From October 27th to 31st, shares of VTB, owned by Viettronics Tan Binh Joint Stock Company (HOSE: VTB), surged to their upper limit for five consecutive sessions, climbing from 9,900 VND to 12,900 VND per share—a remarkable 30% increase. On October 31st, over 364,000 units were matched, significantly outpacing the average volume of previous sessions.

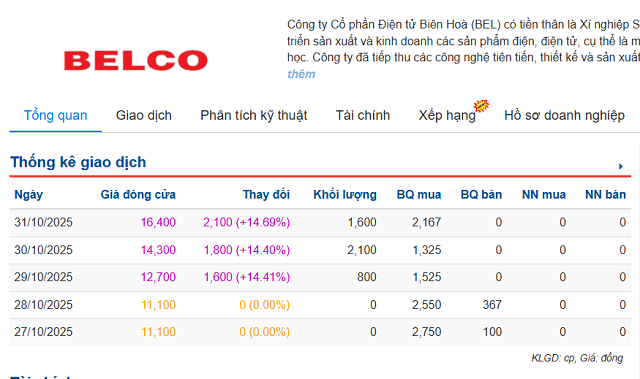

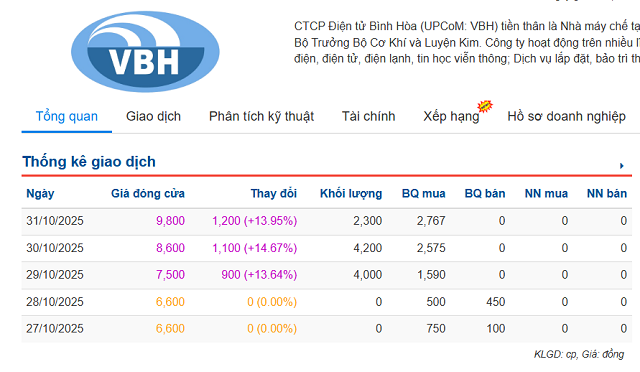

Similarly, shares of BEL (Biên Hòa Electronics JSC, UPCoM: BEL) and VBH (Bình Hòa Electronics JSC, UPCoM: VBH) also hit their upper limits for three consecutive sessions, each rising over 14% per session. Notably, all three companies are subsidiaries of VEC. Meanwhile, VEC’s own stock price soared to its upper limit for six sessions, equivalent to a 123% increase.

Source: VietstockFinance

|

In an official statement, VTB attributed the recent stock price volatility to the news of Geleximco acquiring the state-owned capital in VEC. On October 24th, VEC announced the auction results of over 38.5 million shares, equivalent to nearly 88% of its charter capital held by the State Capital Investment Corporation (SCIC), totaling 2,562 billion VND. Geleximco emerged as the winning bidder.

Notably, the winning bid was approximately 66,000 VND per share, significantly higher than the average market price of VEC’s shares prior to the auction.

VTB confirmed that its production and business operations remain stable, with no internal factors impacting the stock price. The surge is attributed to market reactions to the aforementioned acquisition.

| VEC’s stock price hits upper limit for six consecutive sessions |

VEC, with over 50 years of history, originated as the Electronics Research Department under the Ministry of Machinery and Metallurgy and was equitized in 2007. Once a leading electronics enterprise in Vietnam, VEC has significantly declined after years of losses. Subsidiaries such as Viettronics Thu Duc (VTD), Viettronics Tan Binh (VTB), and Belco have ceased production, primarily leasing premises to sustain operations. VEC is among the 74 enterprises under SCIC slated for complete capital divestment by 2025, as per Decision 690 of the Prime Minister.

Despite its business downturn, VEC still owns prime real estate, including properties at 15 Tran Hung Dao, 29F Hai Ba Trung (Hanoi), and 197 Nguyen Thi Minh Khai (Ho Chi Minh City), along with 4,300m² of land in Cau Giay, planned for a mixed-use building in collaboration with TIG. Meanwhile, the VTB Green Building project in Ho Chi Minh City remains entangled in legal issues.

Meanwhile, Geleximco, established in 1993, is a diversified conglomerate initially focused on import-export. It has since expanded into heavy industries (Thang Long Cement, Thang Long Thermal Power), real estate (An Binh City, Gelexia Riverside, Geleximco Le Trong Tan, Dragon Ocean Do Son), and finance-banking (major shareholder of ABBank).

SCIC plans to auction all 88% of Viettronics shares, starting 71% above market price

– 09:56 01/11/2025

Proposed Expansion of Cau Gie – Ninh Binh Expressway to 6 Lanes

After over a decade of operation, the Cau Gie – Ninh Binh Expressway is severely congested, with vehicle traffic increasing by an average of more than 10% annually. The Vietnam Expressway Corporation (VEC) has submitted a proposal to the Prime Minister, requesting to be designated as the lead agency for expanding the route from four to six lanes.

FPT Telecom: SCIC Registers Transfer of 370.7 Million Shares to the Ministry of Public Security

SCIC has initiated the sale of its entire stake in FPT Telecom (UPCoM: FOX), totaling over 370 million shares, as part of the transfer of state capital management to the Ministry of Public Security. This move comes as FPT Telecom continues to set new quarterly profit records and maintains a substantial cash reserve, accounting for more than half of its total assets.