According to the decision, the State Securities Commission of Vietnam (SSC) has mandated that Hoa Binh Securities Corporation (HBS) cease signing new contracts or extending existing ones related to margin lending services for customers. HBS is also required to halt all margin lending activities and submit a report to the SSC within 48 hours of being placed under special control.

HBS must disclose detailed financial information, including the causes of the situation and the proposed solutions, and report these to the SSC.

Hoa Binh Securities Corporation previously faced suspension of securities depository activities. Illustrative image.

On October 3, the Hanoi Stock Exchange (HNX) issued a decision to restrict trading of HBS shares due to the delayed submission of the audited semi-annual financial report for 2025, which exceeded the 45-day limit. As a result, HBS shares can only be traded on Fridays, starting from October 8.

HBS shares were also moved from the warning list to the controlled list on September 22, due to the company’s delay in submitting the audited semi-annual financial report for 2025, which exceeded the 30-day limit. Currently, the market price of HBS shares stands at 6,100 VND per share.

Earlier, Hoa Binh Securities Corporation experienced significant changes in its senior leadership. In August, Mr. Le Dinh Duong, Chairman of the Board of Directors (BOD) for the 2023-2028 term, resigned for personal reasons. Subsequently, Ms. Tran My Linh, a BOD member, was elected as the new Chairwoman.

The company’s Q2 financial report for 2025 revealed that in the first six months of the year, operating revenue reached 15 billion VND, with after-tax profit at 5.8 billion VND, marking a 14% and 28% decline, respectively, compared to the same period last year.

Recently, Hoa Binh Securities Corporation, Bao Tin Manh Hai, and a group of companies associated with Ms. Nguyen Thi Loan (formerly known as the Chairwoman of Vimedimex Group) and Vimedimex Group jointly established a cryptocurrency asset company with a capital of 10 trillion VND. Hoa Binh Securities Corporation holds a 2% stake in this venture.

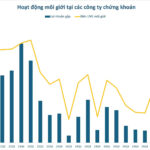

Q3 Brokerage Segment Gross Profit Surges to VND 2 Trillion: Profit Margins Hit 4-Year High

In Q3, brokerage commissions in the securities sector reached their highest level in 14 quarters, surpassing the peak seen during the 2021 retail investor boom.

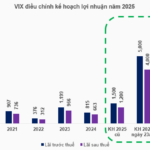

VIX Enhances Business Plan Once More, Outlines Capital Raising Strategy for Crypto Asset Firm

VIX Securities Corporation (HOSE: VIX) is set to elevate its 2025 pre-tax and post-tax profit targets to VND 6,500 billion and VND 5,200 billion, respectively, replacing the plan announced in late September. Additionally, the company plans to issue nearly 920 million shares at VND 12,000 per share to raise capital for proprietary trading, margin lending, and a crypto asset platform.

FLC Calls Extraordinary General Meeting Following Bamboo Airways Takeover

Amidst FLC’s comprehensive restructuring efforts following an extended period of crisis, these strategic moves are taking place.