|

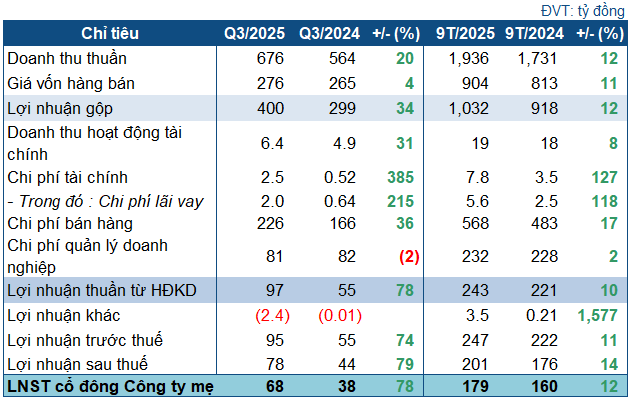

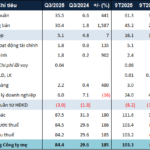

TRA’s Q3/2025 Business Targets

Source: VietstockFinance

|

In Q3, TRA achieved a net revenue of VND 676 billion, a 20% increase year-over-year. Meanwhile, the cost of goods sold rose only slightly by 4%, resulting in a 34% surge in gross profit to VND 400 billion. The gross margin also improved from 53% to over 59%.

Despite the significant growth in gross profit, two major expenses—selling expenses (up 36% to VND 226 billion) and administrative expenses (slightly down to VND 82 billion)—eroded much of this gain. Nevertheless, the company still reported a net profit of VND 68 billion, a 78% increase compared to the same period last year.

TRA attributed the strong Q3 profit growth primarily to the increased sales of key product lines and the expansion of its OTC channel (pharmacy network), which boosted revenue. Additionally, optimizing product mix, focusing on high-margin products, and enhancing supply chain efficiency helped reduce production costs.

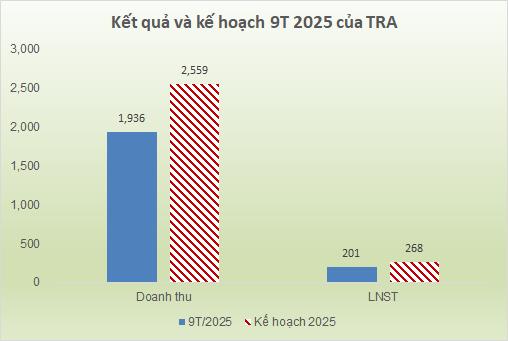

For the first nine months of the year, TRA recorded over VND 1.9 trillion in revenue, a 12% year-over-year increase, with a net profit of VND 179 billion, up 12%. The company has achieved 76% of its annual revenue target and 75% of its post-tax profit plan approved at the 2025 Annual General Meeting.

Source: VietstockFinance

|

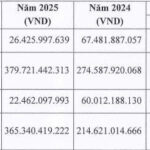

As of September 30, 2025, TRA‘s total assets reached over VND 2.3 trillion, an 8% increase from the beginning of the year, with nearly VND 1.8 trillion in current assets. Cash and cash equivalents stood at VND 691 billion, down 4%.

Short-term receivables surged by 88% to VND 517 billion. Of this, customer receivables increased by 64% to VND 402 billion, and prepayments to suppliers rose by 253% to VND 103 billion. Inventory decreased by 7% to VND 511 billion.

In terms of funding, total liabilities increased by 12% to VND 710 billion. Notably, short-term loans and finance leases decreased by 10% to VND 171 billion, primarily bank debt.

– 16:28 31/10/2025

Western Region’s Fruit & Vegetable Enterprises Hit Record Profits, Expanding 1,500 Workforce Ahead of Market Upgrade

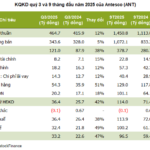

Ahead of its upcoming listing on HOSE, An Giang Fruit and Vegetable Processing Joint Stock Company (Antesco, UPCoM: ANT), a leading player in the Mekong Delta’s processed fruit and vegetable sector, reported a staggering 63% surge in nine-month profits, surpassing its entire 2024 earnings. This remarkable growth is complemented by a significant workforce expansion, now exceeding 1,500 employees.

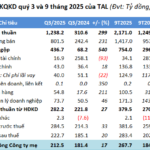

DC4 Reports 70% Q3 Profit Growth, Partners in PVC Land Fund Investment

DICERA Holdings Corporation (HOSE: DC4) has announced its consolidated financial report for Q3/2025, showcasing robust growth compared to the same period last year.