Following a session under selling pressure at the 1,700-point resistance level, the stock market opened the October 30 session in the green, recovering with low liquidity and high divergence. The VN-Index then faced stronger downward adjustments in the afternoon session, closing down 16.26 points (-0.96%) at 1,669.57 points. Foreign trading activity was a negative factor, with net selling reaching 1,210 billion VND across the market.

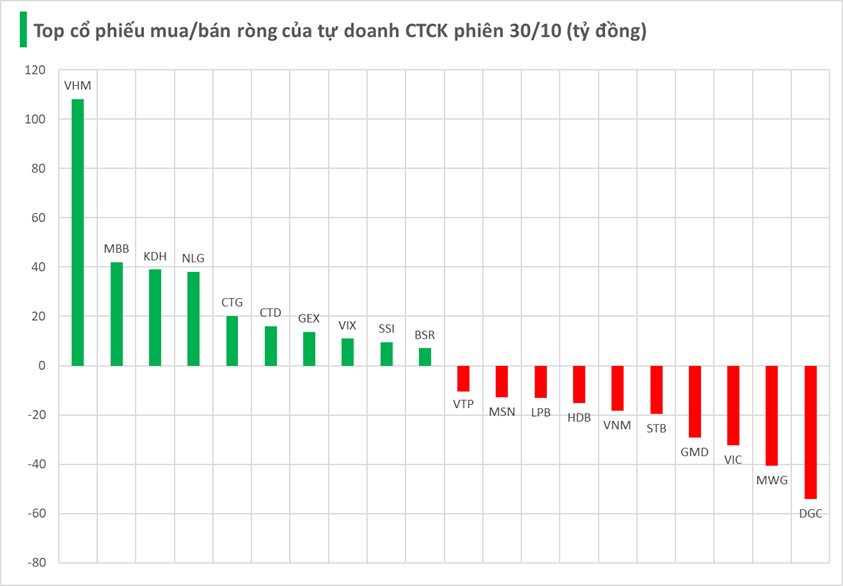

Securities firms’ proprietary trading desks resumed net buying of 82 billion VND on HOSE.

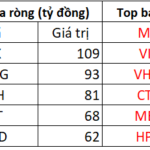

Specifically, VHM and MBB were net bought with values of 108 billion VND and 42 billion VND, respectively. They were followed by KDH (39 billion VND), NLG (38 billion VND), CTG (20 billion VND), CTD (16 billion VND), GEX (14 billion VND), VIX (11 billion VND), SSI (9 billion VND), and BSR (7 billion VND), all of which saw strong buying from securities firms’ proprietary desks.

Conversely, the strongest net selling by securities firms was observed in DGC, with a value of -54 billion VND, followed by MWG (-41 billion VND), VIC (-32 billion VND), GMD (-29 billion VND), and STB (-20 billion VND). Other stocks also recorded significant net selling, including VNM (-18 billion VND), HDB (-15 billion VND), LPB (-13 billion VND), MSN (-13 billion VND), and VTP (-11 billion VND).

Blue-Chip Stock Code Witnessed Abnormal Accumulation of Over 100 Billion VND by Securities Company’s Proprietary Trading Desk on October 30th

Proprietary trading firms have resumed net buying on the Ho Chi Minh City Stock Exchange (HOSE), with a total net purchase of VND 82 billion. This marks a significant shift in market sentiment, as these firms leverage their expertise to capitalize on emerging opportunities within Vietnam’s dynamic equity landscape.

Surprising Rally: Stocks Defy the Odds with “Green and Purple” Gains Amid VN-Index’s Sharp Decline

The surge in oil and gas stocks followed the government’s issuance of a resolution addressing challenges and bottlenecks in the approval process for key aspects of petroleum operations.