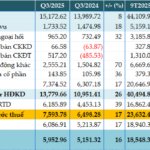

On October 29, 2025, FPT Digital Retail Joint Stock Company (FPT Retail, HoSE: FRT) announced its consolidated business results for the first nine months of 2025. The company reported a consolidated revenue of VND 36,170 billion, a 26% increase year-over-year, and pre-tax profit of VND 804 billion, up 125% compared to the same period last year.

In Q3/2025, FPT Retail saw a 15% revenue increase quarter-on-quarter and 26% year-over-year, driven by the growth of both FPT Shop and Long Châu chains. Notably, after nine months, the FPT Shop chain recorded cumulative profits. By the end of the period, FPT Retail achieved 75% of its annual revenue target and 89% of its pre-tax profit goal for 2025. Online sales across the company reached VND 6,399 billion in nine months, a 27% increase year-over-year.

The Long Châu chain remained the primary growth driver, contributing 69% to FPT Retail’s total consolidated revenue. In the first nine months, Long Châu’s revenue hit VND 24,804 billion, a 38% year-over-year growth, achieving 77% of its annual target. Operational efficiency was maintained even during expansion, with an average monthly revenue of VND 1.2 billion per pharmacy.

In terms of network expansion, by the end of Q3/2025, Long Châu operated 2,317 pharmacies and 203 vaccination centers. Compared to the beginning of the year, the system added 374 new pharmacies and 77 vaccination centers. With a total of 451 new establishments in nine months, the company surpassed its full-year 2025 expansion plan.

For the FPT Shop chain, nine-month cumulative revenue reached VND 11,551 billion, a 6% year-over-year increase, achieving 72% of the annual target. Operational efficiency improved, with average monthly revenue per store in Q3 at VND 2.4 billion, up 14% year-over-year and nearly 30% compared to Q2/2025. This growth was fueled by the recovery in home appliances, services, and laptops, particularly gaming and AI laptops during the back-to-school season.

Additionally, pre-orders for the iPhone 17 surged compared to 2024, bolstering revenue, with the Promax model accounting for 80% of orders. Operational efficiency also improved, with average monthly revenue per FPT Shop store in Q3 reaching VND 2.4 billion, a 14% year-over-year increase and nearly 30% compared to Q2/2025. As of September, FPT Shop operated 624 stores, a reduction of 10 stores since the beginning of 2025.

Soaring Operational Costs Slash Vietbank’s Q3 Pre-Tax Profit by 14%

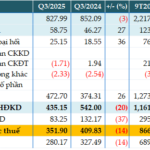

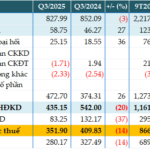

Vietbank (UPCoM: VBB) reported a pre-tax profit of nearly VND 352 billion in Q3/2025, reflecting a 14% year-on-year decline. This decrease is attributed to lower net interest income and higher operating expenses, as indicated in the bank’s consolidated financial statements.

Q3/2025 Financial Reports Deadline: Vinhomes, HDBank, TPBank, Vietjet, BSR, and More Companies Announce Surprising Results by October 30th

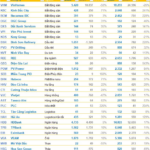

Khang Điền (KDH) reported a staggering 783% surge in Q3/2025 net profit, reaching 654 billion VND. Similarly, Becamex IJC and Intresco saw remarkable growth, with net profits soaring by 203% and 308%, respectively.