With savings interest rates lingering at a modest 4–6% annually, traditional banking remains a safe haven but struggles to deliver substantial returns. Gold, a classic safe-haven asset, continues to captivate investors as its price surged in Q3. However, for retail investors, especially those with limited capital, “gold surfing” is nearly impractical due to high volatility and transaction costs.

Meanwhile, the stock market has emerged as a focal point for individual investors following Vietnam’s upgrade to Emerging Market status by FTSE Russell—a milestone expected to attract billions in foreign capital next year.

Experts emphasize that this upgrade not only boosts market sentiment but also enhances transparency and liquidity. “Domestic retail investors are at a pivotal moment, particularly with stock prices remaining attractive,” one expert noted.

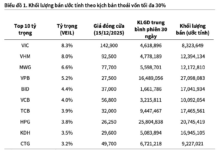

Seizing this momentum, securities firms are launching aggressive campaigns to attract new investors. Notably, MBS—ranked Top 6 in Q3 brokerage market share on HOSE—is making waves with its year-end promotion: investors trading from just VND 10 million qualify for a lucky draw, offering chances to win a VinFast VF3 electric car, iPhone 17 Pro, VinFast Feliz S electric scooter, and an array of tech and fashion prizes.

Beyond its customer-centric promotions, MBS boasts impressive financial performance. Its latest report reveals Q3 profits exceeding VND 418 billion, pushing the 9-month total to VND 1,030 billion—marking its first entry into the securities industry’s “Trillion Club,” a testament to its robust financial foundation and effective growth strategy.

Analysts predict that as Vietnam’s economy rebounds, low interest rates and returning foreign capital will cement equities as the most attractive investment channel—especially for newcomers with limited capital. Even VND 10 million can be the starting point for a long-term investment journey. In a volatile market, choosing the right asset class at the right time can yield not only financial gains but also the chance to own an electric vehicle—a symbol of modern, sustainable living.

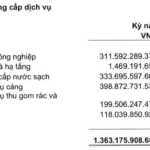

Sonadezi Surpasses Annual Plan with Over One Trillion VND Profit in 9 Months

Following a record-breaking second quarter, Sonadezi’s net profit continued its upward trajectory in Q3 2025, driven by steady growth in port services, clean water operations, and improved gross profit margins. The company has already surpassed its full-year profit target after just three quarters.

VN-Index Stuns with a Dramatic 60-Point Reversal: What’s Driving the Sudden Shift?

“ASEANSC experts believe that short-term market fluctuations present investors with prime opportunities to rebalance their portfolios and strategically identify optimal entry points for new positions.”