VietinBank’s Q3 2025 Financial Highlights

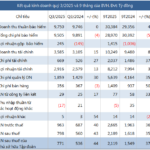

According to the Q3 2025 financial report, Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank, stock code: CTG) recorded pre-tax profits of VND 10,614 billion, a remarkable 62% increase compared to the same period in 2024. For the first nine months of the year, the bank’s after-tax profit reached VND 29,535 billion, marking a 51.4% surge—the highest growth rate among state-owned banks.

This marks the second consecutive quarter VietinBank has surpassed the VND 10,000 billion profit milestone. The bank maintains its position as the industry’s second-highest profit earner, trailing only Vietcombank (VND 11,239 billion).

In Q3, net interest income rose by 10.3% year-on-year to VND 17,176 billion, remaining the largest contributor to VietinBank’s total profits. This growth stems from robust credit expansion, with customer loan balances increasing by 15.6%—outpacing the industry average. The bank’s strategic shift toward retail and small-to-medium enterprise (SME) lending has also bolstered its yield on earning assets.

Net income from service activities declined by 11.9% to VND 1,587 billion, while net foreign exchange earnings dropped by over 10% to VND 546 billion.

However, the securities segment witnessed extraordinary growth. VietinBank reported VND 216 billion in trading securities profits, a 12-fold increase from Q3 2024 (up 1,216.4%). Investment securities profits also rebounded to VND 14 billion, a significant improvement from the VND 202 billion loss in the same period last year.

Other income remained substantial at VND 2,831 billion, despite a 29% year-on-year decline, primarily driven by recoveries from previously written-off debts and collateral liquidation.

A key driver of VietinBank’s profit surge was its disciplined cost management. Total operating expenses in Q3 decreased by 1.2% to VND 6,022 billion, while total operating income grew by 2.7%. This led to a further improvement in the cost-to-income ratio (CIR).

Notably, credit risk provisioning costs plummeted by 36.7% year-on-year to VND 3,867 billion, reflecting enhanced asset quality and effective non-performing loan (NPL) recovery efforts. This reduction was pivotal in driving pre-tax profits up by nearly 62% to VND 10,614 billion.

As of September 30, 2025, VietinBank’s total assets reached VND 2,760 trillion, a 15.8% increase year-to-date. Customer loan balances grew by 15.6% to VND 1,990 trillion, while customer deposits rose by 10.5% to VND 1,780 trillion.

By the end of September, the bank’s NPL coverage ratio stood at 176.5%, up from 171.7% at the end of 2024. The NPL ratio also improved, dropping from 1.24% at the beginning of the year to 1.09%.

Bảo Việt Group Reports Over 2 Trillion VND in Profits After 9 Months

Bao Viet Group (HOSE: BVH) has achieved remarkable business results in the first nine months of 2025, marking three consecutive quarters of profit growth compared to the same period last year. In Q3 alone, the company recorded a net profit of VND 771 billion, a 44% increase, setting a new record for the highest quarterly profit in its history.

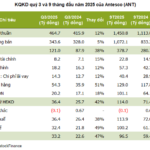

Western Region’s Fruit & Vegetable Enterprises Hit Record Profits, Expanding 1,500 Workforce Ahead of Market Upgrade

Ahead of its upcoming listing on HOSE, An Giang Fruit and Vegetable Processing Joint Stock Company (Antesco, UPCoM: ANT), a leading player in the Mekong Delta’s processed fruit and vegetable sector, reported a staggering 63% surge in nine-month profits, surpassing its entire 2024 earnings. This remarkable growth is complemented by a significant workforce expansion, now exceeding 1,500 employees.

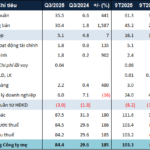

Pharmaceutical Profits Dip: Binh Dinh Pharma’s Net Income Falls 20% Amid Rising Capital Costs and R&D Investments

Bidiphar (HOSE: DBD) has released its consolidated Q3 2025 financial report. Despite significant cost-cutting measures, the company experienced a decline in profits compared to the same period last year, primarily due to rising production costs and losses recorded from its joint ventures and associates.

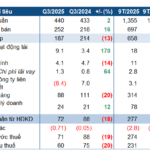

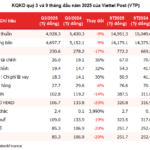

Viettel Post Reports Nearly VND 252 Billion Profit in 9 Months, Operating Cash Flow Turns Positive by Over VND 800 Billion

By the end of Q3, Viettel Post Corporation (Viettel Post, HOSE: VTP) held nearly VND 2.3 trillion in bank deposits, a 24% increase from the beginning of the year. The company’s operating cash flow turned positive, exceeding VND 800 billion, while cumulative net profit for the first nine months reached nearly VND 252 billion.