Despite Vietnam’s position among the top 10 countries with the highest e-commerce growth rates, reaching over $25 billion in 2024 and accounting for 2/3 of the digital economy, a critical bottleneck persists: the payment process.

According to the “Shopping Cart Abandonment Statistics 2025” report by SellersCommerce, the global average cart abandonment rate in 2024 soared to 70.19%. Among the reasons, 25% of shoppers distrust websites with their card information, and 22% find the checkout process too lengthy or complicated, leading to last-minute transaction abandonment.

Unraveling Payment Bottlenecks with Click to Pay Technology

Many consumers grow weary of repeatedly entering lengthy card numbers, CVV codes, cardholder names, and expiration dates. For e-commerce platforms, each abandoned cart represents a lost revenue opportunity.

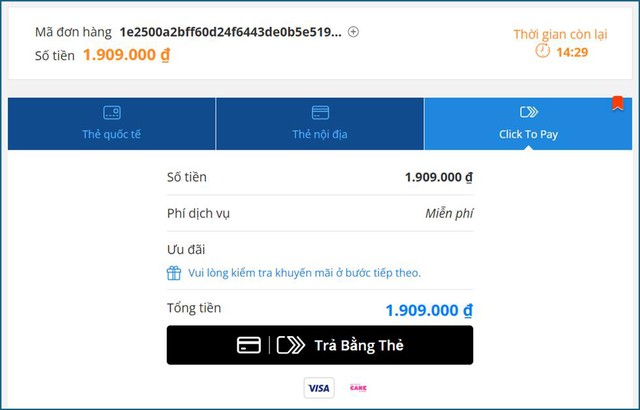

Addressing this challenge, Cake by VPBank, a leading digital bank, has introduced Click to Pay, enabling users to make secure online payments without re-entering card details.

Click to Pay is now integrated by numerous e-commerce sites, offering customers a seamless and secure shopping experience.

This feature operates on Visa’s Click to Pay platform, officially launched in Vietnam in September 2025. Vietnam is the first Southeast Asian nation to adopt this technology, with Cake being one of the few card issuers offering this service locally.

When shopping on websites featuring the Click to Pay logo, Cake Visa cardholders simply select this option, enter their registered phone number and email, and the system automatically identifies the linked card to complete the transaction within seconds.

How Secure is Click to Pay?

Remarkably, Click to Pay’s one-click payment method is more secure than traditional online payments.

It employs tokenization, converting actual card data into single-use “virtual tokens” that are useless if intercepted. Additionally, it incorporates two-factor authentication and 3D Secure, verifying the cardholder’s identity before finalizing transactions. This multi-layered security ensures fast and safe payments.

Mr. Nguyễn Hữu Quang, CEO of Cake by VPBank, stated, “As a pioneer in implementing Click to Pay in Vietnam, Cake aims to deliver faster, safer, and smarter payment solutions, aligning with our commitment to simplify experiences and maximize security.”

Cake was recently honored by Visa as the 2025 Leading Digital Partner in Total Card Transaction Volume and received the Vietnam Pride Card Design Award 2025.

Resolving Pain Points for Buyers and Sellers Alike

For users, Click to Pay reduces checkout time to mere seconds while eliminating card exposure risks through advanced security layers.

For e-commerce businesses, it’s a powerful tool to reduce cart abandonment and boost transaction success rates. Brands like ACFC, AEONESHOP, Maison Online, Mainguyen Mobile, KOI Thé, GearVN, Galaxy Cinema, and Triumph have already integrated Click to Pay, receiving positive customer feedback.

This feature enhances online shopping across three key dimensions: faster, safer, and smarter. Notably, Cake users with Visa cards, physical or virtual, can utilize it without additional registration.

Click to Pay is more than a new feature; it exemplifies Cake’s commitment to elevating customer experiences. With a single click, Cake users enjoy secure shopping and a seamless “tap-and-go” payment experience—a solution eagerly awaited by both e-commerce platforms and customers.

Gobox WMS: The Ultimate Warehouse Management Solution for E-commerce Sellers

In the booming e-commerce landscape, efficient inventory management has become a critical factor for sellers to optimize operations and reduce costs. Gobox WMS emerges as a comprehensive solution, empowering businesses to intelligently control their inventory, minimize errors, and enhance overall business performance.

“State Bank: CIC does not expose customer account numbers, deposit balances, or CVV codes”

The State Bank of Vietnam (SBV) has received a report from the Vietnam Credit Information Center (CIC) regarding an incident related to credit information at the CIC. The SBV has promptly directed the CIC to report and closely coordinate with relevant state authorities to investigate and address the issue, while also ensuring the continuous and smooth operation of the CIC.