Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 777 million shares, equivalent to a value of more than 24.7 trillion VND; the HNX-Index reached over 82.2 million shares, equivalent to a value of more than 1.8 trillion VND.

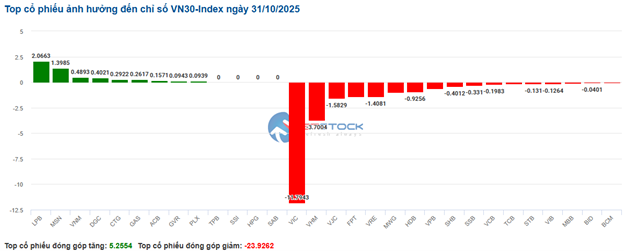

The VN-Index opened the afternoon session with continued selling pressure, causing the index to plummet despite buyers re-emerging towards the end. However, they couldn’t reverse the trend, and the VN-Index closed in the red, quite pessimistically. In terms of impact, VIC, VHM, VCB, and VJC were the most negatively influential stocks on the VN-Index, contributing to a decrease of over 18.2 points. Conversely, GAS, GVR, ACB, and FPT managed to stay in the green, adding only about 2.7 points to the overall index.

| Top 10 Stocks Most Impacting the VN-Index on October 31, 2025 (Calculated in Points) |

Similarly, the HNX-Index showed a quite pessimistic trend, with negative impacts from stocks like CEO (-6.96%), THD (-2.29%), NVB (-1.35%), DHT (-3.42%), and others.

| Top 10 Stocks Most Impacting the HNX-Index on October 31, 2025 (Calculated in Points) |

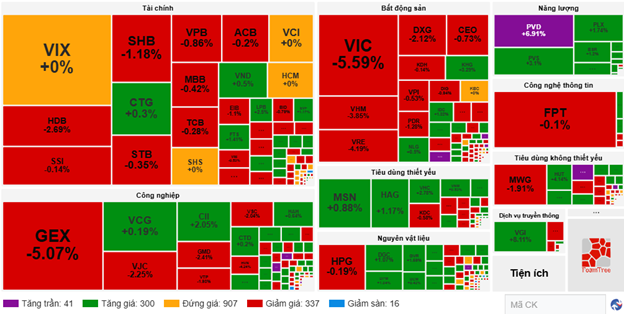

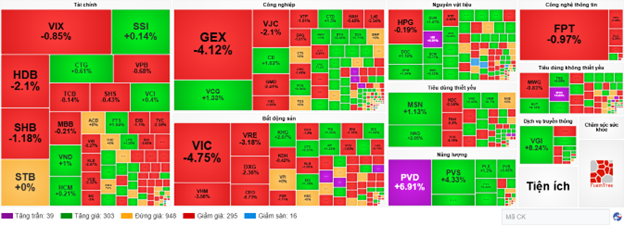

At the close, the VN-Index decreased by 1.23%, despite green dominating most industry groups. The real estate sector saw the largest decline, at 4.22%, primarily due to VIC (-6.42%), VHM (-4.62%), VRE (-3.76%), and CEO (-6.96%). The finance and industrial sectors followed with declines of 1.44% and 1.07%, respectively. Conversely, the communication services sector remained in the green, with the strongest market increase of 4.44%, mainly driven by VGI (+7.3%), VNZ (+1.82%), FOC (+0.76%), and ICT (+0.28%).

In terms of foreign trading, foreign investors continued to net sell over 453 billion VND on the HOSE, focusing on stocks like VIC (234.46 billion), VHM (138.16 billion), CTG (124.25 billion), and MBB (115.93 billion). On the HNX, foreign investors net sold over 58 billion VND, concentrated in PVS (17.51 billion), CEO (15.89 billion), PVI (7.34 billion), and SHS (6.92 billion).

Additionally, by the end of the trading session on October 31, 2025, foreign investors continued to net sell over 23,273 billion VND in October 2025, focusing on large-cap stocks such as MBB, SSI, MSN, and CTG.

| Foreign Net Buying and Selling Trends |

| Top 10 Stocks with the Strongest Foreign Net Buying and Selling on October 31, 2025 |

Morning Session: VN-Index Retreats to Around 1,650 Points, Energy Stocks Surge

At the mid-session break, the VN-Index decreased by nearly 17 points (-1.01%), falling to 1,652.78 points, while the HNX-Index increased slightly by 0.41%, reaching 268.06 points. Market breadth was relatively balanced, with 353 stocks declining and 341 advancing.

Among the top 10 stocks influencing the VN-Index, VIC and VHM were the most negatively impactful, reducing the index by 9.55 points and 3.61 points, respectively. Conversely, GAS and LPB were the most positive, contributing a total of 2.23 points to the overall index.

| Top 10 Stocks Most Impacting the VN-Index in the Morning Session of October 31, 2025 (Calculated in Points) |

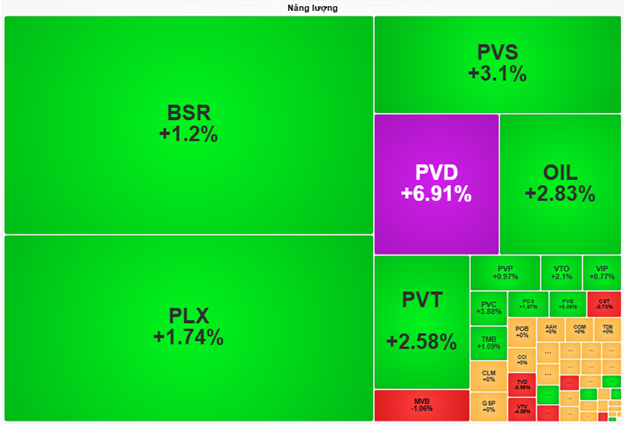

Amid a generally gloomy market, the energy sector emerged as a notable bright spot, with several stocks in this sector surging strongly in the morning session. These included PVD reaching its ceiling price, BSR (+1.2%), PLX (+1.74%), PVS (+3.1%), OIL (+2.83%), PVT (+2.58%), PVC (+3.88%), and PVB (+3.06%).

Source: VietstockFinance

|

Additionally, the communication services sector maintained its strong performance, with VGI increasing by 8.11%, VNZ by 1.82%, and VNB by 1.78%. However, a few stocks still declined, including FOX (-0.89%), CTR (-0.53%), and YEG (-1.59%).

Conversely, the real estate sector recorded the most negative performance today, with significant declines not only from Vingroup stocks but also from others such as KSF (-1.11%), PDR (-1.28%), DXG (-2.12%), TCH (-1.58%), and TAL (-1.57%).

Source: VietstockFinance

|

Foreign investors continued to net sell with a value of 747 billion VND across all three exchanges. Selling pressure was primarily concentrated in VIC, with a value of 197.66 billion VND, far surpassing other stocks. Meanwhile, VIX led the net buying list with a value of only 34.94 billion VND.

10:30 AM: Selling Pressure Intensifies

Pessimistic sentiment continued to dominate large-cap stocks, causing major indices to decline. As of 10:30 AM, the VN-Index decreased by more than 12 points, trading around 1,656 points, while the HNX-Index increased by 1.67 points, trading around 268.63 points.

Stocks in the VN30 basket faced strong selling pressure, reducing the overall index by more than 23 points. Notable declines included VIC, VHM, VJC, and FPT, with respective impacts of 11.79 points, 3.7 points, 1.58 points, and 1.42 points. Other stocks like VRE, MWG, and HDB also recorded significant decreases.

Source: VietstockFinance

|

Capital is fleeing the real estate sector, causing most stocks in this industry to decline. Specifically, strong selling pressure was observed in VIC (-4.65%), VHM (-3.56%), and VRE (-3.18%). Additionally, red dominated stocks like KDH (-0.28%), DXG (-2.12%), TCH (-1.13%), and NVL (-0.72%).

Next, the financial sector is experiencing strong polarization, with selling pressure slightly outweighing buying in stocks like VIX (-0.68%), HDB (-1.95%), SHB (-1.18%), and VPB (-0.68%). In contrast, green appeared in stocks like CTG, HCM, VCI, and SSI, but the increases were insignificant.

Compared to the opening, the market continued to polarize strongly, with over 940 reference stocks. Buyers maintained a stronger position, with 303 advancing stocks and 295 declining stocks.

Source: VietstockFinance

|

Opening: Cautious Start to the Session

Light red appeared right at the start of the trading session, indicating lingering caution among investors. Major indices fluctuated around the reference level, with mixed movements.

The VN-Index decreased by more than 5 points, trading around 1,663 points, while the HNX-Index fluctuated around 267 points.

Red temporarily dominated the VN30 basket, with 17 declining stocks, 11 advancing stocks, and 2 unchanged stocks. Among these, VIC, VHM, VJC, and VRE were the most negatively impactful stocks on the index. Conversely, VNM, CTG, MSN, and LPB were the major contributors to supporting the VN30-Index.

The financial sector continued to show strong polarization, with red slightly dominating at the start of the session. Selling pressure was concentrated in stocks like VIX (-1.54%), SSI (-0.29%), SHB (-0.89%), and TCB (-0.28%).

The materials sector recorded a positive recovery, with green dominating most stocks in this industry. Notable increases included HPG (+0.19%), GVR (+0.18%), DGC (+0.43%), and NTP (+0.93%).

– 15:25 31/10/2025

Stock Market Week 27-31/10/2025: Clear Polarization

The VN-Index extended its decline in the final session of the week, capping off October with a third consecutive week of adjustments. Amid subdued liquidity, the market is likely to remain volatile, characterized by persistent tug-of-war dynamics and heightened divergence.