I. VIETNAM STOCK MARKET FOR THE WEEK OF OCTOBER 27-31, 2025

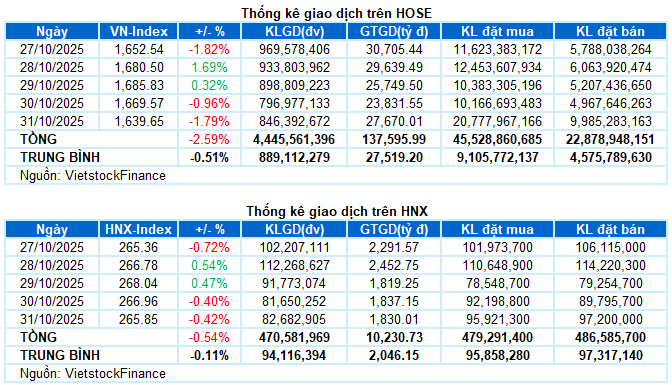

Trading: Major indices universally declined in the October 31st session. The VN-Index retreated to 1,639.65 points, a sharp 1.79% drop from the previous session; the HNX-Index also adjusted by 0.42%, closing at 265.85 points. For the week, the VN-Index lost a total of 43.53 points (-2.59%), while the HNX-Index shed 1.43 points (-0.54%).

Vietnam’s stock market remained entrenched in a corrective trend during the final trading week of October. The early-week sharp decline was once again supported by the August 2025 lows, but the subsequent recovery was short-lived amid lackluster liquidity and weakened support from major stocks. Prolonged sideways sessions with significant volatility and alternating green and red hues vividly reflected strong polarization among stock groups. The VN-Index ended the week at 1,639.65 points, down over 43 points from the previous week.

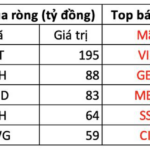

In terms of impact, the 10 most negatively influential stocks collectively erased nearly 24 points from the VN-Index in the final session, with the heaviest pressure stemming from the duo VIC and VHM. Conversely, the contribution of the top 10 positive stocks managed to retain only 3.6 points for the index, underscoring the dominance of selling pressure.

Sector performance was markedly polarized. Real estate led the decline, plunging 4.22%. Selling pressure was widespread, not confined to the Vingroup family, with notable drops in CEO (-6.96%), DXG (-4.48%), PDR (-3.63%), DIG (-3.06%), KBC (-1.41%), TCH (-2.04%), and DXS (-5.41%), among others.

Additionally, financial and industrial sectors weighed heavily on the index, both recording declines exceeding 1%. Numerous stocks tumbled with significant liquidity, including VIX (-4.44%), HDB (-4.19%), SHB (-2.66%), STB (-2.46%), EIB (-2.21%); VJC (-4.35%), HAH (-2.07%), VSC (-5.5%), GMD (-3.4%), VTP (-3.19%), HVN (-4.24%), and GEX hitting the lower limit.

On the upside, energy emerged as a notable bright spot, with several stocks in the sector making impressive gains, including PVD hitting the upper limit, PVS (+1.55%), OIL (+2.83%), PVC (+3.88%), VTO (+2.52%), and PVB (+3.06%). Furthermore, media services and information technology sectors also shone in green, driven primarily by VGI (+7.3%), MFS (+1.4%), VTK (+1.69%); FPT (+1.17%), and CMG (+1.45%).

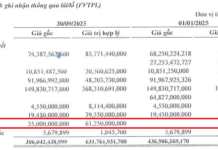

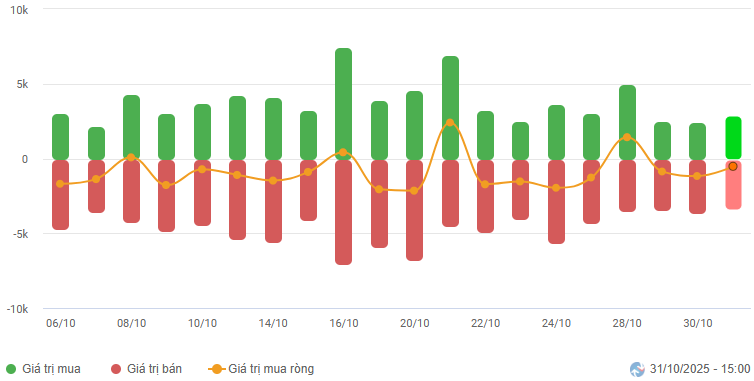

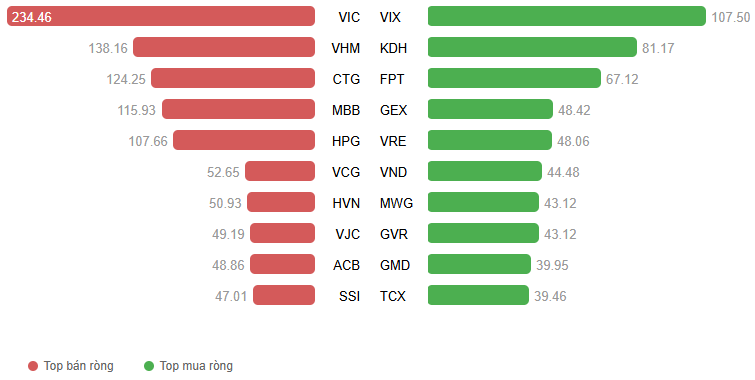

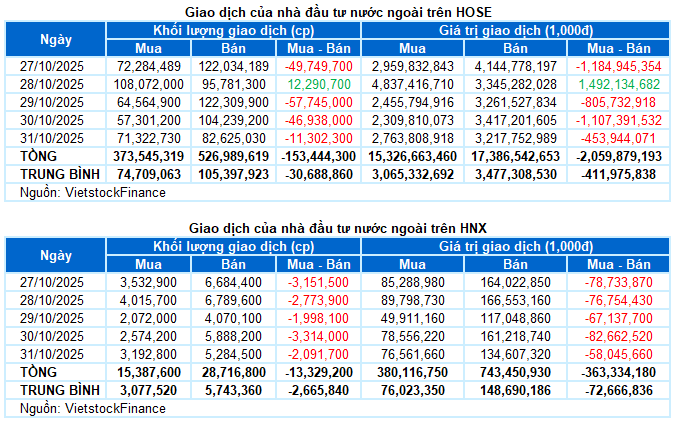

Foreign investors continued to net sell, with a total value exceeding VND 2.4 trillion across both exchanges last week. Specifically, foreign investors net sold VND 2 trillion on the HOSE and over VND 363 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Day. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

Top Performing Stock of the Week: KHG

KHG +19.05%: KHG enjoyed a vibrant trading week with five consecutive sessions of gains, simultaneously setting a new 52-week high. Trading volume remained high above the 20-day average, reflecting investor optimism.

Additionally, the MACD indicator continued to widen its gap with the Signal line after giving a buy signal, further bolstering the positive short-term outlook.

Worst Performing Stock of the Week: GEX

GEX -14.63%: GEX plummeted for the second consecutive week, slicing through the 100-day SMA. The stock price clung to the Lower Band of the Bollinger Bands, accompanied by the emergence of Big Black Candles, indicating strong selling pressure.

Simultaneously, the Stochastic Oscillator continued to weaken and delve deeper into the oversold region, signaling that downside risks remain prevalent.

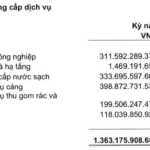

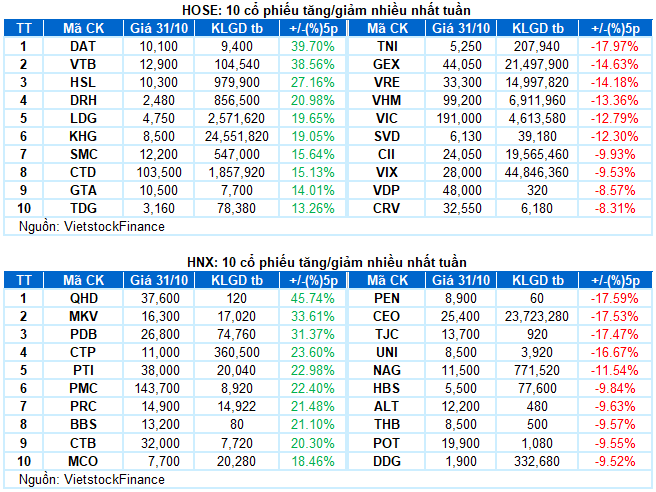

II. WEEKLY STOCK MARKET STATISTICS

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 17:16 31/10/2025

October 30th Session: Foreign Investors Offload Over 1.2 Trillion VND – Which Stocks Took the Biggest Hit?

Foreign block transactions once again emerged as a significant drawback, with substantial net selling observed on the Ho Chi Minh City Stock Exchange (HOSE).