Mr. Nguyen Quang Huy, CEO of the Department of Finance and Banking at Nguyen Trai University, believes that updating land price lists to align with market rates is inevitable. However, adjustments must be implemented correctly, not as a burden, but as a step toward fairness, transparency, and sustainable development.

In a context where real estate prices are high, people’s incomes have not kept pace, and the government aims to cool housing prices for social welfare, a sharp increase in land price lists requires careful, nuanced, and strategic consideration. This ensures that land, a driver of growth, does not inadvertently become a barrier to development.

Experts argue that higher land prices will make it difficult for house prices to cool down. (Illustrative image: Minh Duc)

Essentially, land price lists are the foundation for determining land use fees, taxes, and compensation, representing the “input cost” for any real estate project. When land prices increase significantly, especially in central districts, businesses’ input costs rise sharply, inevitably reflecting in housing prices.

In reality, in many projects in Hanoi, land costs account for 30-50% of the cost structure. Thus, even a 20-30% increase in land prices can push final selling prices up by tens of percent.

“This makes the dream of homeownership for middle-income earners even more distant, while the market risks a serious imbalance—an oversupply of luxury homes and a shortage of affordable housing,” Mr. Huy emphasized.

High land prices make the dream of homeownership for middle-income earners even more distant.

Mr. Nguyen Quang Huy, CEO of the Department of Finance and Banking, Nguyen Trai University

Sharing the same view, Dr. Tran Xuan Luong, Deputy Director of the Vietnam Real Estate Market Research and Evaluation Institute, also believes that the current proposals by some localities to increase land prices are inappropriate.

With land costs accounting for 30-50% of input costs, rising land prices could further escalate real estate prices.

Additionally, herd mentality and the FOMO (fear of missing out) effect are strongly influencing Vietnam’s real estate market. An increase in land prices could quickly lead people and investors to believe prices will continue rising, fueling speculation and creating a more significant bubble than intended by advisors.

The Vietnam Real Estate Association emphasizes that the government, ministries, and localities are seeking solutions to reduce real estate prices. One effective measure is lowering input costs that make up selling prices.

However, rising land prices will impact costs, affecting housing accessibility for those with real needs. For commercial housing, increased land prices will affect project feasibility, driving house prices higher.

Higher land prices will lead to increased housing costs, reducing investment attractiveness, especially for real estate projects in suburban areas. A lack of investment projects will impact the city’s housing development plans in suburban areas aimed at population decentralization. Consequently, the housing supply in the market will continue to decrease, making it challenging to stabilize social welfare in the area.

Moreover, the real estate market is in a fragile recovery phase, with many businesses restructuring and limited capital. Increasing land prices now could create an additional double burden, slowing market recovery. Currently, rental prices for students near universities have risen by about 30%. Higher land prices will also increase rental prices, causing difficulties for students and tenants.

Reducing Investment Attractiveness

According to many experts, excessively high land prices not only increase housing costs but also reduce investment attractiveness.

Mr. Nguyen Quoc Hiep, Chairman of the Vietnam Construction Contractors Association, notes that high land prices could diminish Vietnam’s investment appeal. He explains that the 80-90% occupancy rates in most industrial clusters today stem from three key advantages: low labor costs, reasonable land prices, and favorable logistics infrastructure.

“But if we lose the advantage of reasonable land prices, while labor costs rise, what investment appeal do we have left?” he questioned.

Higher land prices reduce investment attractiveness. (Photo: Minh Duc)

He adds that the 2024 Land Law requires balancing the interests of the state, land users, and investors. However, in current land pricing, the interests of businesses, including land tenants, users, and real estate developers, are not adequately considered.

“Higher land prices increase investment costs and risks, so which businesses will dare to undertake projects? If businesses don’t develop projects, local sustainable revenue will also be affected,” Mr. Hiep emphasized.

Dr. Can Van Luc, a member of the Prime Minister’s Policy Advisory Council, also affirmed that this is an inevitable requirement in urban development but must ensure a balance of interests. The state needs to collect taxes fairly and sufficiently without driving up living costs and housing prices.

“If land prices are set too high relative to the economy’s capacity, it will create a chain reaction, affecting public investment, FDI attraction, and especially people’s access to housing,” Mr. Luc stated.

Higher land prices increase investment costs and risks, so which businesses will dare to undertake projects?

Mr. Nguyen Quoc Hiep, Chairman of the Vietnam Construction Contractors Association

Avoid Uniform and Shock Increases

Experts argue that land price adjustments should be region-specific and not implemented abruptly or as shock increases.

Mr. Nguyen Quang Huy stresses that the core issue in adjusting land price lists lies in the implementation method. Land prices cannot be increased uniformly without corresponding support mechanisms. A good land policy must ensure three pillars: fair state revenue, a healthy business environment, and affordable housing access for citizens.

To achieve this, flexible adjustment coefficients should be applied, differentiating by region, land type, and usage purpose. Land for social housing and affordable commercial housing should be exempt, reduced, or deferred from land use fees. Meanwhile, land for high-end, commercial, or centrally located projects can be priced closer to market rates to avoid budget shortfalls.

Simultaneously, significant reforms are needed in planning, procedures, and legal costs—factors currently contributing significantly to housing prices. Prolonged project preparation increases capital and interest costs, which developers add to selling prices, pushing house prices beyond their real value. Transparent planning, swift approvals, and long-term forecasts can reduce intermediary costs, stabilizing house prices even with higher land prices.

“On a macro level, land is not just a revenue source but a driver of sustainable growth. When intelligently planned and properly utilized, land becomes ‘development capital,’ creating infrastructure, industries, cities, and jobs. Conversely, viewing land solely as a short-term revenue source can lead to price spirals, reduced accessibility, inequality, and weakened national competitiveness,” Mr. Huy emphasized.

Therefore, he believes we need to redefine our development philosophy. Land should not be seen as a burden to maximize revenue but as a strategic resource managed as long-term capital. A reasonable land price list—reflecting market value with policy flexibility—will increase transparent state revenue, reduce housing costs through other savings, and encourage sustainable business development.

According to Nguyen The Diep, Vice Chairman of the Hanoi Real Estate Club, land price lists in many countries balance market reflection with economic and social stability.

He cites Singapore’s example, where land is priced based on the “urban life cycle,” considering 10-20 year development potential. State land prices rise steadily at 2-5% annually, linked to infrastructure and population indices. Singapore also publishes an online land price map, ensuring transparency and limiting speculation.

He suggests Vietnam needs a unified land database connecting tax, notary, banking, and trading platforms, rather than relying solely on administrative surveys. Land price lists should be publicly accessible, easily searchable, and open to social feedback. Prices should not be adjusted abruptly but increased gradually by 3-5% annually by region to avoid “price shocks” and negative impacts on the housing market.

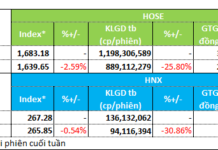

The Hanoi Department of Agriculture and Rural Development recently submitted a draft for the first land price list (as per Article 257 of the 2024 Land Law) to be implemented from January 1, 2026. The draft proposes a 2-26% increase in residential land prices in Hanoi compared to the current list.

Not just Hanoi, many localities nationwide are entering a similar “land price increase cycle” in 2024-2025. In Ho Chi Minh City, the adjusted land price list effective from October 31, 2024, increases by 4 to 38 times, reaching a maximum of 687.2 million VND/m². Bac Giang (old) also saw a roughly 2.4-fold increase, with the highest land price reaching 120 million VND/m². Hai Phong even saw increases of up to 373% compared to the old list.

Emerging Real Estate Satellite Hubs: A Vibrant Ring Around Ho Chi Minh City

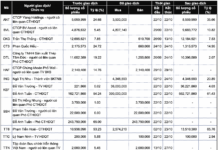

The real estate market is buzzing with activity in the satellite regions surrounding Ho Chi Minh City, as anticipation builds ahead of the city’s expansion. Leading the charge is the former Binh Duong province, topping the charts with an impressive index of 100. Close behind are Dong Nai (38), Ba Ria – Vung Tau (34), and Long An (28), collectively forming a vibrant “satellite belt” around the bustling metropolis.

Vingroup Makes Historic Mark on Congo’s Prime Land, Experts Say

According to industry experts, the partnership agreement between Vingroup Corporation and the Kinshasa Capital Authority (Democratic Republic of the Congo) not only opens up new investment avenues in Africa but also underscores a strategic leap for Vietnamese enterprises onto the global stage.

Dual Heritage of Ha Long – Cat Ba: A Golden Opportunity for Green Tourism and Sustainable Investment

Following its recognition by UNESCO as Vietnam’s first inter-provincial World Natural Heritage site, the Ha Long Bay – Cat Ba Archipelago complex is ushering in a new era: one of tourism development intertwined with conservation, investment coupled with responsibility, and growth aligned with environmental sustainability.