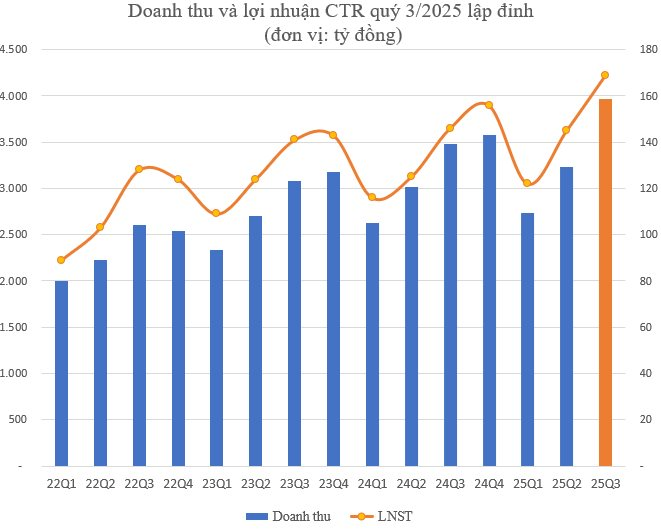

Viettel Construction Corporation (Viettel Construction, stock code: CTR) has released its consolidated financial report for Q3/2025, revealing a record-breaking quarterly net revenue of VND 3,965 billion, a 14% year-on-year increase. This marks the highest quarterly revenue in the company’s history.

Within the Q3/2025 revenue structure, information exploitation and rescue services generated VND 2,030 billion, up 22% year-on-year, accounting for the largest share at 51%. Construction services followed as the second pillar, contributing 27% (VND 1,082 billion), despite a slight 6% decline compared to the same period last year.

Other revenue streams included commercial contracts and proactive solutions (12%) and leased infrastructure operations (6%), rounding out Viettel Construction’s Q3 performance.

Gross profit reached nearly VND 248 billion, a 12% year-on-year growth after deducting cost of goods sold.

Financial revenue surged to nearly VND 25 billion, doubling year-on-year, while financial expenses rose 51% to VND 24 billion. Administrative expenses remained stable at over VND 40 billion.

After deductions, Viettel Construction reported a record after-tax profit of VND 169 billion, up 16% year-on-year. Earnings per share (EPS) for Q3 stood at VND 1,476.

For the first nine months of 2025, CTR’s cumulative net revenue and after-tax profit reached VND 9,940 billion and VND 436 billion, respectively, up 9% and 13% year-on-year.

Viettel Construction’s 2025 targets include VND 13,968 billion in revenue and VND 721 billion in pre-tax profit, representing 10.3% and 6.7% growth from 2024. As of Q3, the company has achieved 67% of its revenue goal and 76% of its profit target.

As of September 30, 2025, total assets stood at VND 7,783 billion, up 9.5% year-to-date. Current assets dominated at VND 6,210 billion, with cash and equivalents surging 59% to VND 2,774 billion.

Total liabilities reached VND 5,624 billion, up 7.3%, primarily driven by short-term debt (VND 5,064 billion). Long-term financial debt slightly decreased to VND 544 billion. Equity totaled VND 2,159 billion, with retained earnings exceeding VND 736 billion by Q3.

On the stock market, CTR shares have rebounded impressively. Closing at VND 94,000 on October 30, the stock hit a three-month high, up 2.4%.

GEG Reports Q3 Profit of VND 75 Billion, Attributed to Electricity Price Lock-In; 9-Month Net Profit Surges 7x Year-on-Year

With the official electricity prices set for the Tan Phu Dong 1 (TPD1) wind power plant and the A7 turbine of the VPL Wind Power Plant, Gia Lai Electricity Joint Stock Company (HOSE: GEG) has reported a remarkable third-quarter performance compared to the same period last year, which saw losses. This positive shift has significantly brightened the company’s cumulative financial outlook.

30 Years of Defining Identity: Viettel Construction Steadfastly Rising in the New Era

Over the past three decades, Viettel Construction Corporation (Viettel Construction) has not only embarked on a journey of building with sweat, intellect, and a spirit of service but has also become a clear testament to why it is hailed as the “symbol of sustainability” in Vietnam’s construction, infrastructure, and technical services sector.

Vinamilk’s Q3 Consolidated Revenue Surges Close to 17 Trillion VND Milestone

Vinamilk reported a consolidated revenue of VND 16,968 billion in Q3, marking a 9.1% year-over-year increase. Consequently, the nine-month cumulative consolidated revenue reached VND 46,678 billion, up 0.7% compared to the same period last year. Vietnam’s leading dairy company saw growth in both domestic and international business segments relative to the previous quarter.