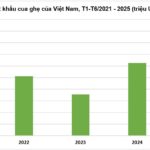

According to Vietnam Customs data, Vietnam’s crab exports in the first nine months of 2025 reached nearly $58 million, a modest 1% increase compared to the same period in 2024. Despite the slight growth, positive signals from emerging markets like the EU and CPTPP bloc indicate significant expansion potential for Vietnam’s processed crab products.

During this period, exports to the U.S. surpassed $46 million, accounting for nearly 81% of total revenue, a 5% rise year-on-year. However, compared to the double-digit growth of the previous year, this slowdown reflects reduced consumption in the U.S. due to high prices, increased logistics costs, and ample supply from Indonesia and the Philippines.

Nevertheless, the U.S. remains a key market, particularly for cooked crab meat and canned crab products, which are popular in the restaurant and retail sectors.

A notable highlight in 2025’s crab export landscape is the robust recovery in the EU and CPTPP markets. Exports to the EU exceeded $2 million, soaring 161% year-on-year, with France doubling its imports (208%) to become Vietnam’s largest crab importer within the bloc.

Exports to CPTPP member countries also rose by 28%. Markets like the UK and Australia showed positive trends, with Australia recording a 280% surge in September 2025, driven by high demand for convenient processed and premium frozen crab products.

In contrast, exports to China and Hong Kong plummeted by 55% and 7%, respectively, due to weak purchasing power and stricter quarantine regulations following increased domestic supply in China.

South Korea saw a 17% decline, reflecting dietary shifts toward local alternatives or cheaper seafood like shrimp and fish.

In 2025, global crab and shellfish prices remained high due to limited natural catches, rising logistics costs, and strong demand in the U.S., Japan, and China.

Snow crab, emperor crab, and blue crab—Vietnam’s primary exports—are expected to maintain or slightly increase in price during Q4 2025.

Importers are increasingly prioritizing traceability, sustainability certifications, and value-added processing—trends Vietnamese businesses are actively adopting to meet market demands.

With a stable recovery, Vietnam’s crab exports are projected to sustain modest growth in late 2025, fueled by holiday demand in the U.S. and Europe. In 2026, growth could reach 3–5% if companies continue diversifying products and markets. However, U.S. trade policy shifts may disrupt export stability to this key market.

“Vietnamese Products Hit a 10-Year High: Seizing the Golden Opportunity to Soar on the Global Stage”

The Vietnamese crab and shrimp industry has witnessed a remarkable surge in exports, propelling the sector to record-breaking heights. This exceptional performance has positioned the industry at its pinnacle over the last decade.