In 2025, the “purple” brand evolved beyond technology, focusing on user experiences and emotions. With the tagline “TPBank App – Ultimate Convenience. Ultimate Living,” the bank positioned its app as more than a financial tool—a personalized space reflecting a premium lifestyle. Features like ChatPay, online card issuance, dual-yield accounts, and customizable interfaces were meticulously designed for seamless, intuitive, and engaging experiences. While not the first bank to integrate music into marketing, TPBank stands out for its subtle, Gen Z-centric cultural resonance.

TPBank transcended traditional sponsorship in “Em Xinh Say Hi,” becoming integral to young artists’ narratives.

|

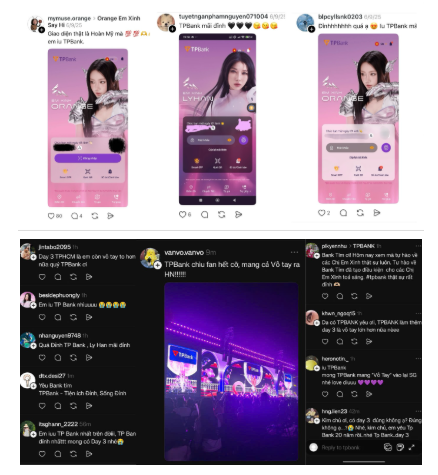

In the reality show “Em Xinh Say Hi,” TPBank seamlessly integrated into the journeys of artists like Orange, Phương Ly, LyHan, and 52Hz. Instead of mere logo placement, each artist was paired with a key app feature: ChatPay with Orange, online credit cards with 52Hz, Flash2in1 cards with LyHan, and dual-yield accounts with Phương Ly. This approach embedded the app into the music narrative, sparking fan curiosity to “Say App Đỉnh” like their idols.

During the show’s run, TPBank App downloads surged 200%, peaking at 120,000 daily downloads, while online credit card sign-ups tripled.

The TPBank App captivated youth with its innovative features.

|

“Em Xinh Say App Đỉnh”: Empowering Youth to Share TPBank’s Story

Following TV success, TPBank launched “Em Xinh Say App Đỉnh” on Threads, Gen Z’s digital hub. The campaign’s dual meaning—”Say” as both “passion” and “speak”—encouraged authentic user-generated content. Fans shared clips, memes, and behind-the-scenes moments of artists using the app, creating unprecedented organic engagement.

The campaign inspired genuine emotional connections through real user stories.

|

Within two weeks, tens of thousands engaged with artist-themed interfaces, propelling TPBank to #1 in positive sentiment and #3 in banking discussions (July-August 2025).

Emotional Connections Driving Sustainable Growth

The campaign’s impact translated into tangible results: a 19% service revenue increase (21% of total income), 11% profit growth year-over-year (VND 6.05 trillion in Q3 2025), and assets surpassing VND 450 trillion.

TPBank proves emotional connection is the ultimate competitive edge in a tech-driven era.

|

“Ultimate isn’t just about technology—it’s about making customers feel ultimate daily,” shared a TPBank representative. By merging tech with emotion, TPBank transformed digital banking into a youth culture staple, winning loyalty through joy, pride, and authenticity.

In a crowded market, TPBank communicates through music, emotion, and youth culture—a distinct strategy proving that in a tech-saturated world, emotional resonance is the true differentiator. This is TPBank’s “App Đỉnh.”

– 14:39 31/10/2025

Empowering Financial Literacy: CIMB Vietnam Partners in Financial Management Training for Workers

Green Knowledge is a nationwide personal finance management training and guidance program tailored for everyday workers, initiated and organized by F88. The program is supported by CIMB Bank Vietnam, a member of the Malaysian financial conglomerate CIMB Group.

SHB Honored by VISA as “Card Growth Star 2025” for the Second Time

Saigon-Hanoi Commercial Joint Stock Bank (SHB) has been honored for the second time by the international payment organization VISA as the “Card Growth Star of 2025.” This prestigious title recognizes SHB’s remarkable growth and relentless efforts in delivering cutting-edge, secure card products and services, along with exceptional customer experiences.

SHB Honored by VISA as “Card Growth Star 2025” for the Second Time

Saigon-Hanoi Commercial Joint Stock Bank (SHB) has been honored for the second time by the international payment organization VISA as the “Card Growth Star of 2025.” This prestigious title recognizes SHB’s remarkable growth and unwavering commitment to delivering cutting-edge, secure card products and exceptional customer experiences.

iDepo VIB: Safeguarding Your Cash Flow During Market Volatility

As the financial markets enter a phase of adjustment, investors are increasingly turning to safer channels. Amid this shift, iDepo by International Bank (VIB) stands out as a balanced solution, offering both security and profitability with an attractive interest rate of up to 6.3% per annum. Additionally, its flexible transfer capabilities on the MyVIB platform make it a standout choice for savvy investors.