Illustrative image

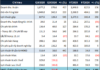

According to preliminary data from the General Department of Customs, Vietnam imported nearly 500,000 tons of fertilizers in September 2025, valued at over $193 million. This reflects a 17.6% decrease in volume and a 13% drop in value compared to the previous month. The import price stood at $401 per ton, marking a 6% increase.

In the first nine months of the year, fertilizer imports totaled over 4.8 million tons, worth more than $1.7 billion. This represents a 25.4% rise in volume and a 33.4% increase in value compared to the same period in 2024.

The average price was $353 per ton, an 8% increase compared to the first nine months of 2024.

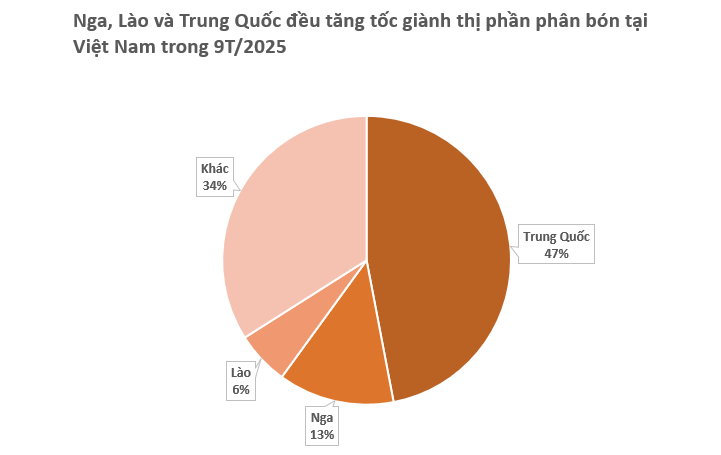

China remained the largest supplier, with Vietnam importing 2.27 million tons valued at over $805 million, up 40% in volume and 55% in value compared to the same period in 2024. The import price from China was $354 per ton, a 10% increase.

Russia followed as the second-largest supplier, with over 605,000 tons valued at more than $276 million, a 36% increase in volume and a 44% rise in value compared to the first nine months of 2025. The average price was $455 per ton, up 6%.

Laos ranked third, supplying over 285,000 tons valued at more than $83 million, a 9% increase in volume and a 22% rise in value. The price also saw a 13% increase, reaching $292 per ton.

According to the Food and Agriculture Organization (FAO), fertilizers play a crucial role in agriculture, contributing 30-60% of input costs and boosting crop yields by 40-50%. Over the years, Vietnam’s fertilizer industry has achieved significant milestones in self-sufficiency, producing 10-10.5 million tons annually and exporting various types of fertilizers. However, Vietnam’s fertilizer application rates are significantly higher than global averages, nearly three times the world’s standard.

Under the Plan for the Development of Organic Fertilizer Production and Use by 2030, with a vision to 2050, Vietnam aims to become a regional leader in organic fertilizer use. The plan targets 50% of cultivated areas using organic fertilizers, with 80% of provinces adopting organic fertilizer models linked to local value chains. It also aims to utilize 100% of available raw materials from agriculture, livestock, fisheries, and household waste for organic fertilizer production, both at household and industrial scales.

Globally, fertilizer prices surged by 42.5% in the first eight months of 2025, primarily due to China’s export restrictions to secure domestic supply. Domestic prices in Vietnam typically follow international trends, benefiting local companies with higher selling prices and strong sales volumes, significantly improving gross profit margins.

Although prices peaked in August and have since cooled as China resumed exports, VNDirect forecasts robust profit growth for Vietnamese fertilizer companies in 2025 compared to 2024. Producers of urea and DAP are expected to benefit most from higher selling prices and lower natural gas input costs.

Unleashing Khánh Hòa’s Potential: A Coastal Growth Hub Seeks Major Investors and Skilled Talent

Nestled in a prime strategic location, Khánh Hòa boasts Vietnam’s longest coastline, the Spratly Islands, deep-water bays, and abundant natural resources, creating “vast space for grand aspirations,” as aptly stated by Assoc. Prof. Dr. Nguyễn Chu Hồi, a member of the 15th National Assembly and Vice Chairman of the Vietnam Association of Seafood Exporters and Producers.