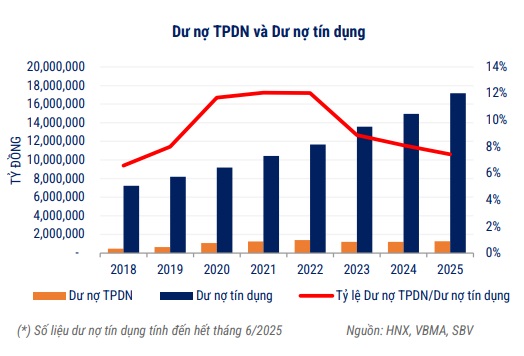

In Q3 2025, Vietnam witnessed 10 public bond issuances totaling over VND 20 trillion, accounting for nearly 16% of the total issuance value. Additionally, there were 119 private placements worth nearly VND 109 trillion, making up more than 84%. The bond market’s size relative to GDP stood at 10.2% by the end of Q3, a slight decrease from 10.25% at the end of 2024.

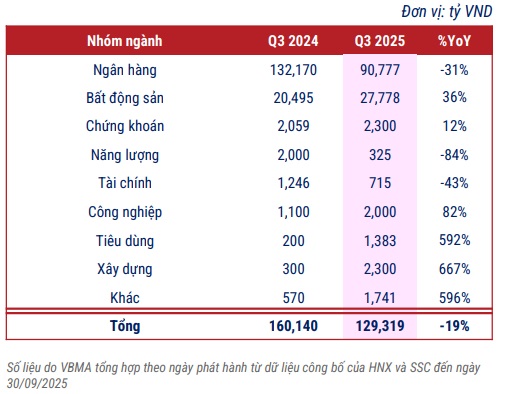

Banks led the issuance with nearly VND 91 trillion, representing over 70% of the total. Real estate followed with almost VND 27.8 trillion, equivalent to 21.5%. Despite a year-over-year decline in issuance value, overall issuance activity since the beginning of the year has improved compared to 2024, showing a 27% increase in value.

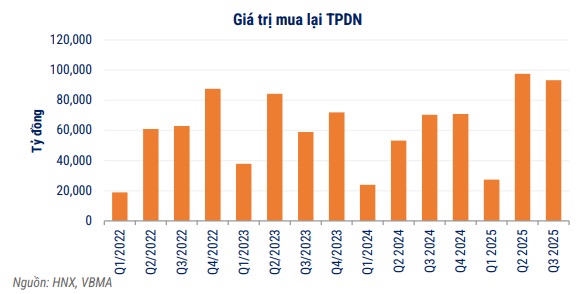

Over VND 93 trillion in corporate bonds were repurchased before maturity in Q3.

According to VBMA, the value of bonds repurchased before maturity in Q3 2025 reached VND 93,295 billion, a nearly 33% increase compared to the same period last year.

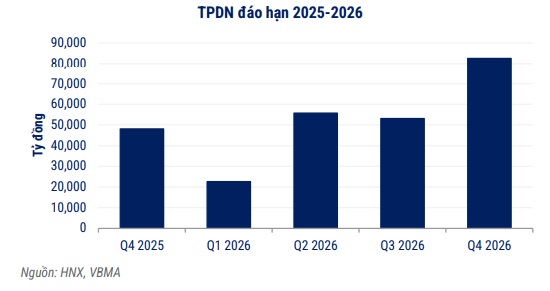

Bonds worth over VND 48 trillion are set to mature in the final three months of 2025. Real estate bonds account for 38% of this amount, valued at more than VND 18.3 trillion, while bank bonds make up 29%, totaling nearly VND 13.8 trillion.

Regarding principal and interest payments, newly delayed bond payments in Q3 2025 amounted to nearly VND 1.67 trillion, an 80% decrease from the previous quarter. However, VND 639 billion of this amount has already been settled.

In the secondary market, private bond transactions reached over VND 392 trillion in Q3, averaging more than VND 6.1 trillion per day, a 15% increase from the previous quarter. Real estate and banking sectors dominated, accounting for 38.6% and 36.6%, respectively.

– 10:34 01/11/2025

Mitigating Risks: Strategic Solutions for Banks Facing Bond Issuance Violations

Government inspectors have concluded that several banks have issued bonds in violation of regulations, particularly in the utilization and management of funds raised from corporate bond issuances. Experts argue that while bond issuance regulations are comprehensive, stricter enforcement and oversight are essential to mitigate market risks.

Vinhomes Global Gate Project Partner Raises VND 5.5 Trillion Through Bond Issuance

Several months after acquiring a portion of the Vinhomes Global Gate project, Thoi Dai Moi T&T successfully mobilized a bond issuance totaling 5.5 trillion VND.