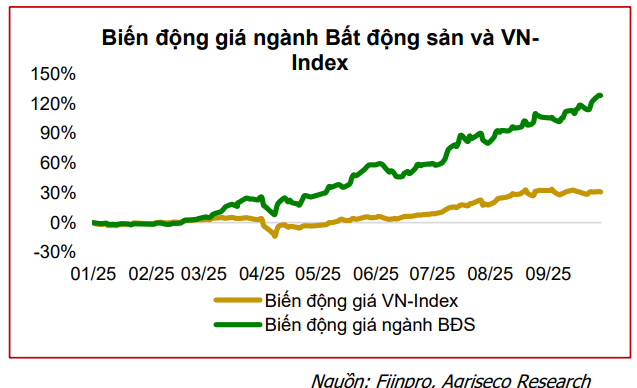

After a period of decline and sideways movement in 2024, the real estate sector index recorded a 128% increase from the beginning of 2025, far surpassing the 31% rise of the VN-Index. This performance was primarily driven by VIC and VHM, while other stocks showed mixed results with increases ranging from 20% to 60%. These outcomes reflect the expectation of a gradual recovery in the real estate sector, supported by improvements in legal frameworks, supply, and market demand.

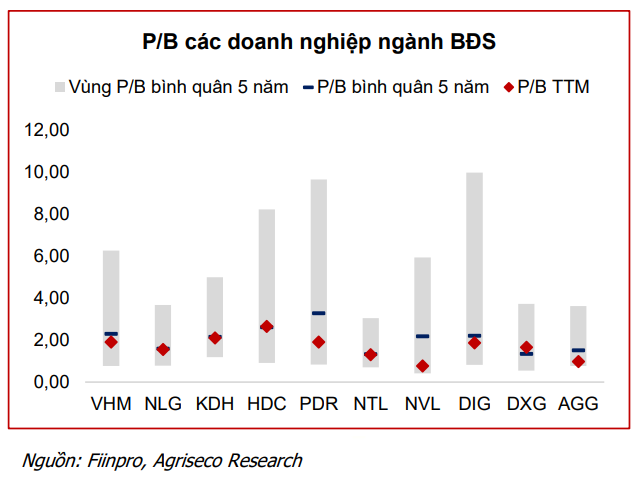

In a recent update, Agriseco Securities noted that the real estate sector’s price-to-book (P/B) ratio is currently trading at 2.2x, higher than the 5-year historical average of 1.8x and approaching the +1 standard deviation level. However, excluding large-cap stocks (VIC, VHM, VRE), the sector’s P/B ratio stands at around 1.7x, equivalent to the long-term average.

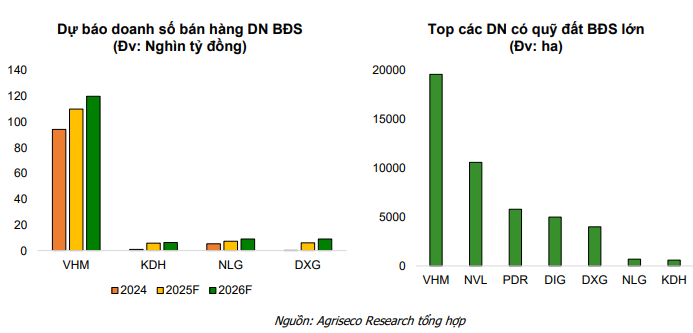

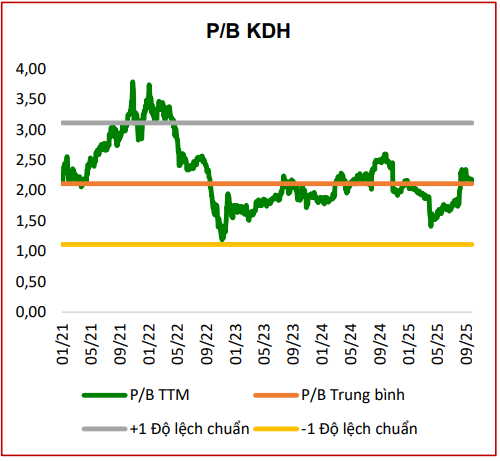

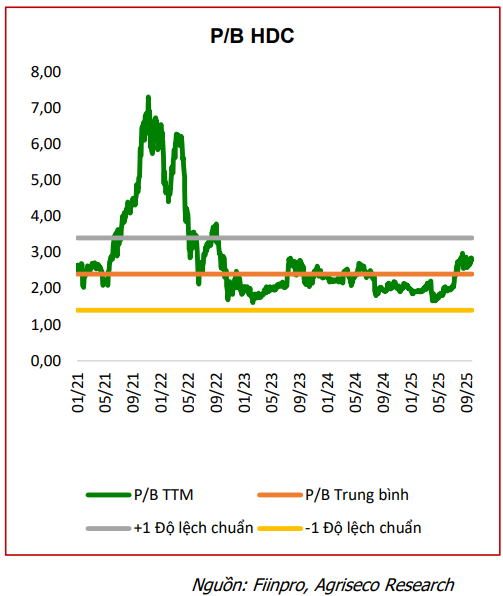

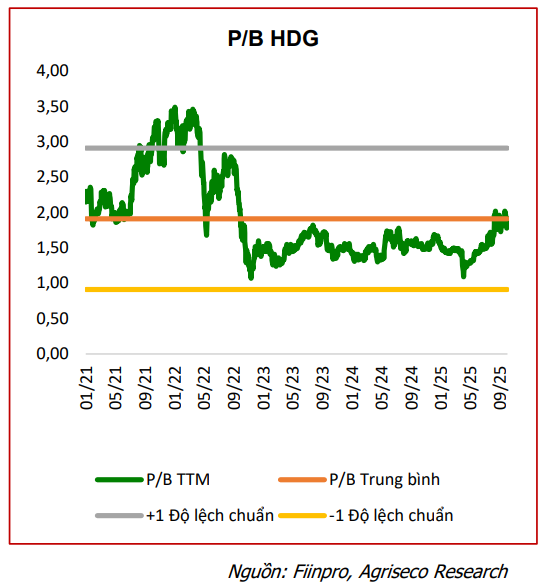

Overall, the real estate sector’s valuation has recovered to its 5-year average, but there remains a clear divergence among stock groups. Large-cap stocks (VIC, VHM, VRE) have rebounded strongly but are still priced lower than their historical averages. Mid- and small-cap stocks (KDH, NLG, DIG, HDC…) are trading at reasonable or discounted valuations, aligning with their 2–3-year business prospects. Investment opportunities are concentrated in companies with clean land banks, strong project execution capabilities, and those benefiting from legal policy changes, amidst short-term risks from profit-taking pressures after a strong rally and project disbursement progress.

Agriseco Research selects companies based on the following criteria: (1) Healthy and safe financial conditions; (2) Ownership of projects in favorable locations benefiting from public investment; (3) Proven project execution capabilities; (4) Most projects have already paid land use fees and fulfilled financial obligations, mitigating risks from potential increases in investment costs due to land price policy changes; (5) Attractive valuations relative to future earnings growth potential.

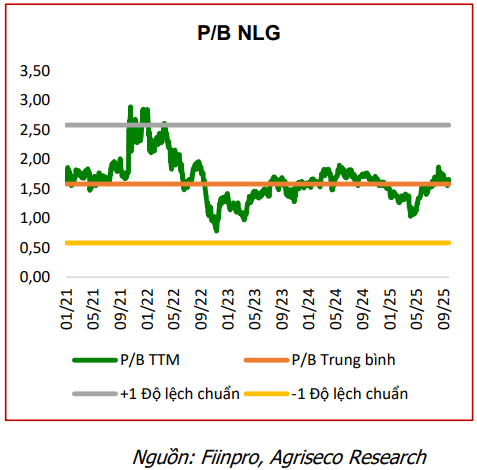

For Nam Long (NLG), Agriseco expects improved sales to drive growth. As of the end of August 2025, NLG is launching new projects such as An Zen Residences in Hai Phong, Mizuki Park, and the next phase of Can Tho. In the final months of the year, NLG plans to launch Southgate, Izumi Canaria within the Izumi City urban area after legal issues were resolved, and Paragon. Agriseco anticipates continued sales growth to boost earnings in the coming years as NLG introduces more new products. The real estate market in areas surrounding Ho Chi Minh City, such as Long An and Dong Nai, where NLG’s projects are concentrated, is expected to recover due to infrastructure development and provincial mergers. Additionally, 2025 profits are projected to increase due to a 15.1% stake divestment in the Izumi City project.

On the other hand, Agriseco Research expects the planned issuance of over 100 million shares to the public, representing 26% of the company, at a price of VND 25,000 per share, to be implemented in the fourth quarter. This will help NLG expand its business operations and restructure its debt. In the medium to long term, NLG will benefit from its large urban land bank of nearly 700 hectares, featuring affordable housing projects that meet real housing demand in the context of limited supply in the southern region.

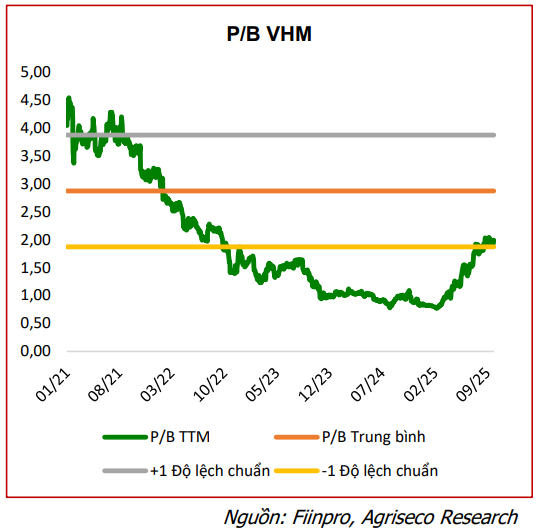

Agriseco believes Vinhomes (VHM) has significant long-term growth potential due to its strong market position, large land bank, and healthy financial condition. Sales in 2025 are forecast to continue rising. By the end of Q2 2025, VHM had signed sales contracts worth VND 67.5 trillion (+31% YoY), with unrecognized sales reaching VND 138 trillion, primarily from major projects like Wonder City, Royal Island, Green City, and Golden City. This provides a solid foundation to drive the company’s revenue and profit. Net profit for the year could reach VND 31 trillion, equivalent to an EPS of approximately VND 7,548 per share.

VHM shares are currently trading at a P/B ratio of 1.9x, lower than the 5-year historical average of 2.1x, reflecting the company’s long-term growth potential.

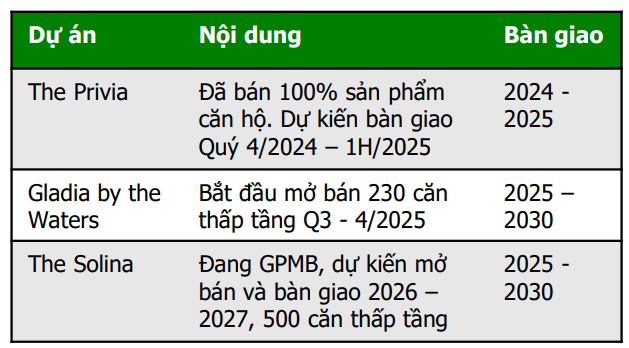

For Nha Khang Dien (KDH), 2025 earnings are expected to grow positively, largely due to the launch of the Gladia project. These products are anticipated to achieve a high absorption rate (over 65%) as the low-rise real estate market in Ho Chi Minh City recovers amid limited supply of landed properties. Real estate sales in 2025–2026 are projected to increase significantly, primarily driven by the Gladia project and partially by Solina.

The medium to long-term outlook is supported by a large land bank of over 600 hectares in the eastern part of Ho Chi Minh City. As of June 30, 2025, inventory reached VND 23,005 billion, concentrated in projects such as KDC Tan Tao, Gladia Solina, Le Minh Xuan 3 expanded industrial park, Green Village, Phong Phu 2, and Binh Trung industrial cluster. These projects all have strong price appreciation potential, expected to drive long-term growth for KDH.

At Phat Tien Nha Ba Ria – Vung Tau (HDC), 2025 profits are forecast to rise significantly from the low base of VND 67 billion in 2024 and exceed the annual plan, driven mainly by the recognition of The Light City Phase 1 and Ngoc Tuoc 2 handovers, along with financial profits from the divestment of the Dai Duong project, totaling over VND 1 trillion, to be recognized gradually in 2025–2026. In the short term, HDC is expected to benefit from information regarding the divestment of large projects. Additionally, market liquidity is shifting back to real estate stocks as the government implements supportive policies such as legal unblocking, public investment promotion, and housing credit easing.

According to Agriseco, HDC owns a 490-hectare land bank in Ba Ria-Vung Tau with low acquisition costs, expected to benefit from the real estate recovery cycle in the region, forecast to begin in late 2025. Sales are anticipated to improve during 2025–2026.

For Ha Do Group (HDG), 2025 profits are projected to grow compared to 2024, driven by the handover of the Ha Do Charm Villas 3 project. This is the next phase of the Hado Charm Villas urban area in Hoai Duc, Hanoi, comprising 108 high-end villas. With expectations of a recovery in Hanoi’s low-rise real estate market, Charm Villas 3 is likely to maintain a positive sales pace. The project is estimated to generate approximately VND 3 trillion in revenue during 2025–2027, serving as a growth driver for HDG’s profits in the second half of 2025 and throughout 2026.

Additionally, the hydropower segment is recovering as the El Nino phase concludes. According to the National Center for Hydrometeorological Forecasting, there is a high probability of neutral weather conditions for the remainder of 2025, increasing hydropower generation for HDG.

Tué Giang

How Are Securities Firms’ Stocks Valued Amid the IPO Wave?

Amidst the robust growth of Vietnam’s stock market, a recent analysis by VNDirect underscores the rationale behind the elevated valuations of securities companies. This perspective highlights the sector’s alignment with the market’s upward trajectory, reflecting its intrinsic value and potential for sustained performance.

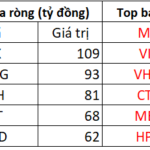

Foreign Investors Continue Net Selling Streak, Exceeding Half a Trillion VND, While Aggressively Accumulating a Single Stock on October 31st Session

Foreign investors heavily offloaded shares in the Vingroup duo, VIC and VHM, with a total value of 419 billion VND.

Market Pulse October 31: Financial and Real Estate Sectors Struggle, VN-Index Retreats to 1,640 Points

At the close of trading, the VN-Index dropped 29.92 points (-1.79%), settling at 1,639.65 points, while the HNX-Index fell 1.11 points (-0.42%), closing at 265.85 points. Market breadth tilted toward decliners, with 414 stocks falling and 330 advancing. Similarly, the VN30 basket saw red dominate, as 21 constituents declined, 8 rose, and 1 remained unchanged.

Stock Market Week 27-31/10/2025: Clear Polarization

The VN-Index extended its decline in the final session of the week, capping off October with a third consecutive week of adjustments. Amid subdued liquidity, the market is likely to remain volatile, characterized by persistent tug-of-war dynamics and heightened divergence.