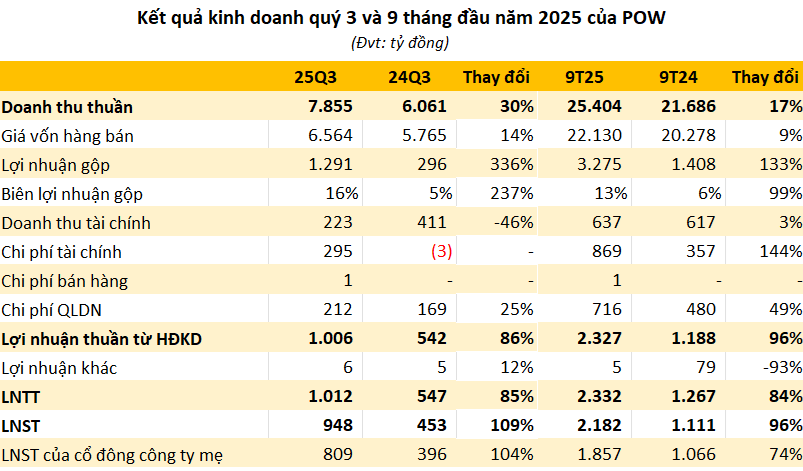

PetroVietnam Power Corporation (PV Power, stock code: POW) has released its Q3/2025 financial report. The company’s net revenue surged by 30% year-on-year to VND 7,855 billion. Cost of goods sold increased by 14% to VND 6,574 billion, resulting in a gross profit of VND 1,291 billion and a gross margin of 16%, a significant improvement from 5% in Q3/2024.

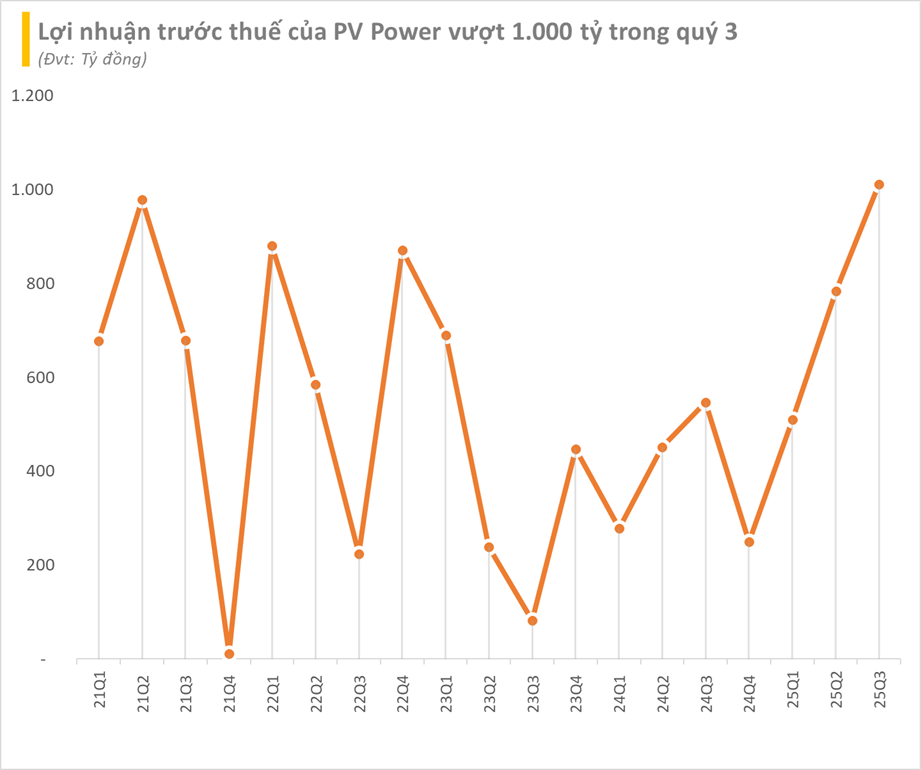

Financial income dropped sharply by 46% to VND 223 billion, while financial expenses reached VND 295 billion. Consequently, PV Power’s pre-tax profit in Q3 soared by 86% year-on-year to VND 1,012 billion, the highest since Q4/2020. Net profit after tax stood at VND 948 billion, up 109% year-on-year, with a net income of VND 809 billion.

For the first nine months of 2025, PV Power’s cumulative revenue reached VND 25,404 billion, a 17% increase year-on-year. Pre-tax profit hit VND 2,332 billion, up 84%, with net income rising 74% to VND 1,857 billion.

As of September 30, 2025, total fixed assets stood at VND 85,771 billion, up nearly VND 5,900 billion from the beginning of the year. Cash and cash equivalents totaled VND 9,700 billion, with an additional VND 11,116 billion in bank deposits with terms under 12 months. Total liabilities were VND 49,296 billion, including loans of over VND 27,700 billion. Equity reached VND 36,475 billion, with undistributed net income of nearly VND 5,500 billion. Chartered capital is VND 23,418 billion, with PetroVietnam holding 79.94% of shares.

Regarding business activities, POW shareholders approved a capital increase plan of VND 7,259 billion to VND 30,678 billion through three methods. First, the company will issue 281 million shares to existing shareholders at a 12% ratio (12 new shares for every 100 held) at VND 10,000 per share, raising VND 2,810 billion. These funds will finance the Nhon Trach 3 and Nhon Trach 4 power plant projects, covering payments to contractors and partners.

Second, POW will issue bonus shares at a 15% ratio (15 new shares for every 100 held), totaling over 351 million shares, using funds from the 2024 audited financial statement’s development investment fund.

Third, POW plans to issue dividend shares at a 4% ratio (4 new shares for every 100 held), sourced from undistributed net income in the 2024 audited financial statement.

These issuances are expected to occur from 2025 to Q1/2026, pending approval from the State Securities Commission. The VND 2,810 billion raised from existing shareholders will fund the Nhon Trach 3 and Nhon Trach 4 projects, with disbursement in Q4/2025 and Q1/2026.

Additionally, PV Power has launched an electric vehicle charging station project as part of its long-term strategy to promote clean energy in Vietnam. Recently, POW partnered with Vingroup, tasking V-Green with developing 1,000 charging points nationwide by 2035. V-Green’s infrastructure will exclusively serve VinFast vehicles.

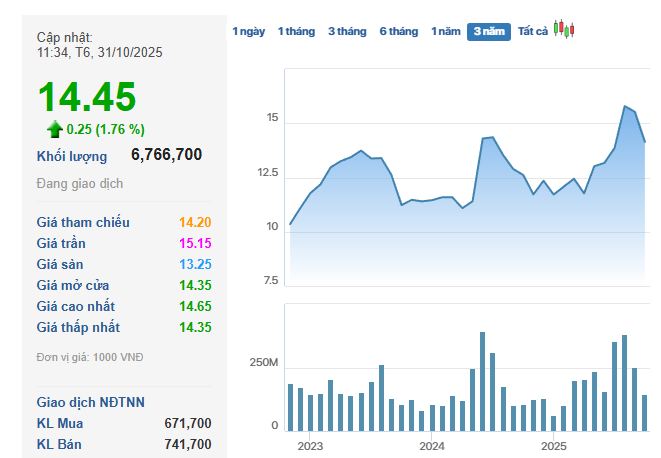

On the market, POW shares closed at VND 14,200 on October 30.

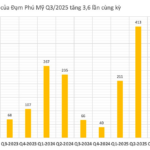

Phú Mỹ Fertilizer (DPM) Reports Q3 Profit 3.6x Higher YoY, Surpassing Annual Targets

The company attributes its success to the robust performance of its core product lines, which have driven significant growth in both revenue and profit margins.