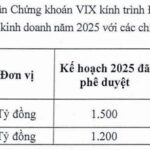

UP Securities Joint Stock Company (UPSC) has announced a resolution to implement a share offering plan for existing shareholders.

Accordingly, UPSC will offer over 32 million shares, with a rights ratio of 1:1, meaning shareholders holding 01 share are entitled to purchase an additional 01 new share.

Shareholders with purchase rights may transfer these rights only once. The recipient of the transferred rights cannot further transfer them to a third party.

The issued shares will not be subject to transfer restrictions. The offering is expected to take place in 2025, following the completion of the dividend share issuance.

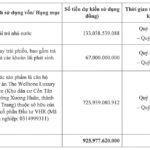

The offering price is set at 10,000 VND per share, with UPSC anticipating proceeds of 320.5 billion VND. Of this amount, 220.5 billion VND will be allocated to margin lending capital, and 100 billion VND will bolster proprietary trading activities. The implementation is scheduled for Q4/2025 – Q1/2026.

Upon completion of this offering, UPSC’s chartered capital will double from 323.7 billion VND to 644.3 billion VND.

This capital increase plan was approved at the 2nd Extraordinary General Meeting of Shareholders held on the morning of October 21, 2025.

During the meeting, UPSC shareholders also agreed to cancel the public bond issuance plan previously approved at the 2025 Annual General Meeting. Instead, they approved an alternative plan to issue up to 300 billion VND in public bonds.

Specifically, the company plans to issue a maximum of 3 million bonds, with a face value of 100,000 VND per bond. These bonds are non-convertible, unsecured, and do not include warrants, establishing a direct debt obligation for the issuer.

The bond interest rate and term will be determined by the Board of Directors. The anticipated 300 billion VND in proceeds will be allocated as follows: 50% to supplement proprietary trading and underwriting activities, and 50% for margin lending.

Previously, on October 1, 2025, UP Securities completed the issuance of 2.37 million dividend shares for the year 2024 to 103 shareholders.

The rights ratio was 25:2, meaning shareholders holding 25 shares received an additional 02 new shares. Following this issuance, the company increased its chartered capital to 323.7 billion VND.

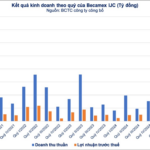

Becamex IJC Reports Highest Profit in 18 Quarters, Accelerates Growth Post-Capital Increase

Becamex IJC (HSX: IJC) has unveiled its Q3 business results, marking the most impressive performance in the last 18 quarters.

Unleash Your Business Potential: SHB Elevates Financial Foundations for Breakthrough Growth

SHB has achieved remarkable business growth in the first nine months, with pre-tax profits reaching 12,235 billion VND, a 36% increase compared to the same period last year. The bank is now strategizing to raise capital, expand its business operations, and enhance its competitive edge to accelerate growth in line with the economy.