Significant Depreciation After a Short Period of Use

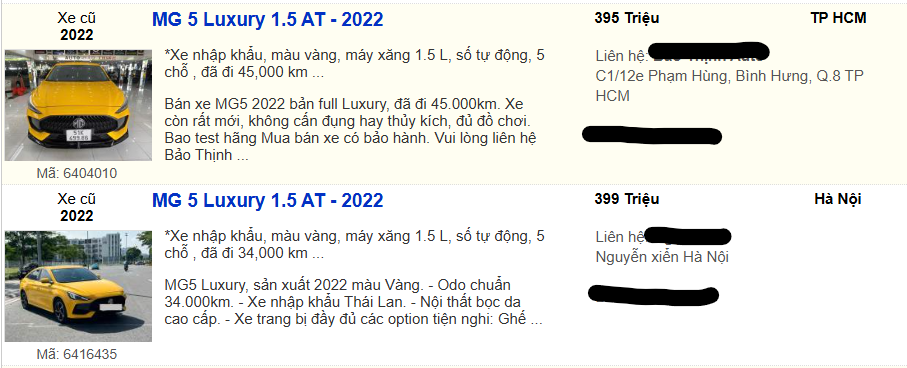

Anh Minh, a resident of District 7, Ho Chi Minh City, purchased an MG5 Luxury 2022 model in early 2023 for approximately 588 million VND. Nearly 18 months later, when he needed to sell the car, the market price for a similar model had dropped to around 400 million VND. On platforms like Bonbanh, the 2022 MG5 with 2–40,000 km on the odometer is commonly listed between 390 and 420 million VND, representing a 25 to 30% decrease from the original price.

This trend isn’t limited to MG; other Chinese models like the Wuling MiniEV, Beijing U5 Plus, and the new BYD Atto 3 electric SUV also show significant depreciation after a short period. While depreciation after 1–2 years is common across many brands, the faster rate of Chinese vehicles has drawn considerable attention from consumers.

Flexible Pricing Policies Create Pressure on the Used Car Market

One common reason for this rapid depreciation is the flexible and frequent pricing adjustments by Chinese automakers. Unlike traditional brands that maintain stable prices, many Chinese models see price reductions just months after launch. While this makes the vehicles more accessible to buyers, it also places greater depreciation pressure on early adopters.

For instance, the MG5, a C-segment sedan introduced in Vietnam with a starting price of 523 million VND, saw its 2022 models discounted to 370–390 million VND by late 2024 to boost sales, a reduction of up to 150 million VND in less than a year.

The Wuling MiniEV, an urban electric mini car, also experienced significant price fluctuations. Launched in mid-2023 with a price range of 239 to 279 million VND, by May 2024, its actual selling price at dealerships had dropped to 179–189 million VND on Chotot, following the entry of new competitors.

Direct price cuts from dealerships and distributors make it challenging for recent buyers to resell their vehicles, as the used car market immediately reflects the new value of the new models. Many consumers report feeling a loss of asset value just after driving their new car for a few thousand kilometers.

New Brands and Market Caution

Another factor affecting resale value is brand recognition and consumer trust. Most Chinese automakers have only been present in Vietnam for 3–5 years, with limited after-sales service networks and brand penetration.

The Beijing U5 Plus, which gained attention at launch for its sub-500 million VND price, is no longer officially distributed after its distributor withdrew. The 2022 Luxury models are now resold for 355–375 million VND, while Japanese counterparts like the Toyota Vios and Honda City retain prices of 450–500 million VND.

The withdrawal of brands like BAIC (Beijing) and Zotye from Vietnam has made consumers more cautious. Concerns about spare part availability and warranty support directly impact the liquidity of these vehicles in the secondary market.

Global Comparison: Depreciation Isn’t Unique to Vietnam

Rapid depreciation of Chinese vehicles isn’t confined to Vietnam. In China itself, consumers face high depreciation rates due to frequent price cuts and short product lifecycles. According to Baijihao, Chinese new energy vehicles (including EVs and PHEVs) can lose up to 50% of their value within two years, far exceeding depreciation rates of American, European, Japanese, and Korean models.

In Thailand, a fast-growing Southeast Asian EV market, Chinese brands like BYD, Neta, and MG face similar challenges. Some electric models depreciate by 15–20% within months, while Japanese and European vehicles retain higher resale values.

The key difference lies in brand stability, after-sales service, and product update cycles. While traditional brands update models every 4–6 years, many Chinese automakers introduce new versions every 12–18 months, quickly rendering older models obsolete.

Even in mainland China, Chinese vehicles have significantly lower resale values compared to Japanese, Korean, American, and European models.

Liquidity Challenges and Market Psychology: A Self-Perpetuating Cycle

Psychological factors also play a significant role. In Vietnam, many used car buyers prefer established brands like Toyota, Honda, Kia, and Hyundai due to their ease of resale, repair, and widespread spare parts availability. Chinese vehicles, despite their features, face skepticism regarding durability, resale value, and technical support.

Used car dealerships reflect this sentiment. Some avoid stocking Chinese used cars due to slow turnover. Models like the MG5, Wuling MiniEV, and BYD Atto 3 are bought back at significantly lower prices, resulting in substantial losses for sellers.

For example, a 2023 BYD Atto 3 Standard with an on-road price of 750–780 million VND is now resold for 620–650 million VND after just 5,000–7,000 km (on Carmudi). In contrast, the Hyundai Kona and Kia Seltos retain 80–90% of their value after a year.

Poor liquidity creates a dual pressure on the used car market: buyers hesitate due to resale concerns, while sellers accept lower prices for quick transactions.

The rapid depreciation of Chinese vehicles in Vietnam and other markets stems from a combination of factors: unstable pricing policies, short product lifecycles, limited after-sales development, and cautious consumer psychology. Despite their initial affordability and features, these brands need time to build market trust and stabilize long-term strategies. As consumers increasingly focus on total ownership costs—including purchase price, depreciation, and maintenance—an attractive initial price alone isn’t enough to ensure long-term value.