According to the Q3 financial report of Vietnam Dairy Products Joint Stock Company (Vinamilk – stock code: VNM), consolidated revenue reached VND 16,968 billion, a 9% increase compared to the same period last year. The cumulative consolidated revenue for the first nine months reached VND 46,678 billion.

In the first nine months, Vinamilk’s domestic consolidated net revenue reached VND 37,118 billion.

Both domestic and international operations of Vinamilk experienced growth compared to the previous quarter. Specifically, in the domestic market, consolidated net revenue increased by nearly 5% year-on-year, reaching VND 13,494 billion, contributing to nearly 80% of the consolidated net revenue in Q3. The growth drivers include digital transformation, e-commerce contributions, expanded Vinamilk store coverage, new product launches, and effective marketing campaigns.

For the first nine months, domestic consolidated net revenue reached VND 37,118 billion. Vinamilk’s international consolidated net revenue increased by nearly 33% year-on-year, reaching VND 3,459 billion. Key markets in Asia and Africa showed strong growth.

As a result, pre-tax profit and consolidated after-tax profit in Q3 reached VND 3,126 billion and VND 2,511 billion, respectively, increasing by over 6% and nearly 5% compared to the same period last year. For the first nine months, pre-tax profit and consolidated after-tax profit reached VND 8,173 billion and VND 6,586 billion, respectively, with earnings per share at VND 2,804.

Ms. Mai Kiều Liên, CEO of Vinamilk, stated, “Vinamilk’s Q3 revenue and profit demonstrate that we are on the right track in our brand repositioning and digital transformation journey. The improvement in both domestic and international operations is a crucial foundation for the company to achieve the business plan approved by the shareholders’ meeting.”

Similarly, VNG Corporation (stock code: VNZ) announced its Q3 financial report, with net revenue reaching VND 2,894 billion, a 12% increase compared to the same period in 2024. Adjusted net profit from business operations reached VND 263 billion, a 30% increase year-on-year, attributed to tight cost control.

VNG’s after-tax profit on separate financial statements reached over VND 67 billion, a 572% increase year-on-year.

After-tax profit on separate financial statements reached over VND 67 billion, a 572% increase year-on-year. VNG attributed this to strong revenue growth, effective cost management, and reduced long-term financial investments compared to Q3/2024.

The Q3 financial report of Kinh Bắc Urban Development Corporation (stock code: KBC) showed a net revenue of over VND 1,347 billion and a net profit of over VND 307 billion, increasing by 42% and 57% year-on-year, respectively.

KBC attributed the growth primarily to increased revenue from industrial zones, real estate transfers, and factory sales compared to the same period last year.

For the first nine months, net revenue reached nearly VND 5,039 billion, and after-tax profit reached nearly VND 1,563 billion, 2.5 and 3.9 times higher than the same period last year, respectively. The growth drivers included land lease and industrial zone infrastructure services with over VND 3,680 billion (3.3 times higher), real estate transfers with over VND 696 billion (a 65% increase), and factory sales with nearly VND 133 billion.

As of September 30, Kinh Bắc’s total assets reached nearly VND 66,600 billion, a 49% increase from the beginning of the year. Cash and cash equivalents reached over VND 9,400 billion, a 43% increase. Inventory also increased significantly by 81% to nearly VND 25,100 billion, driven by the Tràng Cát Urban and Service Area project, which increased by 92% to over VND 16,200 billion, and the Lộc Giang Industrial Zone, which increased by nearly 25 times to over VND 1,400 billion.

Meanwhile, KBC’s total liabilities continued to rise by 68% to nearly VND 40,500 billion. Financial debt reached VND 27,000 billion, mostly long-term bank loans, 2.7 times higher than the beginning of the year and accounting for 67% of total debt.

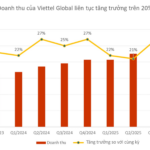

In Q3, Viettel Global Investment Joint Stock Company (Viettel Global – stock code: VGI) achieved consolidated sales and service revenue of VND 11,622 billion, a 27% increase compared to Q3/2024. This marks the 8th consecutive quarter of over 20% growth. After-tax profit reached VND 4,160 billion, a 569% increase year-on-year, setting a new record for the highest quarterly profit and best growth for Viettel Global.

Viettel Global’s after-tax profit reached VND 7,427 billion, more than double the figure for the first nine months of 2024.

Notably, all markets where Viettel invests experienced high revenue growth, with Viettel Tanzania increasing by 46%, Viettel Haiti by 32%, and Viettel Myanmar by 31%. Even in markets where Viettel holds over 70% market share, such as Burundi and Lumitel, growth reached up to 40%.

For the first nine months, VGI’s net revenue reached VND 31,881 billion (a 24% increase year-on-year), and after-tax profit reached VND 7,427 billion (more than double the figure for the first nine months of 2024). As of September 30, consolidated total assets reached VND 73,877 billion, an increase of VND 10,438 billion (16%) compared to the beginning of the year.

May Việt Tiến Corporation’s (stock code: VGG) Q3 profit reached its highest level since 2019, driven by a 310% surge in financial income and a 1.5-fold increase in associate profits, resulting in a 9-month performance exceeding the annual target by 18%.

Specifically, May Việt Tiến recorded a net profit of VND 119 billion, a 1% increase year-on-year, and the highest quarterly profit since 2019. Revenue also increased by 1% to over VND 2,722 billion.

The highlight of the business results was the financial income, which surged by 310% to over VND 38 billion, along with associate profits, which increased by 1.5 times to nearly VND 30 billion.

For the first nine months, VGG’s net revenue reached nearly VND 7,897 billion, a 4% increase year-on-year and a historical high. Net profit reached nearly VND 311 billion, a 22% increase and the highest level in seven years for a 9-month period. With these results, VGG achieved 81% of its revenue plan and exceeded its annual profit target by 18%.

Vinamilk’s Q3 Consolidated Revenue Surges Close to 17 Trillion VND Milestone

Vinamilk reported a consolidated revenue of VND 16,968 billion in Q3, marking a 9.1% year-over-year increase. Consequently, the nine-month cumulative consolidated revenue reached VND 46,678 billion, up 0.7% compared to the same period last year. Vietnam’s leading dairy company saw growth in both domestic and international business segments relative to the previous quarter.

Two Years After Vinamilk’s Rebranding Move, CEO Reveals Surprising Consumer Feedback: ‘If Vinamilk Were a Person, I’d Marry It!’

Vinamilk’s representative stated that the ultimate goal of brand building is to capture the trust and affection of consumers.