Vietnam Airlines Surges Ahead, Transporting 6.7 Million Passengers in Q3/2025

Over the past three months, despite the unpredictable global political and economic landscape, high fuel prices, and intense market competition, Vietnam Airlines has demonstrated remarkable resilience. The airline successfully navigated these challenges, achieving significant growth.

Specifically, Vietnam Airlines transported 6.7 million passengers, marking an 11% increase compared to the same period last year. For the first nine months of the year, the airline carried nearly 19.4 million passengers, a 12.3% rise year-on-year, and handled approximately 250,000 tons of cargo and mail, equivalent to 111% of the previous year’s figure.

In the broader market, international passengers reached an estimated 34.5 million (1.14 times higher than the same period in 2024), while domestic passengers grew by 7.2% to 28.4 million.

International Network Expansion Drives Impressive Q3 Profits for Vietnam Airlines

Despite a 700 billion VND increase in costs due to exchange rate fluctuations, Vietnam Airlines’ Q3 and year-to-date financial results exceeded expectations, thanks to robust operational growth. This sets a solid foundation for Q4 and the full year 2025.

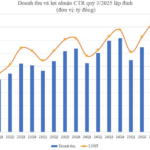

Consolidated revenue for Q3/2025 reached 30,782 billion VND, 12.3% higher than Q3/2024, with a post-tax profit of 732 billion VND. For the first nine months, consolidated revenue totaled 90,177 billion VND, 4.58% above the same period in 2024, and post-tax profit exceeded 7,174 billion VND, up 14.5% year-on-year.

In the first nine months of 2025, Vietnam Airlines proactively launched several new international routes to meet the growing demand for travel to and from Vietnam. These routes target high-potential markets, driving long-term growth and bolstering the airline’s business performance.

During Q3/2025, Vietnam Airlines successfully issued 897,104,037 shares, increasing its capital to 8,971 billion VND. As of September 30, 2025, both the parent company and consolidated entity’s equity turned positive, eliminating negative equity.

This capital increase, coupled with strong business results, has strengthened Vietnam Airlines’ financial position, enabling investments in fleet expansion, infrastructure, and digital transformation for the 2026–2030 period. The airline has also launched a large-scale fleet modernization program, marking a significant step toward enhancing operational capacity and expanding its international network.

Vietnam Airlines has launched new international routes to meet the growing demand for travel to and from Vietnam.

Vietnam Airlines Achieves New Milestones in Q3

Beyond its financial achievements, Q3 was a vibrant period for Vietnam Airlines, marked by several notable activities. At the “80 Years of Independence, Freedom, and Happiness” National Achievement Exhibition, the airline’s “Sky Aspiration” booth attracted nearly 1 million visitors and was recognized as an Outstanding Exhibition Space. This showcase not only celebrated the nation’s 80-year journey but also highlighted Vietnam Airlines’ innovative spirit and contributions as a pioneer in Vietnam’s aviation industry.

Another significant milestone was the launch of the Check-in Lounge at Tan Son Nhat’s Terminal 3, a luxurious check-in space embodying the airline’s pioneering spirit. This new offering elevates the passenger experience, redefines aviation service standards in Vietnam, and reinforces Vietnam Airlines’ leadership in customer service and experience.

Additionally, Vietnam Airlines continues to invest in strategic projects, including a new fleet, infrastructure at Long Thanh Airport, an aviation logistics ecosystem, and new international routes such as Hanoi – Cebu, Hanoi – Jakarta, and Ho Chi Minh City – Copenhagen. These initiatives lay the groundwork for future growth, expand the international network, and solidify the airline’s global presence.

The impressive Q3 and year-to-date results have earned Vietnam Airlines international acclaim, with numerous prestigious awards. The airline ranks among the Top 20 Best Airlines Worldwide, Top 25 Safest Airlines, and has been recognized for its exceptional Economy Class and as a 5-Star Global Airline by APEX. It also features in DestinAsia’s Top 10 Best Asian Airlines and Top 10 Best Airlines lists.

Notably, Vietnam Airlines ranked 86th in the 2025 Fortune Southeast Asia 500, reflecting its outstanding financial performance and regional influence. In celebration of its 30th anniversary (May 27, 1995 – May 27, 2025), the airline’s workforce received a Commendation from the Prime Minister, acknowledging its contributions to Vietnam’s socio-economic development and international integration.

Văn Phú Surpasses 75% of 2025 Profit Target, Sets Sights on Dominating Southern Market

Văn Phú announced a strong Q3-2025 performance, achieving revenues of VND 395 billion, primarily driven by its flagship projects, The Terra – Bắc Giang and Vlasta – Sầm Sơn.

GEG Reports Q3 Profit of VND 75 Billion, Attributed to Electricity Price Lock-In; 9-Month Net Profit Surges 7x Year-on-Year

With the official electricity prices set for the Tan Phu Dong 1 (TPD1) wind power plant and the A7 turbine of the VPL Wind Power Plant, Gia Lai Electricity Joint Stock Company (HOSE: GEG) has reported a remarkable third-quarter performance compared to the same period last year, which saw losses. This positive shift has significantly brightened the company’s cumulative financial outlook.

HDBank Surpasses 14,800 Billion VND in 9-Month Profit, Maintains Lead in Profitability Ratios, Dividends, and Bonus Shares Up to 30%

HDBank (HDB), Ho Chi Minh City Development Joint Stock Commercial Bank, reported a consolidated pre-tax profit of VND 14,803 billion for the first nine months of 2025, marking a 17% increase year-on-year. The bank’s profitability metrics remain at the forefront of the industry, with a return on equity (ROE) of 25.2% and return on assets (ROA) of 2.1%, underscoring its operational efficiency and robust financial foundation.