Illustrative image

After over a decade of robust investment, China is solidifying its leadership in the global electric vehicle (EV) industry through a strategic global expansion.

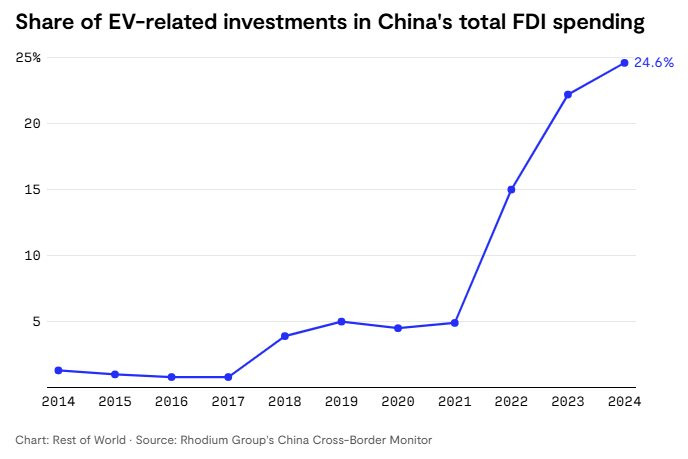

Data from the Rhodium Group reveals that between 2014 and 2025, major Chinese EV and battery corporations like CATL, BYD, and others invested a total of $143 billion in EV and battery production projects abroad.

China’s overseas investment network in the EV industry to date

While Europe was previously the primary destination for Chinese capital, since 2024, investments have shifted significantly to Asia, Africa, and Latin America—regions rich in resources, low in costs, and experiencing rapid growth in EV demand. For the first time, China’s overseas EV investments have surpassed domestic investments.

China’s EV investments as a share of total FDI continue to grow strongly.

Bill Russo, founder and CEO of Automobility Limited (Shanghai), notes, “This is a strategic move to secure the entire value chain, from raw materials to finished products. It’s a critical strategy amid rising geopolitical tensions and trade barriers.”

The top two recipients of Chinese investment are Indonesia ($22 billion) and Hungary ($18 billion).

In Europe, Hungary is emerging as the second-largest battery production hub outside China, thanks to Prime Minister Viktor Orbán’s government’s generous tax incentives and infrastructure support. The country maintains close ties with Beijing, countering the EU’s trend of reducing dependence on China.

Meanwhile, Indonesia has become the world’s nickel hub, supplying over two-thirds of global demand. Its 2014 ban on raw ore exports has made it a strategic destination for Chinese firms, fostering a closed-loop supply chain—from mining and refining to battery and EV production.

Indonesia aims to have 2 million electric cars and 12 million electric motorcycles on its roads by 2030. Analysts suggest Japan’s lag in EVs has opened opportunities for China to dominate the Asian market.

CATL, the world’s largest battery manufacturer, has invested in large-scale projects in Germany, Hungary, Indonesia, and Spain. Its 100 GWh plant in Hungary is set to launch in 2026, while its $6 billion project in Indonesia began earlier this year, aiming to complete a global battery supply chain.

BYD, China’s largest EV brand, is building its first European passenger car factory in Hungary and a $1 billion project in West Java, Indonesia, slated for completion in early 2026.

According to Rhodium, in Q2 2025, over 75% of China’s raw material investments shifted to Africa—surpassing Asia and Latin America for the first time. Morocco, Nigeria, and Latin American countries like Mexico and Brazil are emerging as new EV and battery production hubs.

Despite substantial investments, overseas project completion rates remain lower than domestic ones. Rhodium reports only 25% of announced overseas projects are completed, compared to 45% in China; cancellation rates are also twice as high. Companies face challenges with legal regulations, labor, and local opposition to imported workers.

Professor Louis Brennan (Trinity College Dublin) observes, “Planning approvals in China are far quicker than abroad. Additionally, reliance on Chinese labor in factory construction often sparks local controversy.”

Despite these challenges, experts predict China’s global expansion will continue. Bill Russo emphasizes, “Even if only a fraction of these projects are completed, it underscores China’s clear goal: reshaping the global EV supply chain around its industrial and geopolitical interests.”

Source: Rest of World

Q1 2025-2026: AgriS Sustains Steady Growth Momentum, Accelerates Strategic Execution for the Next Phase of Development

AgriS consistently delivers operational efficiency and sustained growth, even as the market enters a phase of cyclical adjustment.

Germany Discovers Massive Lithium Deposit, Poised to Reshape the Global Electric Vehicle Industry

Unveiling a staggering 43 million ton lithium reserve, this newfound deposit holds the potential to revolutionize Europe’s electric vehicle landscape. By significantly reducing reliance on Chinese imports, it paves the way for Europe to emerge as a dominant force in the global EV supply chain.