VIB Reports Q3 2025 Financial Results: Over 7.04 Trillion VND in Profit, Up 7% Year-on-Year

Robust Growth and a Strong, Secure Balance Sheet

As of September 30, 2025, VIB’s total assets reached over 543 trillion VND, a 10% increase since the beginning of the year. Outstanding loans grew by 15% to nearly 373 trillion VND, driven by balanced contributions from three core business segments: Retail, Corporate, and Financial Institutions. In Retail, VIB continued selective credit expansion, focusing on core products like home loans, auto loans, and business loans, targeting high-quality customers with robust collateral and full legal compliance. For Corporate & Financial Institutions, VIB accelerated working capital loans, production financing, and project investment loans for reputable businesses with strong financial capabilities and sustainable growth potential.

Customer deposits grew by over 11%, reaching nearly 308 trillion VND. Notably, CASA balances and High-Yield Accounts surged by 39% year-to-date, reflecting the success of VIB’s idle cash optimization strategy. In Q3 2025, VIB launched the “Profit Duo” solution, combining High-Yield Accounts with the Smart Cashback Card under the tagline “Leading the Profit Trend.” This smart cash management solution helps customers maximize idle and spending funds, offering a combined benefit of up to 9.3%. This Profit Duo is set to revolutionize how Vietnamese leverage their capital’s earning potential.

VIB’s Profit Duo Generates Up to 9.3% Returns on Account Balances

Asset quality significantly improved in Q3, with the NPL ratio dropping to 2.45%, a 0.23% decrease from Q1, showcasing the effectiveness of VIB’s prudent credit policies. The loan portfolio remains balanced, with over 73% in Retail and SME segments, where 90% of retail loans are secured by fully compliant real estate assets in major urban areas. The remaining 27% is allocated to Corporate & Financial Institutions, primarily leading enterprises in FDI, state-owned, and private sectors.

In Q3, VIB issued a 14% bonus share, completed a 21% dividend payout in cash and shares, and maintained optimal safety ratios: CAR (Basel II) at 12.4% (vs. 8% requirement), LDR at 79% (vs. 85% limit), and NSFR at 107% (vs. 100% Basel III standard).

9-Month Profit Up 7%, Diversifying Revenue Streams

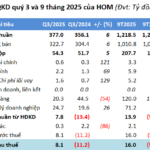

For the first nine months of 2025, VIB recorded 14.7 trillion VND in operating income and 7.04 trillion VND in pre-tax profit, up 7% year-on-year. Net interest income reached nearly 11.9 trillion VND, remaining the primary contributor as VIB expanded credit across segments with competitive rates, focusing on high-quality, collateralized customers. Aligning with government directives, VIB maintained reasonable lending rates to support economic recovery, achieving a 3.2% NIM that balances profitability and asset quality.

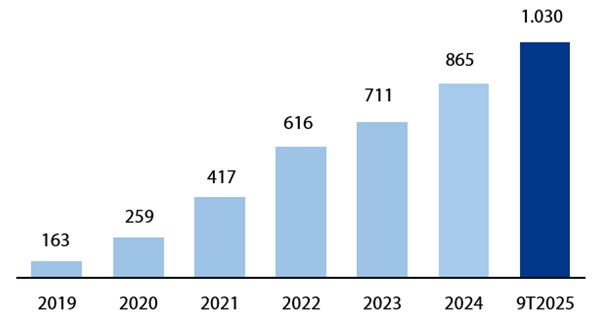

Non-interest income contributed over 19% of total revenue, driven by fees and services. As of September 30, 2025, VIB’s credit cards surpassed 1 million in circulation, with 9-month spending exceeding 104 trillion VND, up 15% year-on-year. New digital banking services—bill payments, international transfers, tuition fees, insurance—and corporate solutions also significantly boosted fee income.

Chart: VIB Credit Cards in Circulation (2019–9M2025, in Thousands)

Operating expenses remained stable at 5.46 trillion VND, thanks to process optimization and cost management. Credit risk provisions fell 31% year-on-year due to prior conservative provisioning and improved asset quality.

Building a Comprehensive Financial Ecosystem, Enhancing Customer Experience

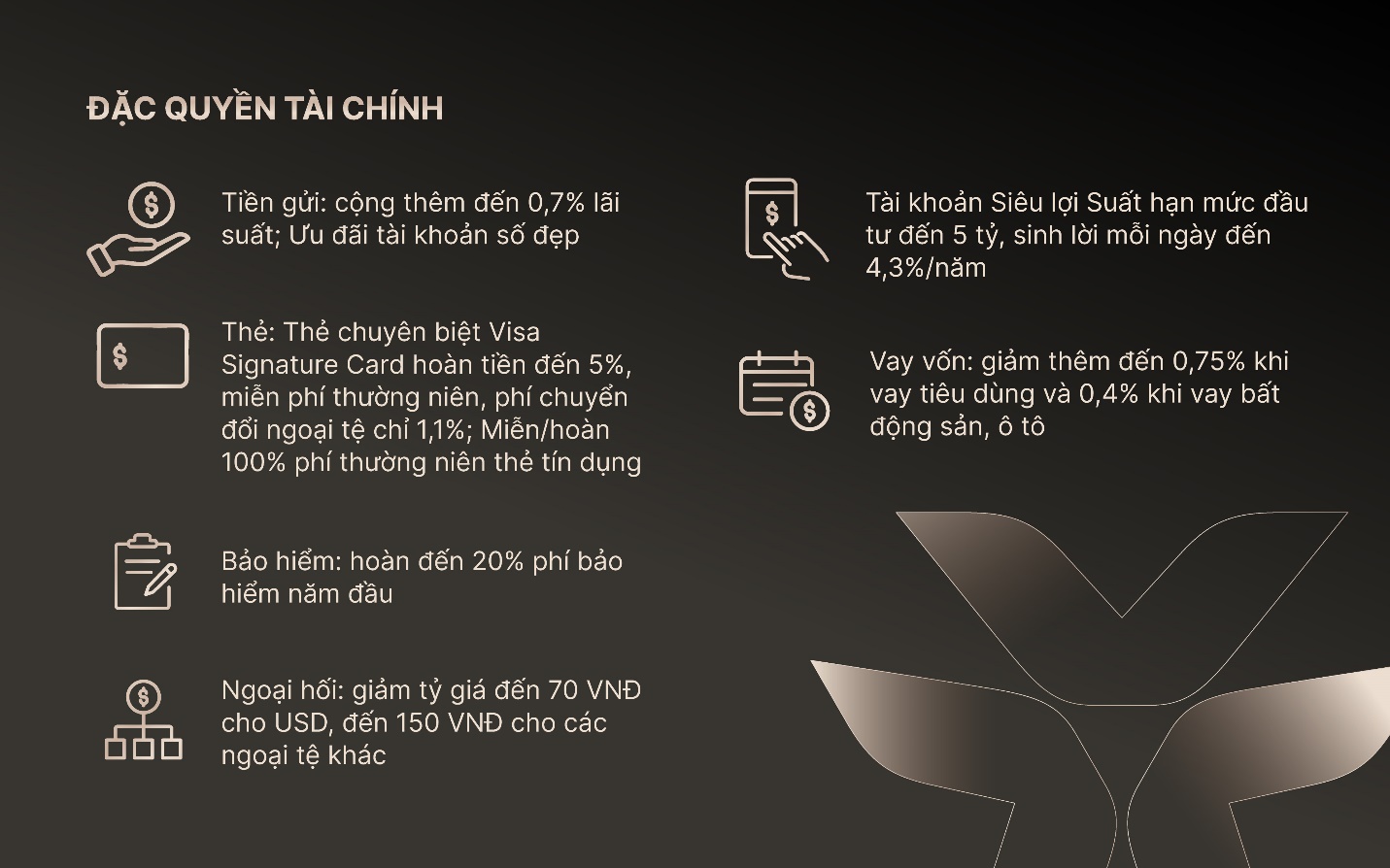

Responding to demand for holistic financial solutions, VIB launched Privilege Banking, a premium service program marking a new milestone in asset-building partnerships with clients. Positioned as “Value Measured by Experience, Not Just Assets,” Privilege Banking offers a full ecosystem combining financial benefits, lifestyle perks, and elite services, solidifying VIB’s leadership in Vietnam’s priority banking segment.

VIB Privilege Banking: A Comprehensive Ecosystem of Financial Privileges

In Q3, Visa awarded VIB three accolades at the 2025 Vietnam Client Conference: Digital Pioneer for PayFlex, Payment Volume Growth (100% increase), and Supply Chain Payment & Commercial Card Innovation for VIB Business Card.

VIB Wins 3 Visa Awards for Card Spending Growth and Innovation

VIB’s Q3 results underscore its strategic focus on operational efficiency, risk control, and digital transformation. With a strong financial foundation, high credit quality, and an evolving digital ecosystem, VIB is poised to accelerate in Q4, delivering sustainable value to customers, shareholders, and Vietnam’s economy.

VIB Reports 9-Month Profit of Over VND 7,040 Billion, Up 7%, with 21% Dividend Payout for 2025

Vietnam International Bank (HOSE: VIB) has announced its business results for the first nine months of 2025, reporting pre-tax profits exceeding 7.04 trillion VND, a 7% increase compared to the same period in 2024. The bank achieved impressive growth in credit and deposit mobilization, with rates of 15% and 11%, respectively. Asset quality continues to improve, with safety management maintained at optimal levels.

When Banks Know You Better: VIB’s Journey in Personalizing Customer Experiences

As one-size-fits-all solutions fade into obsolescence, customers now demand financial services tailored to their unique needs and lifestyles. From personalized cards to customized financial journeys, VIB is redefining customer understanding—not just through data, but through empathy and attentive listening.

Reaping Sweet Rewards from Cambodia: Rubber Industry Enterprises See a 60% Surge in Profits

A leading rubber industry enterprise has announced remarkable Q3 financial results, driven by the exceptional performance of its Cambodian subsidiary and enhanced selling prices.