VCG shares inched up by a mere 0.2% during the morning session on October 31st. Despite the significant profit increase, the market was not entirely surprised, as rumors about the trillion-dollar deal had been circulating beforehand.

In July and August of this year, Vinaconex divested its entire 51% stake in Vinaconex Tourism Investment and Development JSC (UPCoM: VCR). VCR is the developer of the Cát Bà Amatina resort real estate project, spanning over 172 hectares in Hai Phong City. The initial investment in VCR was recorded at approximately VND 1.63 trillion in Vinaconex’s financial statements.

Current status of the Cát Bà Amatina project. Source: Vinaconex

|

In the consolidated Q3/2025 financial statements, the VND 5.56 trillion in construction in progress related to the Cát Bà Amatina project was no longer recorded at the end of the period. Consequently, Vinaconex received nearly VND 4.7 trillion in cash during the quarter from investment recovery. Most of this amount was lent out as short-term loans.

As of the end of Q3, Vinaconex reported VND 6.26 trillion in short-term receivables from loans, a 9.4-fold increase from the beginning of the quarter. The identity of the borrower was not explicitly disclosed, but the company stated that all loans were secured by assets and bank guarantees.

Robust Core Operations

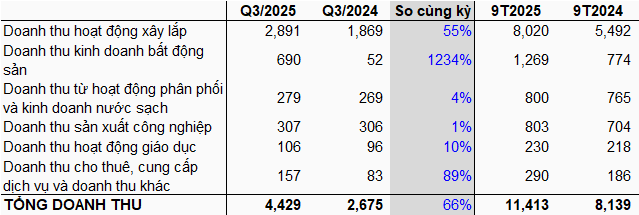

Apart from the windfall profit from the share divestment, Vinaconex’s core operations in Q3 also showed improvement compared to the same period last year, with total revenue reaching VND 4.43 trillion, a 66% increase. The construction and real estate segments were the primary growth drivers.

The company’s total gross profit in Q3/2025 reached VND 611 billion, a 56% increase.

|

Vinaconex’s Revenue by Business Segment

Unit: Billion VND

Source: Vinaconex’s Consolidated Financial Statements

|

In the first nine months of this year, Vinaconex achieved a net revenue of over VND 11.4 trillion and a consolidated after-tax profit of nearly VND 3.8 trillion, representing a 40% and 394% increase, respectively, compared to the same period last year. With these results, the company has fulfilled 74% of its revenue plan and exceeded its annual profit target by 215%.

– 1:58 PM, October 31, 2025

Vinaconex-ITC Welcomes New Chairman, Accelerates Cát Bà Amatina Project Under Fresh Ownership

Vinaconex-ITC’s shareholder structure has undergone a significant transformation with the addition of four new shareholders: Hanoi Anpha Real Estate Trading Floor LLC, Imperia An Phu LLC, Silver Field International Trading LLC, and Phu Quoc East Zone LLC.

“Q2’s Big Win: Vinaconex and Industry Giants Invest in the Nearly 20-Trillion Dong Highway Project”

Vinaconex reports a remarkable surge in net profit for the second quarter of 2025, reaching nearly VND 309 billion, an impressive over-threefold increase compared to the same period last year. Alongside this impressive financial performance, the company has also ventured into a significant investment, committing funds towards the development of a nearly VND 20,000-billion highway project.

Opening the Parallel Road of Ring Road 4 by the End of 2025

“Thus far, Component Project 2.1 has achieved over 50% of its targeted output. As such, the contractors are committed to continuing their efforts in completing the remaining road and bridge works. With dedication and hard work, the aim is to have the parallel road of the Ring Road 4 open to traffic by the end of 2025.”