On the afternoon of October 30th, the National Assembly continued its plenary discussion on the implementation of the state budget, the allocation of the central budget, and the results of the Assembly’s resolutions on socio-economic development.

During the debate, Delegate Thach Phuoc Binh (Vinh Long) highlighted that, according to the World Gold Council, Vietnamese citizens hold approximately 400–500 tons of gold, valued at $35–40 billion, which accounts for nearly 8% of the country’s GDP. Vietnam consumes an average of 55 tons of gold annually, placing it among the highest gold-consuming nations in the region.

However, Mr. Thach Phuoc Binh noted that the majority of this gold remains locked away in private vaults, representing a vast untapped resource for the economy. He emphasized the need for mechanisms to transform this dormant capital into active investment.

Deputy Head of the Vinh Long National Assembly Delegation, Thach Phuoc Binh, speaking at the session on the afternoon of October 30th. Photo: National Assembly Media

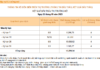

Mr. Binh further pointed out that in 2024 and early 2025, the price gap between domestic and international gold prices exceeded $14 million per tael, even reaching $20 million at times. This disparity reflects market instability and speculative hoarding. While the State Bank has intervened through gold bar auctions, these measures are only short-term solutions. The root cause lies in the absence of a transparent, modern, and secure market mechanism for citizens.

In response, the Vinh Long delegate proposed five key solutions to mobilize and monetize the gold held by the public.

First, stabilize the gold market by reducing the price gap between domestic and international markets to below $5 million per tael within 6–12 months. Control speculation and increase supply through regulated imports.

Second, establish a National Gold Exchange as a groundbreaking institutional initiative. Citizens could deposit physical gold into standardized vaults, receiving digital certificates for trading, collateral, or conversion. This would enable the government to manage actual gold flows while safeguarding citizens’ ownership rights.

Mr. Binh also suggested developing financial products such as gold deposit certificates, gold investment funds, and gold-backed bonds. Citizens could contribute gold or invest in Vietnamese dong, earning profits based on gold prices, thereby transforming dormant capital into active investment.

Fourth, encourage the conversion of gold into Vietnamese dong through policies such as free vault storage, interest rate incentives, or issuing government gold bonds exclusively for those selling physical gold.

“If just 10–15% of the gold held by citizens is channeled into the financial system, equivalent to $5–7 billion, we would secure substantial capital for investing in infrastructure, digital technology, and more, without increasing public debt,” suggested Delegate Thach Phuoc Binh.

Fifth, ensure system safety, transparency, and prohibit banks from mobilizing or lending in gold. Regularly publish a “National Gold Bulletin” to provide citizens with comprehensive information, fostering market confidence.

Cần Giờ Transformed: Mega Projects and Infrastructure Revitalize the Region

As the groundbreaking Can Gio Coastal Urban Area project and key transportation initiatives take shape in Ho Chi Minh City, the local economy and community are experiencing a remarkable transformation and renewed vitality.

Elevating Bilateral Ties: General Secretary’s UK Visit Set to Usher in a New Era of UK-Vietnam Relations

The upcoming visit of General Secretary To Lam marks a significant milestone in the relationship between the United Kingdom and Vietnam, paving the way for an elevated bilateral partnership, according to UK Ambassador to Vietnam Iain Frew.