| Trung An’s Quarterly Business Results for 2024-2025 |

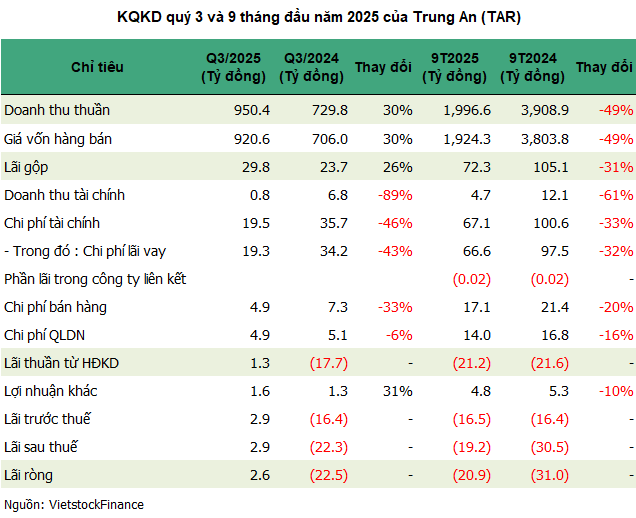

Trung An has shown signs of recovery, ending a five-quarter loss streak with a net profit of VND 2.6 billion in Q3/2025, a significant turnaround from the VND 22.5 billion loss in the same period last year. Revenue for the quarter reached over VND 950 billion, a 30% increase and the highest in the past year, with a gross profit margin maintained above 3%, typical for the rice industry.

The primary driver of this profit reversal was the substantial reduction in various expense categories. Financial costs decreased by 46% to VND 19.5 billion, while selling and administrative expenses dropped by 33% and 6%, respectively, to VND 4.9 billion each.

|

Previously, TAR struggled with high financial costs, particularly interest expenses. However, by cutting these costs by 32%, the company narrowed its nine-month net loss to nearly VND 21 billion, compared to VND 31 billion in the same period last year. Despite this, nine-month revenue fell by nearly half to under VND 1,997 billion, achieving only 48% of the annual plan and falling short of the VND 9 billion profit target. As of September 2025, the company still holds nearly VND 90 billion in undistributed after-tax profits.

Total outstanding loans at TAR as of Q3 remained above VND 1,225 billion, a slight 6% decrease from the beginning of the year, but all are short-term debts. The two largest creditors are BIDV – Mekong Delta Branch with nearly VND 588 billion and Agribank Ho Chi Minh City Branch with over VND 501 billion, along with VND 110 billion from Sacombank Can Tho Branch.

Financial Restructuring Amid Credit Challenges

In early August, Trung An’s Board of Directors approved a plan to borrow VND 190 billion from Agribank Ho Chi Minh City Branch to purchase rice for the 2025 National Reserve. The loan term is up to 4 months per delivery, depending on the contract progress.

At the 2025 Annual General Meeting, Chairman Phạm Thái Bình stated that the company is focusing on financial restructuring to reduce capital costs, the main cause of profit decline in recent years. The number of lending banks has been reduced from 7 to 2 key institutions, despite ongoing challenges in accessing capital for the rice industry.

Mr. Phạm Thái Bình – Chairman of TAR speaking at the year-end seminar in 2024 – Photo: Daibieunhandan

|

Improved Cash Flow, Yet Dependent on Receivables

In terms of assets, Trung An holds nearly VND 5 billion in cash and bank deposits, each accounting for about 50%, though this is three times the amount at the beginning of the year, it still represents only 0.2% of total assets. The largest asset is receivables, making up over 64% of total assets at VND 1,553 billion, a 10% decrease from the start of the year. Inventory increased slightly to VND 259.5 billion, comprising 7% of total assets.

Thanks to improved receivables management, Trung An’s net cash flow from operating activities turned positive at nearly VND 82 billion, compared to a negative VND 96 billion in the same period last year. However, receivables still include over VND 494 billion from Ms. Phan Thiên Trang, recorded as an advance payment for the acquisition of Tay Do Hospital, which remains legally incomplete.

After years of financial crisis and audit issues that restricted stock trading, Trung An is working to resolve disputes between the old and new audit firms to rectify the situation this year.

On October 31, TAR shares rose over 2% to VND 4,700 per share after announcing a return to profitability, up 27% over the past year. However, in the last three months, the stock has lost about 24% of its value, and compared to its peak of nearly VND 41,000 per share in late 2021, TAR has lost nearly 90% of its market capitalization.

| TAR Stock Price Movement Over the Past Year |

– 15:58 31/10/2025

“Industry Leader” in Textiles Surpasses $500 Billion Quarterly Revenue for the First Time, Achieving 3-Year Profit Peak

For the first time, Q3 revenue surpassed the VND 5,000 billion mark, while profits from associated companies soared by 84%, enabling Vietnam Textile and Garment Group (Vinatex, UPCoM: VGT) to record its highest net profit in three years.

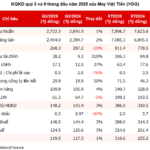

Viet Tien Garment Reaches 7-Year Profit Peak Fueled by Financial Segment and Accelerating Affiliate Gains

Vietnam Garment Manufacturing Corporation (UPCoM: VGG) reported its highest quarterly profit since 2019 in Q3, driven by a 310% surge in financial revenue and a 50% increase in associate profits year-over-year. This stellar performance propelled the company’s nine-month results 18% above its annual target.

May 10 Reports Q3 Profits Surging 150%, Reaches Peak Profitability Since 2022

In Q3/2025, Garment Corporation No. 10 – JSC (UPCoM: M10) reported a net profit of VND 48.5 billion, a 52% increase year-over-year, matching its peak in Q4/2022. This impressive performance is attributed to significant cost-cutting measures and contributions from financial revenue.