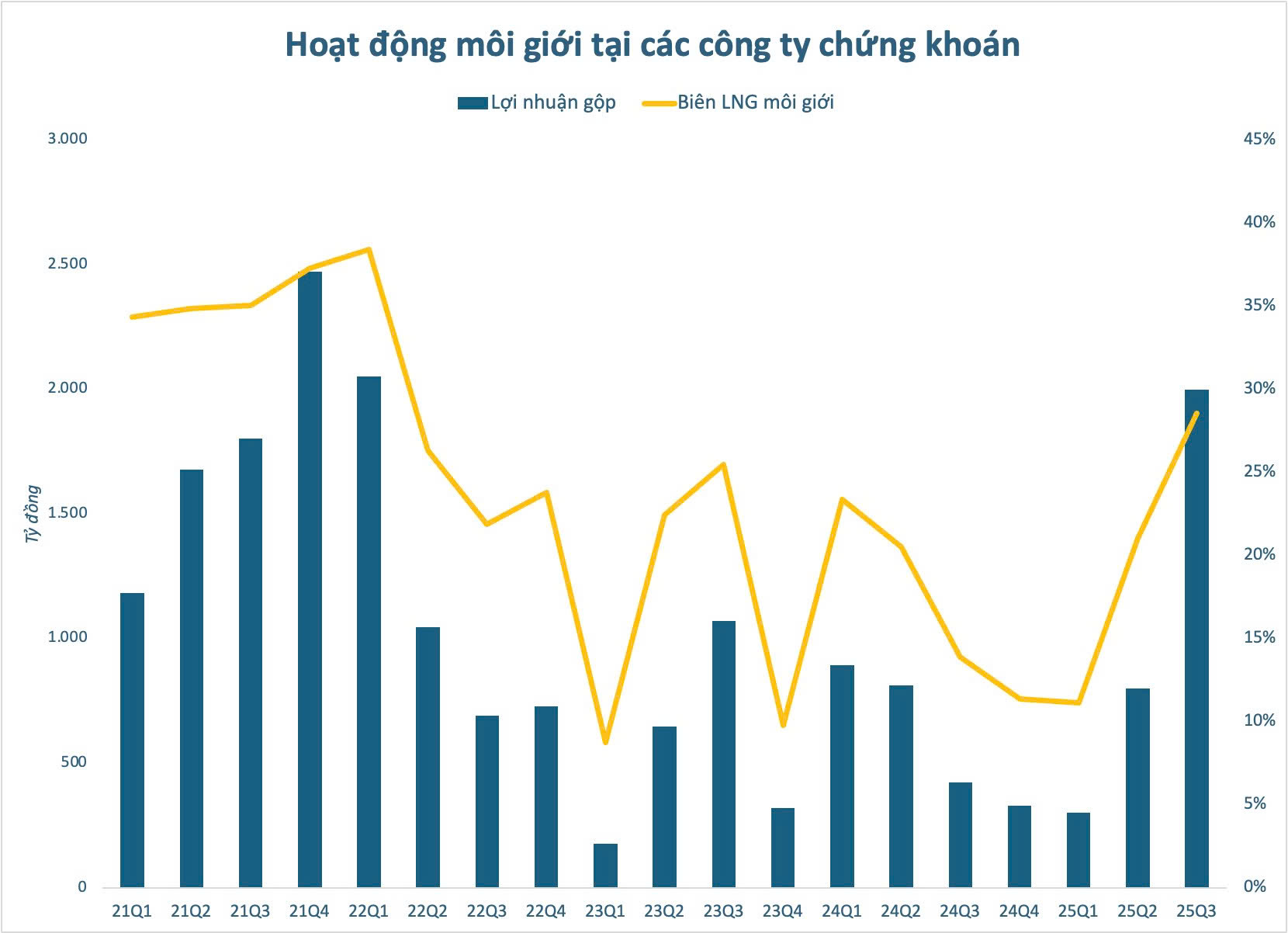

The buoyant stock market has set the stage for a lucrative third quarter for securities firms, with the brokerage segment experiencing an unprecedented “golden season.”

Industry-wide brokerage revenue surged to approximately VND 7 trillion, an all-time high. While operational costs rose in tandem, reaching VND 5 trillion, the gross profit for the brokerage sector soared to over VND 2 trillion, yielding a remarkable 29% gross margin—the highest in 14 quarters since the 2021 F0 investor boom.

3406af12bfb132ef6ba0.jpg

This robust brokerage performance contributed significantly to the securities industry’s record-breaking pre-tax profit of VND 19 trillion in Q3, alongside other segments like proprietary trading and lending.

Driving these impressive figures are the market’s strong liquidity, investor optimism, and securities firms’ strategic adaptations. As the Ho Chi Minh City Stock Exchange (HOSE) consistently recorded billion-dollar trading sessions, brokerage firms reaped substantial rewards.

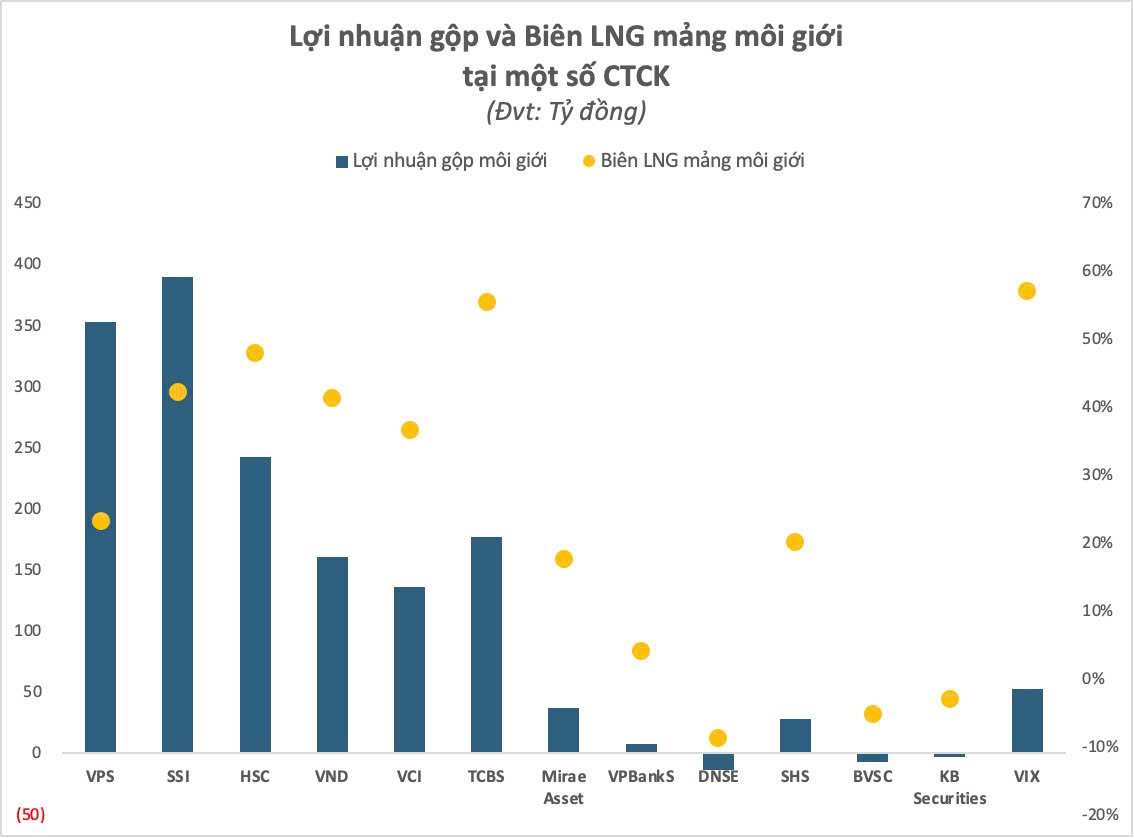

Leading firms reported brokerage revenue doubling year-on-year. VPS maintained its top position with Q3 brokerage revenue exceeding VND 1.5 trillion, capturing 21% of the market. The company achieved a gross profit of over VND 350 billion, with a 23% margin.

SSI and HSC trailed closely, generating brokerage revenues of approximately VND 920 billion and VND 500 billion, respectively, with margins ranging from 42% to 48%. TCBS stood out with a 55% margin, earning nearly VND 180 billion in gross profit from brokerage in Q3. Similarly, VIX Securities garnered VND 92 billion in brokerage revenue, with a gross profit of nearly VND 53 billion, achieving a 57% margin.

Conversely, firms like DNSE, BVSC, and KBSV reported brokerage segment losses in Q3.

The thickness of brokerage gross margins largely depends on each firm’s strategic focus. Some prioritize high-quality client portfolios over sheer volume, while others emphasize market reach. Many maintain large brokerage teams, whereas others adopt a 100% digital brokerage model, reducing direct personnel.

Amid fierce competition to retain clients, rising costs reflect the intense market rivalry. Sustaining high margins will be challenging if trading activity cools or interest rates shift.

Looking ahead, the brokerage segment’s outlook remains positive. Liquidity consistently exceeds $1 billion per session, and individual capital shows no signs of withdrawal. Institutional capital is returning as FTSE Russell upgrades Vietnam to a secondary emerging market, promising ETF and international investment fund inflows, expanding opportunities for foreign client acquisition.

Additionally, the IPO and new listing market is revitalizing. Large-scale deals in finance, technology, and real estate are boosting demand for advisory services, account openings, and warrant distribution. Some firms are diversifying into asset management and specialized investments to reduce reliance on traditional transaction fees.

Despite varying strategies, brokerage operations remain pivotal for securities firms. High-quality client portfolios offer greater benefits than standard transaction fees, particularly in driving margin lending. Larger client bases also facilitate the introduction of products like asset management, bond investments, and fund certificates to investors.

Elevating Vietnam’s Stock Market: A Golden Opportunity to Cement Its Global Financial Standing

Speaking at the Emerging Vietnam “Beyond the Upgrade” event hosted by SSI Securities, Ms. Wanming Du, Director of Asia-Pacific Policy at FTSE Russell, remarked that over the past decade, she has witnessed numerous markets transition from frontier to emerging status. However, no country compares to Vietnam in terms of the speed and scale of its reforms.

SHB Unveils Plan to Boost Capital to VND 53,442 Billion

SHB (Saigon-Hanoi Commercial Joint Stock Bank) is set to seek shareholder approval via written consent for a proposed charter capital increase of VND 7,500 billion.