Three Catalysts Propelling Vietnam’s Stock Market

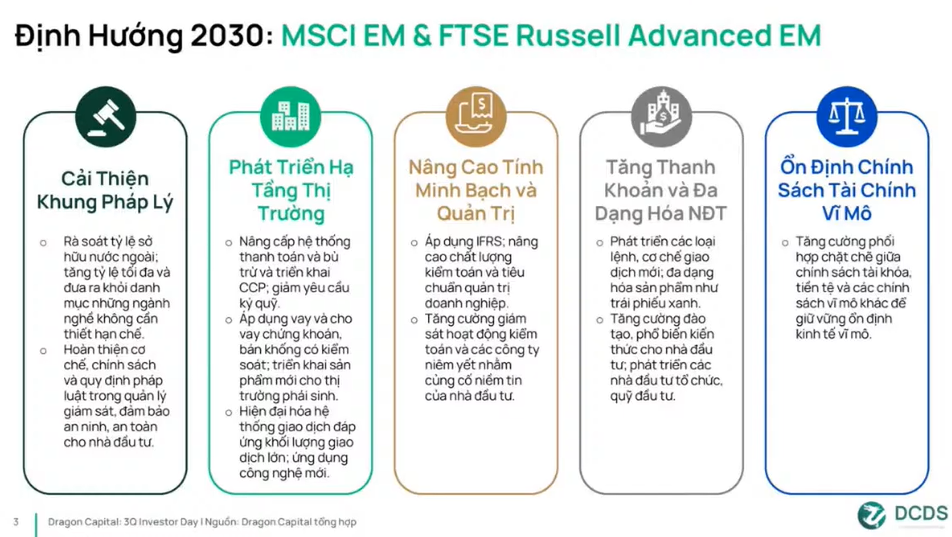

In October, FTSE Russell announced the upgrade of Vietnam’s stock market from Frontier to Secondary Emerging status. However, this remains under review, pending a final assessment in March 2026, with the official upgrade scheduled for September 2026.

At a recent seminar, Mr. Nguyễn Sang Lộc, Director of Portfolio Management at Dragon Capital, noted that lingering doubts about the upgrade are understandable. The upgrade has been discussed for years, and the recent progress warrants a few more months of observation to ensure a smooth transition.

Dragon Capital representatives emphasized that the upgrade is just the beginning of a 2-3 year journey. During this period, regulators must enhance legal frameworks, trading infrastructure, transparency, and liquidity to attract major institutional investors to Vietnam’s market.

Following FTSE Russell, Vietnam aims for MSCI inclusion—a more ambitious goal with higher standards and greater capital attraction potential, expected within 3-5 years.

|

The upgrade also sparks anticipation for a new IPO wave. Approximately USD 47.5 billion in IPO value is expected over the next three years, spanning sectors like consumer goods, financial services, hospitality, entertainment, technology, and information. This diversification will attract large investment funds, ranging from tens to hundreds of billions of USD.

|

Regarding foreign investors’ prolonged net selling, Dragon Capital experts anticipate a reversal starting in 2026, further boosting the market.

Ms. Trịnh Hải Ngọc Anh, an expert from SSIAM, echoed this sentiment, citing three key factors—market upgrade, large-scale IPOs, and positive foreign capital inflows—as catalysts for a pivotal phase in Vietnam’s stock market, particularly in Q4 2025.

These factors are supported by a favorable macro environment, including high GDP growth expectations, increased public investment, and institutional and infrastructure reforms (e.g., KRX system, Decree 245), fostering positive market prospects.

1,800 Points: A Realistic Target for 2026

Addressing investor queries about VN-Index reaching 2,000 points by year-end, Ms. Trịnh Hải Ngọc Anh suggested this is a more suitable medium-to-long-term goal.

As of October 2025, the VN-Index has surged 55% from its April low, with a trailing P/E of 14.9x—in line with the 10-year average and below the 15-16x levels seen in previous bull markets. SSIAM forecasts a 2026 forward P/E of around 12x, indicating further upside potential.

However, 1,800 points in 2026 is more realistic, reflecting growth potential based on fundamentals and corporate valuations. Passive ETF inflows will only materialize post-official upgrade. Until then, capital flows will rely on expectations and active fund investments. Risks include exchange rates, high margin debt, reform implementation delays, and global geopolitical volatility.

Over the next year, the market will be driven by sectors with superior profit growth. SSIAM projects a 15% average after-tax profit growth for 2026 across its 100-stock portfolio, representing 85-90% of market capitalization.

This growth is led by three sectors: materials (25% growth), benefiting from public investment and real estate recovery; financials, particularly banking (17.8% growth), with improved asset quality and net interest margins; and retail, especially non-essential consumer goods (14% growth).

Regarding the upgrade’s impact, Mr. Nguyễn Lê Ngọc Khoa, Investment Director at KIM Vietnam, highlighted FTSE’s stock selection criteria: market cap, free-float ratio, and foreign ownership limits. Few stocks outside the large-cap segment meet these criteria.

Thus, large-cap stocks remain the focal point for upgrade-related opportunities, particularly in financials, construction, consumer goods, chemicals, and real estate, attracting significant capital inflows.

KIM representatives noted the market’s strong Q2 and Q3 performance. Despite mixed macroeconomic signals recently, substantial opportunities lie ahead.

– 14:12 31/10/2025

The Upcoming IPO Boom: Highlands, Golden Gate, Điện máy xanh, and Long Châu Set to Make Waves

In 2025, a stable macroeconomic foundation, coupled with converging catalysts, is setting the stage for a new wave of IPOs.

Vietnam’s Stock Market Post-Upgrade: New Opportunities, New Challenges

Following its official upgrade by FTSE Russell, Vietnam’s stock market is entering a transformative phase, marked by heightened expectations for foreign capital inflows, improved asset quality, and enhanced trading infrastructure. However, this evolution also brings new demands for transparency and governance capabilities.