Every year, tens of thousands of Vietnamese fall victim to scams, losing not only money but also trust in the digital space. Therefore, building a safe and reliable digital Vietnam is not just the responsibility of government agencies but also a shared duty of the entire financial and banking system, as well as every individual citizen.

This core message was emphasized during the seminar “Financial Security in the Digital Age,” part of the program “Building the Nation – Proud Vietnam,” co-produced by VCCorp and HTV9.

Featuring two distinguished guests, Mr. Vu Duy Hien, Deputy Secretary-General and Chief of the National Cybersecurity Association, and Mr. Vu Thanh Trung, Vice Chairman of the Board of Directors of Military Commercial Joint Stock Bank (MB), the seminar provided deep insights into financial security in an era where technology offers both economic opportunities and increasingly sophisticated risks.

“Awareness as the Shield” – The Key Defense for Users

According to the Cybersecurity and High-Tech Crime Prevention Bureau, in the first 8 months of 2025, Vietnam recorded over 1,500 online fraud cases, a 65% increase compared to the same period in 2024, with estimated losses exceeding 1.66 trillion VND. Over 4,500 malicious domains were detected, employing sophisticated tactics like deepfake, crypto scams, OTP theft, and impersonation of police or banks. The surge in cybercrime threatens digital trust and national digital transformation efforts.

Currently, on average, one in every 220 smartphone users has been a victim of online fraud. This highlights that user awareness remains a weak point in the digital financial ecosystem. Without sufficient risk identification skills, even the most advanced security technologies struggle to be effective.

Mr. Vu Duy Hien emphasized, “Awareness is the most critical shield protecting citizens in the digital space.” Therefore, individuals must proactively safeguard their personal information and adhere to basic online safety principles.

However, it’s essential to acknowledge that Vietnam’s regulatory bodies, businesses, and financial institutions face a severe shortage of high-skilled cybersecurity professionals. Additionally, coordination among agencies, banks, and technology companies remains fragmented, hindering effective information sharing and incident response. The current legal framework for cybersecurity also lags behind the rapid evolution of cybercrime, complicating investigation, prosecution, and deterrence efforts.

Thus, alongside individual vigilance, Mr. Vu Duy Hien stressed the need for collective action from the financial and banking system. “Banking Shield” – A 24/7 Race Against Cybercriminals

Recognizing the responsibility to protect customers from digital threats, Mr. Vu Thanh Trung, Vice Chairman of the Board of Directors of Military Commercial Joint Stock Bank (MB), a pioneer in implementing App Protection solutions for online transaction security, stated: “With approximately 35 million users, MB’s challenge is not just protection but also ‘winning the speed race’ in the 24/7 battle against cybercriminals. We aim for a ‘0% risk’ strategy, ensuring no incidents occur.”

Beyond strengthening defenses, MB adopts a “Reverse Thinking” approach, simulating scam scenarios to identify and patch security vulnerabilities. The bank also invests heavily in expert capabilities, ensuring its team is equipped with robust “digital antibodies” to protect customers consistently.

Mr. Vu Thanh Trung highlighted that for scams outside the banking system, which exploit customer trust and lack of awareness: “We cannot solely blame users. At MB, we believe supporting and protecting customers from these risks is a critical responsibility of the bank.”

MB has implemented proactive measures, such as using Artificial Intelligence (AI) to analyze user behavior and detect anomalies, and integrating malware scanning to prevent potential threats.

Additionally, MB focuses on balancing security with user experience. A digital banking app must not only be smooth and user-friendly but also incorporate multi-layered protections, including voice recognition, biometrics, data encryption, and advanced authentication technologies.

Mr. Trung also emphasized the importance of interbank data sharing. When fraudulent activity is detected in an account, device, or IP address, this information must be shared promptly to prevent criminals from reoffending across other institutions. “We must proactively prevent, not just react after damage occurs,” he asserted.

Toward a Safe and Trustworthy Digital Nation

For Vietnam to become a safe and sustainable digital nation, Mr. Vu Duy Hien, Deputy Secretary-General of the National Cybersecurity Association, stressed that cybersecurity must accompany digital transformation. “Digital transformation cannot succeed without cybersecurity. A faster, more convenient system lacking control poses immense risks, and the cost of remediation far exceeds prevention expenses,” he noted.

According to Mr. Hien, Vietnam must swiftly develop a flexible and robust legal framework that keeps pace with the complexities of cybercrime while fostering innovation. This foundation will enable financial institutions and technology companies to thrive in the digital environment.

The financial and banking sector is a critical front in cybersecurity efforts. Investment in technology infrastructure and information security must be prioritized alongside product development and customer experience. In reality, many organizations allocate less than 10% of their technology budget to security, despite it being essential for user trust.

Alongside technology and policy, raising public awareness is the final but equally vital piece of the puzzle. The National Cybersecurity Association is implementing numerous communication and training programs to help citizens recognize scams, understand risks, and protect themselves in the digital environment.

From a business perspective, Mr. Vu Thanh Trung emphasized the importance of collaboration among three key stakeholders: the Government, Businesses, and Citizens. The Government sets high cybersecurity standards and rapid response mechanisms. Businesses, particularly banks, lead in technology deployment and data protection. Meanwhile, user awareness is crucial for bridging security solutions with everyday life.

He concluded: “With unity and shared responsibility among these three parties—led by the Government and driven by Businesses—we will build a strong National Digital Antibody, making Vietnam a safe, trustworthy, and prosperous digital nation in the technological era.”

The talk show “Building the Nation – Proud Vietnam” is an inspiring series co-produced by the Government’s Information Portal, HTV9, and VCCorp, with strategic partner Masterise Group and Military Commercial Joint Stock Bank (MB). The program honors outstanding individuals, stories, and initiatives, reflecting the collaboration between the Government, businesses, and communities in building a modern, integrated, and happy Vietnam.

As one of Vietnam’s top 5 banks, MB leads in digital transformation, innovation, and sustainable development, aiming to deliver tangible value to customers, society, and the nation. Stay tuned for more inspiring episodes of “Building the Nation – Proud Vietnam,” featuring stories from MB and other Vietnamese enterprises.

Forging Digital Trust: MB’s 24/7 Battle Against Cybercrime to Safeguard Customer Data and Assets

At the seminar titled “Financial Security in the Digital Age,” held as part of the “Building the Nation – Pride of Vietnam” program, a leader from Military Commercial Joint Stock Bank (MB) stated: “Our goal is not only to provide convenient financial services but also to protect users from all cyber threats.”

HDBank Surpasses 14,800 Billion VND in 9-Month Profit, Maintains Lead in Profitability Ratios, Dividends, and Bonus Shares Up to 30%

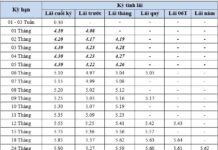

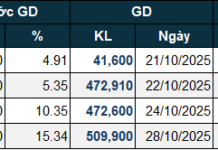

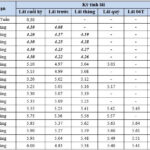

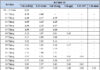

HDBank (HDB), Ho Chi Minh City Development Joint Stock Commercial Bank, reported a consolidated pre-tax profit of VND 14,803 billion for the first nine months of 2025, marking a 17% increase year-on-year. The bank’s profitability metrics remain at the forefront of the industry, with a return on equity (ROE) of 25.2% and return on assets (ROA) of 2.1%, underscoring its operational efficiency and robust financial foundation.

Hanwha Life Secures Spot in Vietnam’s Top 500 Most Profitable Enterprises for 2025

On October 28, 2025, Hanwha Life Vietnam was honored at the “Top 500 Most Profitable Enterprises in Vietnam 2025” (PROFIT500) award ceremony, organized by Vietnam Report in Hanoi. This marks the sixth consecutive year, since 2020, that Hanwha Life Vietnam has maintained this prestigious title.

Vinamilk’s Q3 Consolidated Revenue Surges Close to 17 Trillion VND Milestone

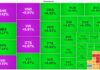

Vinamilk reported a consolidated revenue of VND 16,968 billion in Q3, marking a 9.1% year-over-year increase. Consequently, the nine-month cumulative consolidated revenue reached VND 46,678 billion, up 0.7% compared to the same period last year. Vietnam’s leading dairy company saw growth in both domestic and international business segments relative to the previous quarter.