According to the recently released Q3 financial report, as of September 30, the short-term and long-term financial loans of Vietnam’s “Steel King” have surged by nearly 17% compared to the beginning of the year, marking five consecutive quarters of increasing debt.

However, this development aligns with the group’s previously outlined strategy, as the company is channeling resources into the Hoa Phat Dung Quat 2 Steel Complex.

At the 2024 Annual General Meeting, Mr. Tran Dinh Long, Chairman of Hoa Phat, confirmed that the Dung Quat 2 project would be financed with half equity and half loans. This mega-project in Quang Ngai spans 280 hectares with a total investment of up to VND 85 trillion.

Despite the substantial financial debt, Hoa Phat’s balance sheet reflects robust financial health. As of September 30, the company’s total assets reached nearly VND 246.2 trillion, including ample cash and deposits of nearly VND 28 trillion and inventory valued at VND 45.6 trillion. Notably, fixed assets soared to over VND 104.7 trillion, a VND 37 trillion increase from the start of the year.

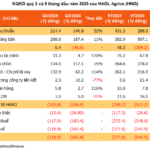

For Q3/2025, Hoa Phat Group reported revenue of VND 36,794 billion and post-tax profit of VND 4,012 billion, up 7% and 33% year-on-year, respectively.

Over the first nine months, the Group achieved revenue of VND 111,031 billion, a 5% increase, and post-tax profit of VND 11,626 billion, a 26% rise compared to the same period last year.

With these results, Hoa Phat has fulfilled 65% of its revenue target and 78% of its post-tax profit goal for the first nine months. The steel segment and related products remain the primary drivers, contributing 93% of revenue and 83% of post-tax profit.

– 4:30 PM, October 31, 2025

Hoa Phat’s Near 100 Trillion VND Debt and Soaring Interest Expenses: Unveiling the Unique Reason Behind the Surge

Hòa Phát’s debt has risen primarily due to the disbursement of medium and long-term loans, which are financing ongoing investment projects. Notably, the majority of this increase is attributed to the Hòa Phát Dung Quất 2 Steel Complex project.

HAGL Agrico Reports Hundreds of Billions in Losses Despite Strong Rubber and Fruit Sales

Despite a resurgence in gross profit and a significant increase in revenue from rubber latex and fruit sales, billionaire Trần Bá Dương’s agricultural company has reported its 18th consecutive quarterly net loss. This persistent deficit is primarily attributed to escalating financial expenses, which continue to erode the company’s overall performance.

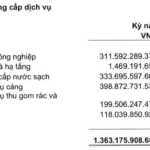

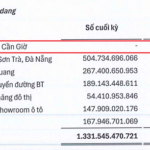

Sonadezi Surpasses Annual Plan with Over $1 Billion Profit in 9 Months

Following a record-breaking second quarter, Sonadezi’s net profit continued its upward trajectory in Q3 2025, driven by steady growth in port services, clean water, and improved gross margin. The company has already surpassed its full-year profit target after just three quarters.