Vietnam has maintained a high export growth rate throughout the Renovation period from 1986 to the present, even during the challenging times of the COVID-19 pandemic. (Photo: An Đăng/TTXVN)

|

Amid global economic pressures and risks, Vietnam continues to emerge as a growth highlight in Asia, thanks to its impressive recovery and flexible adaptability to fluctuations.

According to a report released in late October 2025, both HSBC and Standard Chartered have revised upward their GDP growth forecasts for Vietnam to 7.9% and 7.5%, respectively, nearly 2 percentage points higher than previous estimates.

Similarly, earlier this month, major international organizations such as the International Monetary Fund (IMF), World Bank (WB), and Asian Development Bank (ADB) also adjusted their growth forecasts for Vietnam, citing it as a “rare bright spot maintaining stable recovery” amidst global economic volatility.

This is evident in the third-quarter 2025 GDP growth of 8.23%—the highest since 2011. This figure not only demonstrates the economy’s resilience but also underscores Vietnam’s significant adaptability as global supply chains face challenges and trade protectionism spreads.

According to Standard Chartered, three key factors sustaining Vietnam’s growth include stable trade, robust foreign direct investment (FDI), and a strong recovery in domestic demand.

In terms of trade, the total import-export turnover for the first nine months of 2025 exceeded $680 billion, up nearly 20% year-on-year. In September 2025 alone, exports reached $42.7 billion, a 24.7% increase, despite the U.S. imposing a 20% tariff on most imports from Vietnam.

Processing rice for domestic and export markets at Hạnh Phúc Rice Factory, Lương An Trà Commune, Tri Tôn District, An Giang Province. (Photo: Vũ Sinh/TTXVN)

|

Exports to the U.S. still grew by 38%, driven by product diversification and the increasing competitiveness of Vietnamese businesses.

This shows that Vietnam not only withstands global trade policy impacts but also proactively seizes opportunities to reposition itself in the international supply chain, becoming a critical link in the “China+1” strategy of many multinational corporations.

Alongside trade, FDI remains a highlight of the economy. As of September 2025, disbursed FDI reached $18.8 billion, the highest in five years; newly registered capital hit $28.5 billion, up 15.2% year-on-year.

A notable shift is the changing investment structure. Alongside traditional capital from South Korea, Singapore, and Japan, the U.S. and mainland China are emerging as major new investors, focusing on high-tech manufacturing, renewable energy, and industrial infrastructure.

According to HSBC, Vietnam is “becoming a strategic choice in the global value chain restructuring” due to its stable macro environment, flexible fiscal policies, and rapidly improving industrial infrastructure.

Domestically, internal growth drivers also show strong recovery. Third-quarter 2025 retail sales rose 12%, with inflation controlled at 3.38%, below the government’s 4.5% target.

Tourism rebounded strongly, welcoming 15 million international visitors in nine months, equivalent to 120% of pre-pandemic 2019 levels.

Monetary policy stability continues to support businesses. Standard Chartered forecasts the refinancing rate will remain at 4.5% in 2025-2026, maintaining reasonable liquidity and balancing growth with inflation control.

Vietnam has achieved the feat of “low starting point, high growth” through “innovation and openness.” Pictured: Loading containers onto a 200,000DWT vessel at Gemalink International Port, Phú Mỹ Town, Bà Rịa-Vũng Tàu Province. (Photo: Hồng Đạt/TTXVN)

|

However, the IMF warns that U.S. tariff policies could reduce Vietnam’s GDP growth by 0.5-0.7 percentage points in Q4/2025 if not offset by public investment and domestic consumption.

Additionally, domestic risks such as rising household debt, spending cutbacks, and a slow-recovering real estate market may create short-term pressures.

Yet analysts remain optimistic, viewing these challenges as a “necessary test of Vietnam’s economic management resilience”—an economy that has proven its ability to overcome major shocks, from the 2008 global financial crisis to the COVID-19 pandemic.

According to the World Bank (WB), Vietnam’s healthy fiscal space, thanks to low public debt and stable macroeconomics, provides opportunities for large-scale public investment, addressing infrastructure bottlenecks, creating jobs, and boosting private investment.

Meanwhile, the ADB recommends Vietnam maintain its three key pillars—sustainable FDI, domestic consumption, and effective public investment—while accelerating digital and green energy transitions.

This is seen as a “strategic direction” for Vietnam to sustain high growth while ensuring long-term development quality.

From an international perspective, Vietnam is entering a new development phase where growth speed is no longer the sole goal but a measure of adaptability and governance quality.

Maintaining over 8% GDP growth in Q3/2025, along with optimistic forecasts from HSBC (7.9%) and Standard Chartered (7.5%), makes the once “ambitious” 8.5% target for 2025 increasingly feasible.

Diệu Linh

– 05:00 31/10/2025

Unlock Sustainable Success: Vietnam’s Opportunities for APEC Businesses

Speaking at the APEC Business Summit, President Luong Cuong affirmed that amidst global uncertainty, Vietnam offers businesses stability, security, and the opportunity for sustainable success.

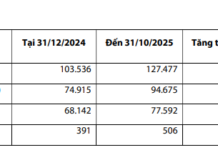

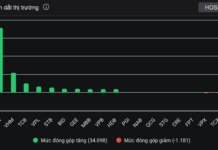

Elevating Vietnam’s Stock Market: A Golden Opportunity to Cement Its Global Financial Standing

Speaking at the Emerging Vietnam “Beyond the Upgrade” event hosted by SSI Securities, Ms. Wanming Du, Director of Asia-Pacific Policy at FTSE Russell, remarked that over the past decade, she has witnessed numerous markets transition from frontier to emerging status. However, no country compares to Vietnam in terms of the speed and scale of its reforms.

SHB Unveils Plan to Boost Capital to VND 53,442 Billion

SHB (Saigon-Hanoi Commercial Joint Stock Bank) is set to seek shareholder approval via written consent for a proposed charter capital increase of VND 7,500 billion.