From a $2 Billion Peak to Penny Stock Prices

Over the past decade, Trinh Van Quyet has been one of the most prominent figures on the Vietnamese stock market.

By late 2017, based on market capitalization, he surpassed Pham Nhat Vuong to become Vietnam’s wealthiest individual, primarily due to his holdings in ROS shares of FLC Faros Construction JSC.

At that time, his net worth reached 58.852 trillion VND, an increase of over 25,000 trillion VND from 2016—equivalent to approximately $2 billion.

Forbes recognized him as eligible for USD billionaire status, but due to insufficient transparency and asset stability, he was not officially listed.

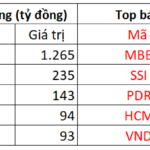

At his peak, Quyet held 135 million FLC shares, 2.6 million ART shares, and 318.5 million ROS shares. However, this success was short-lived: starting in 2018, the “FLC family” stocks plummeted, with ROS dropping from over 200,000 VND per share to just a few thousand—akin to the price of a cup of tea or a bunch of vegetables.

According to market trends, Quyet’s current securities assets are valued at around 2.3 trillion VND. During the 2024 trial, he declared that his personal assets accumulated over 20 years of entrepreneurship had dwindled to approximately 4.8–5 trillion VND.

On March 29, 2022, Quyet was arrested and charged with stock market manipulation and fraud.

During the June appellate trial, the court accepted his appeal, reducing the fraud sentence and converting the market manipulation prison term into a fine.

At the trial, Quyet compensated over 20 billion VND (1.886 trillion VND recovered). Additionally, he received leniency requests from over 100 victims and 5,000 organizations and individuals.

Recently, the Ministry of Justice confirmed that Trinh Van Quyet has fully paid all court-mandated fines and joint compensation with other defendants.

FLC Group: From Collapse to Revival

Following Trinh Van Quyet’s arrest in March 2022, FLC Group plunged into crisis: accounts were frozen, key executives resigned, and hundreds of real estate projects stalled or were revoked.

Previously, FLC owned a portfolio of nearly 300 projects nationwide, ranging from urban developments and resorts to industrial zones.

Post-collapse, projects like Hoang Long Industrial Park (Thanh Hoa), Thai Binh International Hospital, and Yen Thuy Golf Resort (Hoa Binh) were halted.

However, FLC is now showing signs of restructuring and resurgence.

In aviation, FLC has reassumed control of Bamboo Airways, its founding airline, after an unsuccessful restructuring under new investors. Chairman Le Thai Sam stated that FLC will directly manage the airline to revive its brand.

In real estate, FLC has relaunched several large-scale projects.

In June 2025, FLC introduced Hausman Premium Residences at FLC Premier Parc (Dai Mo, Hanoi), marking its return to the property market after a two-year hiatus.

In April 2025, Gia Lai Province approved FLC’s proposal to develop an airport urban area in Cat Tan (Phu Cat).

In October 2024, FLC proposed a 700-hectare golf course, villa, convention center, and entertainment complex in Quang Tri, with an estimated investment of 20 trillion VND.

FLC’s “Rebirth Milestone” Event Set to Unfold in Less Than Two Weeks After Turbulent Chapter

Following an unprecedented period of leadership turmoil and instability, FLC is beginning to signal its first steps toward a comprehensive restructuring effort. On November 11th, the conglomerate will convene an extraordinary shareholders’ meeting to seek input on critical matters.

No Information Available on Trịnh Văn Quyết’s Prison Sentence Enforcement

The Director of the Civil Judgment Enforcement Agency stated that Mr. Trịnh Văn Quyết has fully complied with all financial obligations outlined in the court ruling. However, regarding the execution of his prison sentence, the agency has no further information.