Recently, Thai Binh Investment Joint Stock Company submitted a report detailing the trading results of NLG shares issued by Nam Long Investment Joint Stock Company.

According to the report, during the trading period from September 29, 2025, to October 28, 2025, Thai Binh Investment successfully sold only 110,000 shares out of the registered 2.5 million NLG shares, representing 4.4% of the total. The incomplete transaction was attributed to the share price not meeting expectations.

Following this transaction, Thai Binh Investment’s holdings of NLG shares decreased from nearly 17.08 million to approximately 16.97 million shares, reducing their ownership stake in Nam Long from 4.43% to 4.41%.

Notably, Mr. Nguyen Duc Thuan, a member of Nam Long’s Board of Directors, also serves as the Chairman of Thai Binh Investment’s Board of Directors.

Illustrative image

In a related development, Thai Binh Investment recently registered to transfer nearly 17 million NLG warrant shares of Nam Long Investment from October 27, 2025, to November 10, 2025, with the aim of restructuring its investment portfolio.

If the transaction is successful, Thai Binh Investment will no longer hold any warrant shares in Nam Long’s current offering.

Under the offering plan, Nam Long will issue approximately 100.12 million shares at a price of VND 25,000 per share through a rights issue.

The rights ratio is set at 100:26, meaning shareholders owning 100 shares will be entitled to purchase 26 new shares. The subscription and payment period is scheduled from October 20, 2025, to November 17, 2025.

Upon completion of the offering, Nam Long’s chartered capital is expected to increase from nearly VND 3,851 billion to approximately VND 4,852 billion.

Regarding business performance, Nam Long’s Q3/2025 consolidated financial report revealed a net revenue of over VND 1,877 billion, a 5.1-fold increase compared to the same period last year. After deducting taxes and fees, the company reported a net profit of more than VND 234 billion, compared to a net loss of over VND 40 billion in the previous year.

Nam Long attributed the significant growth in revenue and net profit to increased sales of land, apartments, townhouses, and villas.

For the first nine months of 2025, Nam Long achieved a net revenue of nearly VND 3,941 billion, 4.8 times higher than the same period in 2024, with a net profit after corporate income tax exceeding VND 441 billion, an 8.1-fold increase.

For 2025, Nam Long set a target of VND 6,794 billion in net revenue and VND 701 billion in net profit. As of the end of Q3, the company has achieved 58% of its revenue target and nearly 63% of its net profit goal.

As of September 30, 2025, Nam Long’s total assets decreased by 6.4% from the beginning of the year to nearly VND 28,387 billion. Inventory accounted for VND 17,852 billion, or 62.9% of total assets.

On the liabilities side, total payables stood at nearly VND 14,020 billion, an 11% decrease from the beginning of the year. Short-term and long-term loans totaled over VND 6,992 billion, representing 49.9% of total liabilities.

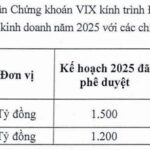

Securities Firm Aims to Quadruple 2025 Profit Plan, Targeting Capital Raise of Over 24 Trillion VND

The company anticipates raising over 11,000 billion VND through its upcoming share offering. This capital will be allocated to fund the development of the VIX Cryptocurrency Exchange and bolster resources for proprietary trading and margin lending activities.

DIC Corp Yet to Disburse Full Proceeds from 2021 Share Offering

As of October 7, 2025, DIC Corp has disbursed approximately VND 1,422.8 billion out of the total VND 1,499.9 billion raised from its 2021 share offering, leaving nearly VND 77.1 billion yet to be allocated.