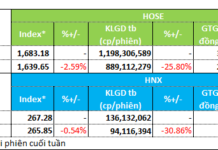

The stock market experienced a volatile final week of October. The week began with a sharp decline in the opening session, but quickly rebounded to around 1,675 points in the following session, driven by strong buying interest in several large-cap stocks. Throughout the week, market sentiment remained divided, with selling pressure primarily emanating from large-cap stocks, causing the overall index to continue its downward trend. Conversely, mid-cap and small-cap stocks witnessed more active participation, particularly in sectors that had not seen significant gains recently. By the end of the week, the VN-Index closed at 1,639.65 points, down 43.53 points (-2.59%) from the previous week.

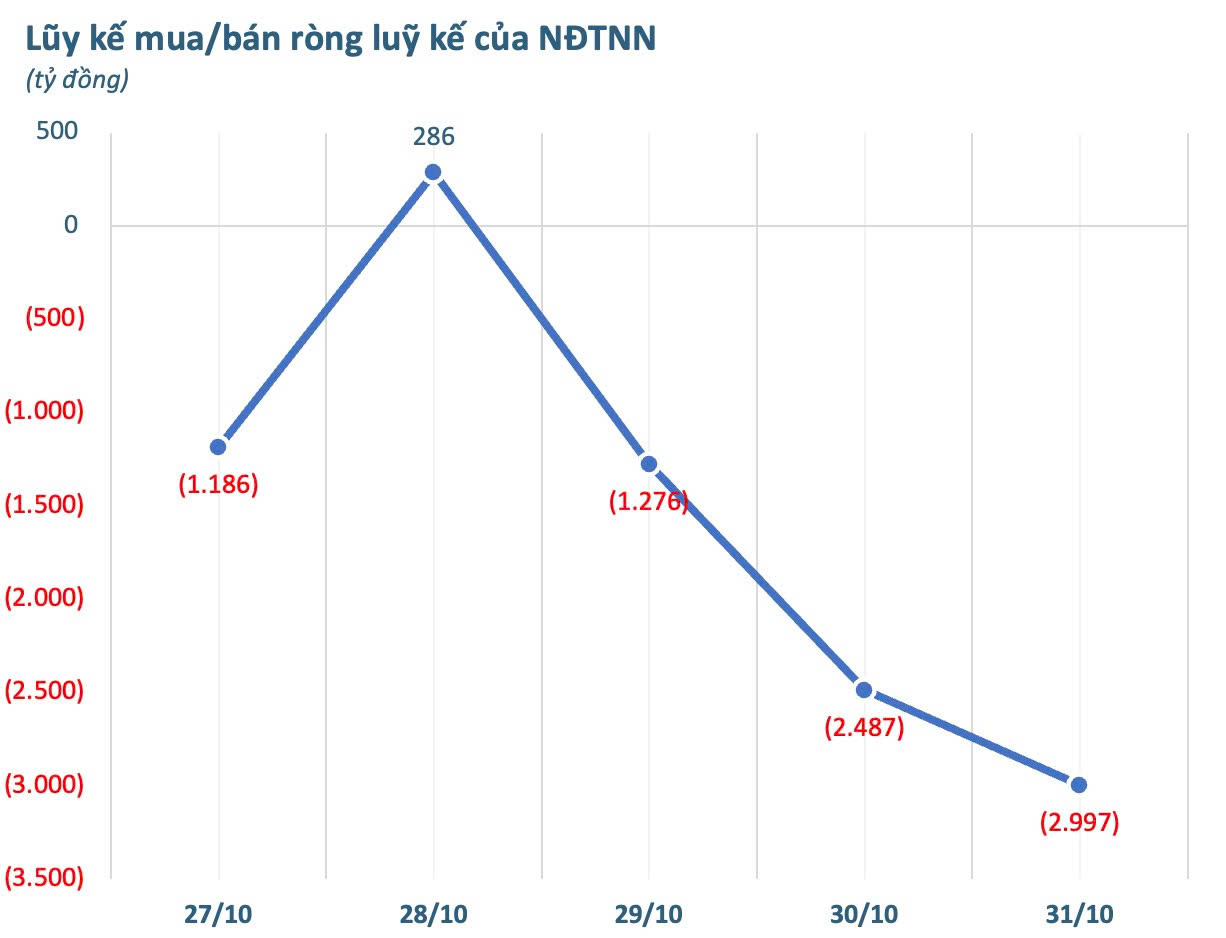

Foreign investors continued their net selling streak, with outflows reaching thousands of billions of dong per session. The sole exception was on October 28th, when foreign investors turned net buyers. Over the five sessions, foreign investors net sold a total of VND 2,997 billion across the market.

Breaking it down by exchange, foreign investors net sold VND 2,659 billion on HoSE, VND 358 billion on HNX, and net bought VND 20 billion on UPCoM.

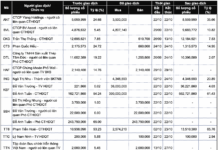

Among individual stocks, MBB faced the heaviest selling pressure, with a net outflow of VND 1,185 billion. SSI followed closely behind with VND 937 billion in net selling, while VIX (-VND 470 billion) and HPG (-VND 277 billion) also experienced significant outflows. Other large-cap stocks under withdrawal pressure included VIC (-VND 212 billion), CEO (-VND 210 billion), CTG (-VND 203 billion), and VCI (-VND 160 billion). PDR, HDC, VND, and VHM also saw net selling ranging from VND 147 billion to VND 158 billion each.

On the buying side, FPT led the way with a net inflow of VND 1,350 billion, making it the most heavily accumulated stock by foreign investors for the week. VPB followed with VND 286 billion, HDB with VND 225 billion, and VRE with VND 160 billion. HAH (VND 141 billion), TCB (VND 101 billion), and STB (VND 87 billion) also attracted significant foreign interest. Additionally, LPB, VJC, KDH, FRT, and MWG recorded net buying values ranging from VND 50 billion to nearly VND 80 billion.

IR AWARDS: November 2025 Disclosure Schedule Highlights

In November, the stock market anticipates several key information disclosure events, including the release of the Purchasing Managers’ Index (PMI), the effective HNX30 Index portfolio, the October socio-economic report, the deadline for the reviewed (non-mandatory) Q3 financial statements, the announcement and effectiveness of the MSCI Index portfolio, and the maturity of the 41I1FB000 bond.

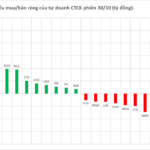

Blue-Chip Stock Code Witnessed Abnormal Accumulation of Over 100 Billion VND by Securities Company’s Proprietary Trading Desk on October 30th Session

Proprietary trading firms have resumed net buying on the Ho Chi Minh Stock Exchange (HOSE), with a total net purchase of VND 82 billion. This marks a significant shift in market sentiment, as these firms leverage their expertise to capitalize on emerging opportunities within Vietnam’s dynamic equity landscape.