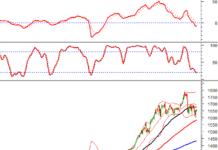

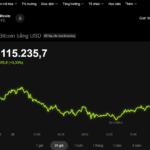

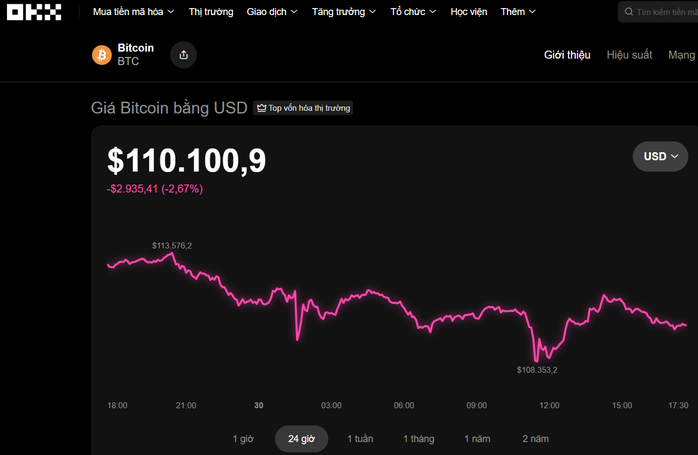

On the evening of October 30th, the cryptocurrency market took an unexpected downturn. Data from OKX reveals that Bitcoin dropped nearly 3% in the past 24 hours, falling to $110,100.

Other major cryptocurrencies also experienced declines: Ethereum (ETH) fell by almost 3% to $3,890, XRP dropped nearly 4% to $2.50, and Solana (SOL) decreased by over 1.5% to $191. Meanwhile, BNB saw a slight increase of nearly 1%, rising to $1,120.

According to Cointelegraph, as gold prices plummeted to $3,915, the investment landscape witnessed a notable shift in capital allocation. Bitcoin had previously surged by nearly 6.7%, indicating that many investors are moving funds from gold to cryptocurrencies in search of quicker returns.

Bitcoin is currently trading at $110,100. Source: OKX

A key factor driving this trend is the decision by the U.S. and China to reduce import tariffs on certain goods from 20% to 10%, which has boosted risk sentiment and encouraged capital inflows into the cryptocurrency market.

Notably, Bitcoin ETFs in the U.S. attracted an additional $839 million, while gold funds saw outflows of nearly $4.1 billion.

Despite gold’s price correction, it remains a safe-haven asset. Renowned cryptocurrency investor David Bateman suggests that the recent decline is short-term, and historically, gold tends to recover swiftly after each 10% drop.

Meanwhile, Bitcoin still has room for growth. JPMorgan predicts its price could reach $165,000 in 2025, as the cryptocurrency remains undervalued compared to gold.

As gold prices tumble, capital is shifting from safe-haven investments to Bitcoin—a high-risk, high-reward asset. Both assets retain their unique roles: gold as a long-term wealth protector, and Bitcoin as a fast-paced opportunity with higher risk.

Cryptocurrency Assets in Vietnam: A Beginner’s Opportunity Like ‘Starting First Grade’

“Our greatest concern at present is the issue of human resources. When the resolution was issued, Vietnam’s digital asset market was largely spontaneous. Tens of millions of participants entered the market, most of whom lacked foundational experience or understanding of this field. We recognize that the risks in this area are significant,” said Mr. Phan Đức Trung, Chairman of the Vietnam Blockchain and Digital Asset Association.

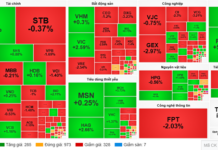

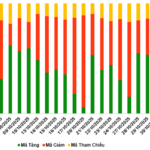

FTSE CEO: Vietnam Poised for Deeper Integration into Global Capital Markets

The forum titled “Emerging Vietnam: Beyond the Upgrade,” hosted by SSI Securities on October 30th, offered profound insights into the prospects of Vietnam’s economy and stock market following its elevation to emerging market status.

Today’s Crypto Market, October 28: Shocking Revelation About a $10 Billion Digital Asset Exchange Company

HVA Investment Corporation has recently established DNEX in Da Nang, aiming to develop a digital asset trading platform with a collaborative scale of 10,000 billion VND.