VND by the end of September.

TDH stated that the late payment interest was recorded from the date of VAT payment delay until the company deposited the tax amount into the temporary account of the Ministry of Public Security – Investigation Police Agency, as required by law, to facilitate the collection and verification of documents related to the 365.5 billion VND VAT refund.

|

QT Distribution LLC was established in August 2024 in Hanoi, specializing in wholesale household goods (excluding pharmaceuticals). Its charter capital is 9 billion VND, with Mr. Pham Quang Tung as the owner and Director. Similarly, HCT Express Logistics JSC has Mr. Tung as a founding shareholder with a 20% stake. The company was established in November 2024 in Hanoi, with a charter capital of 3 billion VND. Other shareholders include Ms. Nguyen Thi Mai Le (60%) and Ms. Pham Nguyen Hanh Quyen (20%). |

– 14:20 31/10/2025

DXS Q3 Profits Double Year-Over-Year, Secures Nearly 6 Trillion VND in Marketing and Project Distribution Deposits

Revised Introduction:

CTCP Dịch vụ Bất động sản Đất Xanh (HOSE: DXS) reported a remarkable surge in consolidated net profit for Q3, doubling year-over-year. Notably, short-term receivables reached approximately VND 10.5 trillion, with nearly VND 6 trillion attributed to deposits and advance payments for marketing and project distribution contracts.

Pharmaceutical Profits Dip: Binh Dinh Pharma’s Net Income Falls 20% Amid Rising Capital Costs and R&D Investments

Bidiphar (HOSE: DBD) has released its consolidated Q3 2025 financial report. Despite significant cost-cutting measures, the company experienced a decline in profits compared to the same period last year, primarily due to rising production costs and losses recorded from its joint ventures and associates.

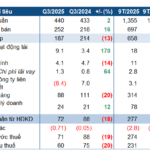

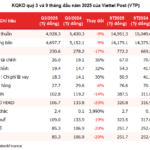

Viettel Post Reports Nearly VND 252 Billion Profit in 9 Months, Operating Cash Flow Turns Positive by Over VND 800 Billion

By the end of Q3, Viettel Post Corporation (Viettel Post, HOSE: VTP) held nearly VND 2.3 trillion in bank deposits, a 24% increase from the beginning of the year. The company’s operating cash flow turned positive, exceeding VND 800 billion, while cumulative net profit for the first nine months reached nearly VND 252 billion.

A Business Doubling Vingroup, The Gioi Di Dong, Hoa Phat’s Revenue, Pocketing Over 900 Billion VND Daily on Average

This marks the second-highest revenue in the company’s history, narrowly trailing the record set in Q1 2022.