[IR AWARDS] Key Information Disclosure Schedule for October 2025

[IR AWARDS] Key Information Disclosure Schedule for September 2024

-

03/11: PMI Announcement

Effective Index Composition (HNX30) -

06/11: Socio-Economic Report for October 2025

MSCI Index Composition Announcement -

14/11: Deadline for Q3/2025 Financial Statements (Reviewed, Non-Mandatory)

-

20/11: Maturity Date for 41l1FB000

-

25/11: Effective MSCI Index Composition

Timely and accurate information disclosure in the stock market is a fundamental responsibility of publicly traded companies toward their shareholders and investors. This is also the primary criterion in the annual IR Awards program, jointly organized by Vietstock and the FiLi E-Magazine, to honor listed companies with the best IR practices.

Notable Information Disclosure Violations in October 2025

In the most recent month, the State Securities Commission (SSC) has penalized several companies for information disclosure violations, including IDICO Group JSC (HNX: IDC), Lof International Dairy JSC (UPCoM: IDP), Nam Song Hau Petroleum Trading and Investment JSC (UPCoM: PSH), Sonadezi Chau Duc JSC (HOSE: SZC), Tien Phong Securities JSC (HOSE: ORS), An Thinh JSC (UPCoM: ATB), and Vinh Long Food JSC (UPCoM: VLF) for failing to disclose mandatory information as required by law.

The SSC also penalized LVA Trading and Services JSC (HNX: LBE), IDC, and SZC for incomplete information disclosure.

Additionally, KIDO Group JSC (HOSE: KDC) was fined for misleading information disclosure.

|

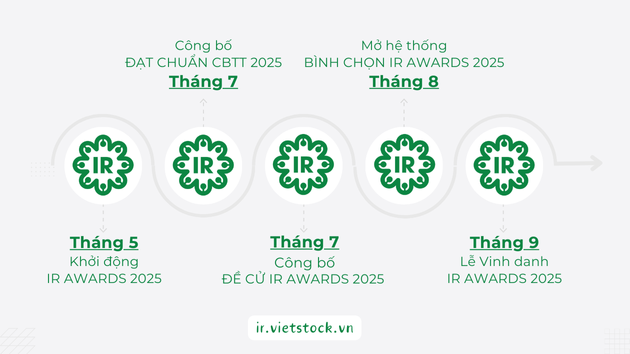

IR AWARDS 2025 The IR Awards is an annual program recognizing listed companies with the best Investor Relations (IR) practices, held since 2011. It is jointly organized by Vietstock, the VAFE Association, and FiLi E-Magazine. The IR Awards acknowledges and honors companies that meet the highest standards in information disclosure through a comprehensive survey and the annual announcement of the List of Companies Meeting Information Disclosure Standards. The IR Awards celebrates companies with the best IR practices of the year, based on quantitative evaluations, investor and financial institution voting, and the annual IR Awards Ceremony. |

– 08:00 01/11/2025

Blue-Chip Stock Code Witnessed Abnormal Accumulation of Over 100 Billion VND by Securities Company’s Proprietary Trading Desk on October 30th Session

Proprietary trading firms have resumed net buying on the Ho Chi Minh Stock Exchange (HOSE), with a total net purchase of VND 82 billion. This marks a significant shift in market sentiment, as these firms leverage their expertise to capitalize on emerging opportunities within Vietnam’s dynamic equity landscape.

Surprising Rally: Stocks Defy the Odds with “Green and Purple” Gains Amid VN-Index’s Sharp Decline

The surge in oil and gas stocks followed the government’s issuance of a resolution addressing challenges and bottlenecks in the approval process for key aspects of petroleum operations.

Elevating Vietnam’s Stock Market: A Golden Opportunity to Cement Its Global Financial Standing

Speaking at the Emerging Vietnam “Beyond the Upgrade” event hosted by SSI Securities, Ms. Wanming Du, Director of Asia-Pacific Policy at FTSE Russell, remarked that over the past decade, she has witnessed numerous markets transition from frontier to emerging status. However, no country compares to Vietnam in terms of the speed and scale of its reforms.

SHB Unveils Plan to Boost Capital to VND 53,442 Billion

SHB (Saigon-Hanoi Commercial Joint Stock Bank) is set to seek shareholder approval via written consent for a proposed charter capital increase of VND 7,500 billion.