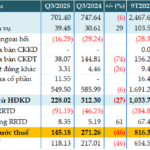

Bac A Commercial Joint Stock Bank (Bac A Bank) has once again raised its savings interest rates across multiple terms, with the highest listed rate reaching up to 6.5% per annum. This marks the third interest rate hike by Bac A Bank since the beginning of October. Following these consecutive increases, the mobilization interest rates at Bac A Bank have risen by 0.45%-0.65% per annum.

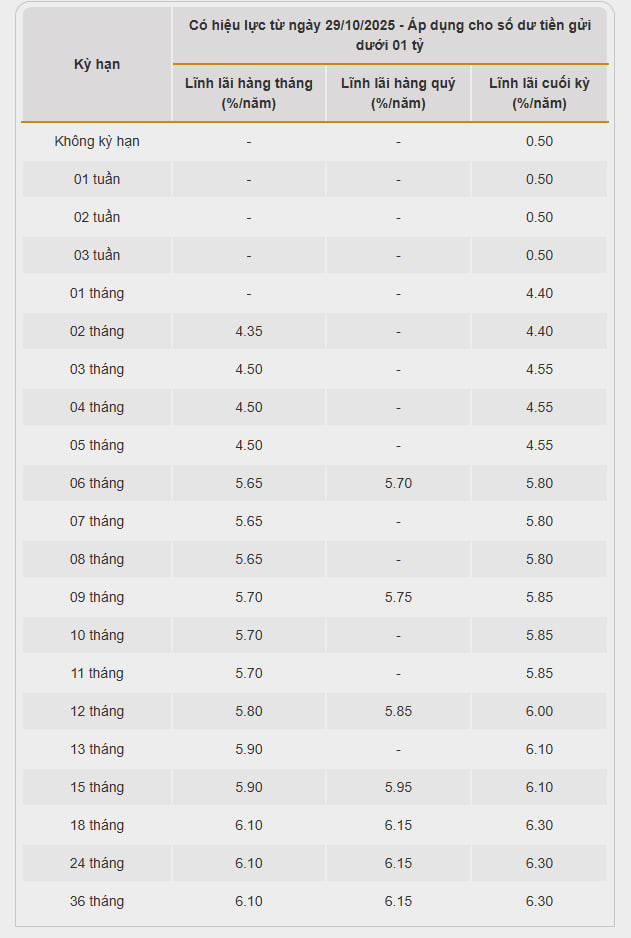

According to the latest mobilization interest rate schedule for deposits under 1 billion VND (interest paid at maturity), Bac A Bank has adjusted the rates for 1-2 month terms by an additional 0.2% per annum, bringing it to 4.4% per annum, while maintaining the 3-5 month term at 4.55% per annum.

For terms of 6 months and longer, interest rates have uniformly increased by 0.2% per annum to the following new levels: 6-8 months at 5.8% per annum, 9-11 months at 5.85% per annum, 12 months reaching 6.0% per annum, and 13-15 months at 6.1% per annum. The highest interest rate for deposits under 1 billion VND is 6.3% per annum, applicable to terms from 18 to 36 months.

Source: Bac A Bank

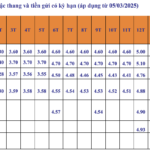

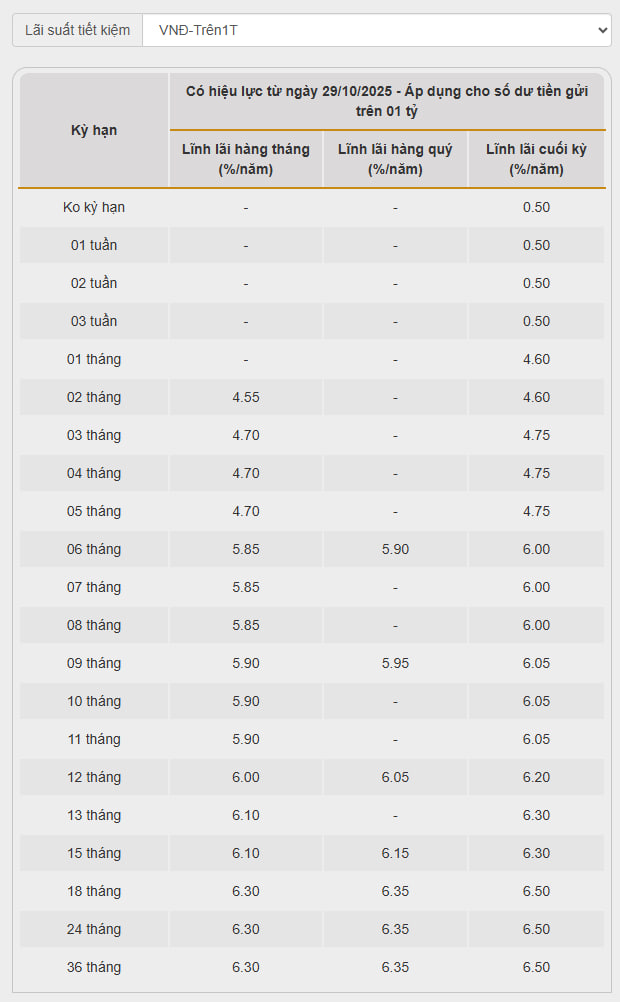

For deposits of 1 billion VND and above, Bac A Bank has also increased rates by 0.2% per annum for terms of 1-2 months and 6-36 months.

Specifically, the interest rate for 1-2 month terms has risen to 4.6% per annum, while the 3-5 month term remains at 4.75% per annum, having reached the regulatory cap. With an additional 0.2% per annum increase, the savings interest rate for 6-8 month terms for deposits of 1 billion VND and above at Bac A Bank has officially risen to 6% per annum, and the latest rate for 9-11 month terms is 6.05% per annum.

The latest savings interest rate for 12-month terms has also increased to 6.2% per annum, and for 13-15 month terms, it has risen to 6.3% per annum, reaching 6.5% per annum for terms from 18 to 36 months.

With this interest rate schedule, Bac A Bank currently offers the highest mobilization interest rates in the system across most terms.

Source: Bac A Bank

Savings Interest Rates on the Rise

In late October, banks collectively raised interest rates and launched significant incentives to attract deposits, responding to the surge in demand for medium and long-term capital as the year-end approaches.

October: 6 Banks Simultaneously Hike Savings Interest Rates, One Offering Up to 6.3% Annually

Since early October, six banks—GPBank, NCB, Vikki Bank, Bac A Bank, VCBNeo, and HDBank—have raised their savings interest rates, according to recent statistics.