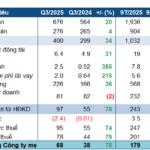

As of September 30, 2025, HDBank’s total assets reached VND 782 trillion, marking a 12.1% increase since the beginning of the year. Credit growth surged by 22.6%, primarily focused on priority sectors and essential business production. The bank’s non-performing loan ratio stood at 1.97% individually, while its Basel II Capital Adequacy Ratio (CAR) reached 15%, among the highest in the market.

A standout achievement is the non-interest income of VND 5.366 trillion, soaring by 178.6% year-on-year, driven by a robust digital transformation strategy and diversified revenue streams. Digital transactions increased by 47%, accounting for 94% of total transactions, resulting in a cost-to-income ratio (CIR) of 25.7%—one of the lowest in the industry. HDBank now serves over 20 million customers, solidifying its position as a modern, customer-friendly, and sustainably growing bank.

Subsidiary units also reported strong results. HD SAISON achieved a profit of VND 1.1 trillion, with a return on equity (ROE) of 24.4%, maintaining its leadership in consumer finance. HD Securities recorded a profit of VND 614 billion, up 30%, securing the top ROE in the industry. Vikki Bank turned profitable after just seven months of transformation, attracting over 1.3 million new customers and launching Vikki Café—a next-generation branch offering unique and exceptional customer experiences.

Notably, HDBank is seeking shareholder approval for a 30% dividend and bonus share distribution plan for 2025 (25% in stock dividends and 5% in bonus shares), continuing its consistent high payout policy over the years.

Under Decree 69 amendments, foreign ownership at HDBank has been raised to 49%, broadening opportunities to attract foreign capital and enhance stock liquidity in the market.

HDBank’s leadership visiting the London Stock Exchange

During General Secretary Tô Lâm’s official visit to the United Kingdom, the London Stock Exchange (LSE) discussed a Memorandum of Understanding (MOU) to establish a cooperation framework supporting HDBank in exploring international listing and capital raising opportunities. This initiative aims to benefit HDBank, its subsidiaries, and clients, while expanding global investor outreach through London’s capital markets.

With exceptional profitability, an attractive dividend policy, a clear digital and international integration strategy, HDBank is poised to sustain double-digit growth, reinforcing its position among Vietnam’s highest-performing banks.

Vinamilk’s Q3 Consolidated Revenue Surges Close to 17 Trillion VND Milestone

Vinamilk reported a consolidated revenue of VND 16,968 billion in Q3, marking a 9.1% year-over-year increase. Consequently, the nine-month cumulative consolidated revenue reached VND 46,678 billion, up 0.7% compared to the same period last year. Vietnam’s leading dairy company saw growth in both domestic and international business segments relative to the previous quarter.

Purifying the Digital Realm: Combating the Intoxication of Online Power

Delegate Trịnh Xuân An urged a focus on ensuring national security in cyberspace, cleaning up the online environment, and preventing behaviors associated with “internet power intoxication.”