According to Circular No. 96/2020/TT-BTC, companies must explain their business performance in financial reports if post-tax profits fluctuate by 10% or more compared to the same period the previous year.

Hoang Huy Investment and Financial Services Corporation (stock code: TCH) recently submitted an explanation for the profit discrepancy in Q2 compared to the same period last year.

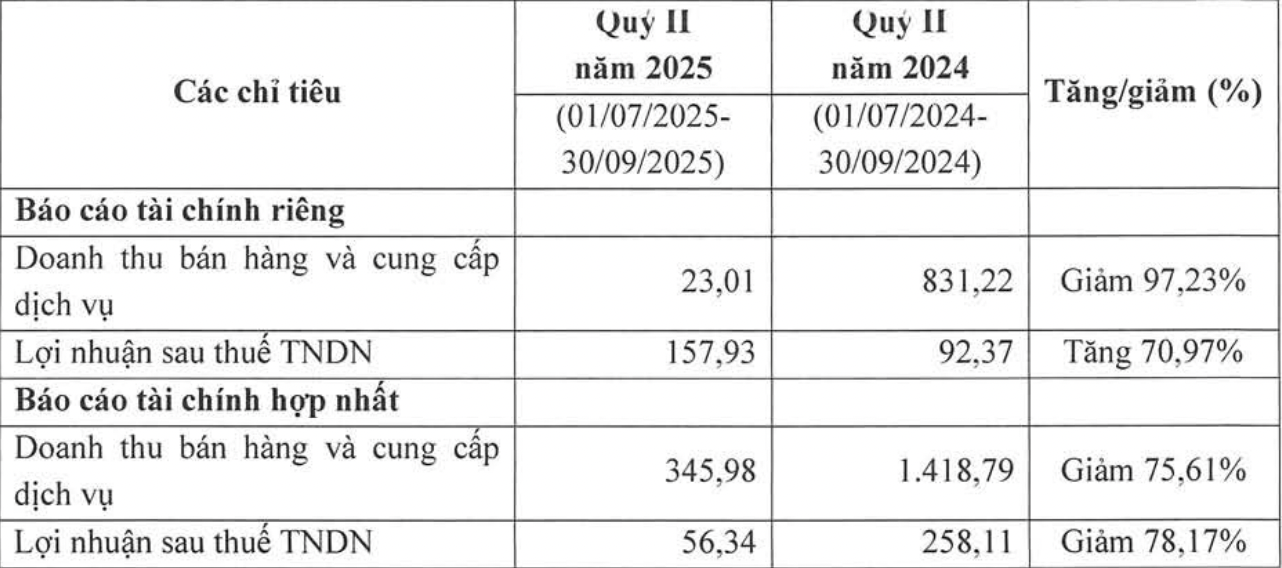

In its standalone financial report, Hoang Huy’s revenue from sales and services plummeted to VND 23.01 billion, a staggering 97.3% decline compared to 2024. However, post-tax profit remained at VND 157.93 billion, decreasing by only 70.97%, thanks to dividend income from subsidiary companies.

In the consolidated financial report, TCH’s revenue from sales and services reached VND 345.98 billion, a 75.6% drop, while consolidated post-tax profit stood at VND 56.34 billion, down 78.17% year-on-year.

TCH’s sales and service revenue plummeted by 97% year-on-year. Screenshot.

Hoang Huy attributed this sharp decline to the completion and revenue recognition of major projects such as Hoang Huy New City, Hoang Huy Grand Tower, Hoang Huy Commerce (Tower H1), and Gold Tower in previous periods. Meanwhile, new flagship projects like Hoang Huy Green River, Hoang Huy Commerce (Tower H2), and Hoang Huy New City II are still under construction and have not yet reached the handover stage, resulting in minimal revenue generation this quarter.

As of September 30, the company recorded VND 3,086 billion in customer deposits for real estate projects, with Hoang Huy New City II accounting for VND 1,884 billion and Hoang Huy Green River for VND 965 billion. Therefore, revenue and profit recognition will primarily occur in the final quarters of the 2025 fiscal year, as products are handed over to customers.

Another member of the Hoang Huy Group, CRV Real Estate Group JSC (stock code: CRV), also explained its significant profit decline compared to the same period last year.

In its standalone financial report, revenue from sales and services reached VND 23.01 billion, a 21.79% decrease compared to 2024. Post-tax profit was VND 9.80 billion, down 75.66%.

In the consolidated financial report, revenue from sales and services was VND 73.47 billion, an 84.19% drop, while post-tax profit stood at VND 20.98 billion, a 67.49% decline year-on-year.

The company stated that during this period, it focused on developing the Hoang Huy New City II urban area project in Hai Phong. As of September 30, customer deposits for projects totaled VND 1,965 billion. The company expects to hand over low-rise products from this project in the final quarters of the 2025 fiscal year, recognizing revenue and profit accordingly.

For projects like Hoang Huy Commerce (Tower H1), Hoang Huy Grand Tower in Hai Phong, and Gold Tower in Hanoi, the company noted that these projects have been completed and handed over to customers, with revenue recognized in previous periods. Consequently, sales revenue in the recent quarter was insignificant, leading to lower business results compared to the same period.

Once a symbol of traditional taxis in Ho Chi Minh City, Vinasun’s business results have continued to decline in recent quarters due to competition from ride-hailing services. Illustrative image.

Vinasun’s taxi profits also saw a sharp decline, prompting the company to provide an explanation as required. Vietnam Taxi Corporation (Vinasun, stock code: VNS) reported a 11.7% drop in Q3 revenue compared to the same period last year, significantly reducing profits.

Post-tax profit according to the parent company’s financial report was VND 7.79 billion, a decrease of VND 11.75 billion (60.1%) compared to Q3/2024. Consolidated post-tax profit reached VND 9.25 billion, down VND 11.73 billion (55.9%) year-on-year.

Meanwhile, some listed companies reported impressive triple-digit growth. Vinh Son – Song Hinh Hydropower JSC (stock code: VSH) announced a Q3 post-tax profit of VND 211.1 billion, an increase of VND 133.3 billion (171.31%) compared to 2024.

The company attributed this growth primarily to electricity production and financial activities. In Q3, favorable hydrological conditions in the Central and Central Highlands regions, with prolonged rainfall, improved water inflows to reservoirs compared to the same period. Commercial electricity output reached 559.94 million kWh, a 42% increase, with electricity production revenue hitting VND 556 billion, up 40% year-on-year.

Electricity production costs rose by VND 26.77 billion (over 10%), mainly due to taxes and related expenses, but electricity production profit still reached VND 132.9 billion, a 90% increase year-on-year.

Additionally, Q3 financial profit was VND 15.87 billion, a 26% increase compared to the same period, primarily due to a VND 15.69 billion (24%) reduction in financial expenses as banks lowered lending rates and outstanding debt decreased.

Q3/2025 Financial Reports Due by October 28: Major Corporations Announce Earnings, OCB Reports Pre-Tax Profit Surge of Nearly 250%

Masan Hightech Materials (MSR) reported a pre-tax profit of VND 14 billion in Q3, a remarkable turnaround from a VND 292 billion loss in the same period last year. Meanwhile, PAN Group (PAN) saw a 16% decline in Q3 pre-tax profit to VND 305 billion. However, for the first nine months, PAN’s profit rose 3% to VND 848 billion.

Q3/2025 Financial Reports Deadline: Vincom Retail, Nam Long, DIG, Hoa Phat, and More Leading Enterprises Announce Updates by October 29th

In Q3/2025, Gelex’s pre-tax profit soared to VND 1,253 billion, marking a remarkable 149.7% increase compared to the same period last year. Meanwhile, PNJ’s after-tax profit for Q3/2025 reached VND 496 billion, a staggering 129.7% growth, equating to a daily profit of over VND 4.06 billion for the company.