On October 31, the ABS Board of Directors passed a resolution to relieve Mr. Nhâm Hà Hải of his position as CEO and terminate his employment contract effective November 1, 2025. Mr. Hải had previously submitted his resignation on October 28.

Concurrently, ABS appointed Mr. Nguyễn Quang Đạt as the new CEO for a two-year term, commencing on November 1, 2025.

Mr. Nguyễn Quang Đạt Appointed as ABS CEO

|

Born in 1985 in Hanoi, Mr. Đạt is also a founding shareholder of DATS Capital Joint Stock Company (DATS Capital).

DATS Capital, established in April 2024 and headquartered in Hanoi, specializes in investment consulting services (excluding financial, accounting, and legal consulting).

The company has a registered capital of 1.5 billion VND, with three founding shareholders: Mr. Nguyễn Quang Đạt (66.667%), Ms. Nguyễn Thị Minh Phương (Mr. Đạt’s spouse, 26.667%), and Mr. Nguyễn Quang Đức (6.666%). Mr. Đạt serves as both CEO and legal representative.

Previously, Mr. Đạt held a brief tenure as Deputy CEO of Aseansc Securities from August to September 2025. He also served as CEO of Royal International Securities JSC (later UP Securities) from June 2024 to January 2025.

His career spans several prominent securities firms, including VNDIRECT, Mirae Asset, AIS, and the technology company DATX Vietnam.

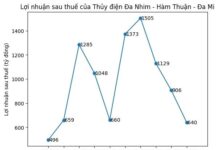

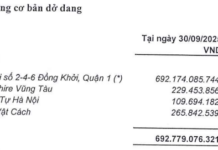

Returning to ABS, the company recently released its Q3 2025 financial report, showcasing robust growth in line with industry trends.

ABS recorded over 140 billion VND in operating revenue, a 59% increase year-over-year. Key revenue drivers included lending, brokerage, hold-to-maturity investments, and proprietary trading. After expenses, net profit reached over 46 billion VND, up 73%.

Q3 results propelled nine-month pre-tax profit to nearly 131 billion VND, a 26% increase year-over-year and 65% of the annual target. Net profit for the nine-month period totaled 105 billion VND, up 26%.

| ABS Nine-Month Profit Trends in Recent Years |

– 08:53 01/11/2025

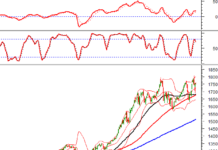

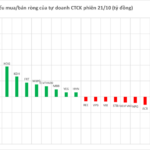

Blue-Chip Stock Code Witnessed Abnormal Accumulation of Over 100 Billion VND by Securities Company’s Proprietary Trading Desk on October 30th Session

Proprietary trading firms have resumed net buying on the Ho Chi Minh Stock Exchange (HOSE), with a total net purchase of VND 82 billion. This marks a significant shift in market sentiment, as these firms leverage their expertise to capitalize on emerging opportunities within Vietnam’s dynamic equity landscape.