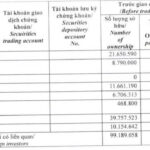

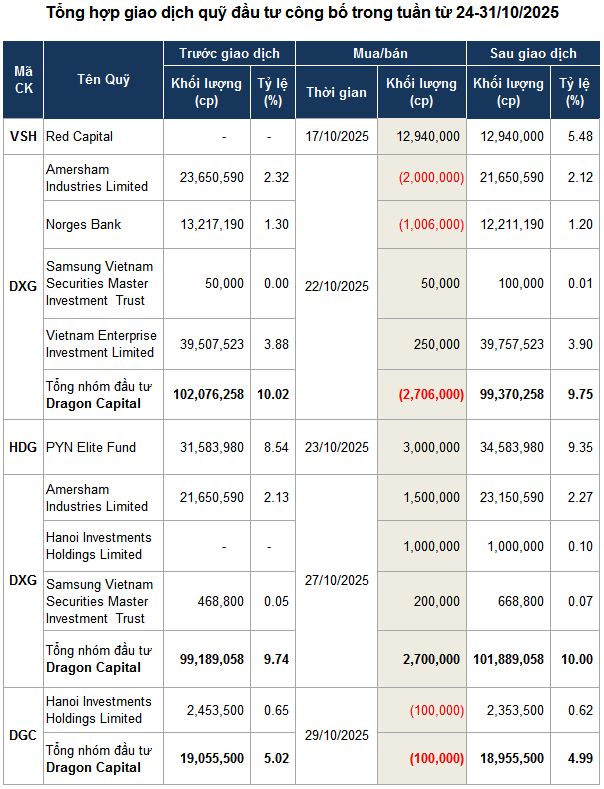

A notable focus is on Dragon Capital. After a series of net selling of DXG (Dat Xanh Group) shares from mid-October, totaling over 11.5 million shares, the fund unexpectedly returned to buy 2.7 million DXG shares on October 27th, raising its ownership stake back to 10%, equivalent to nearly 101 million shares.

| Performance of DXG stock from the beginning of 2025 to the session of October 31, 2025 |

Based on the closing price of October 27th, Dragon Capital spent approximately VND 55 billion to increase its holdings in this real estate company. Previously, during the period from September 24th to October 23rd, the price of DXG had corrected by about 12%.

| Performance of DGC stock from the beginning of 2025 to the session of October 31 |

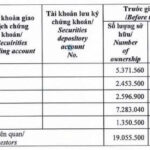

Conversely, Dragon Capital sold 100,000 shares of DGC (Duc Giang Chemicals Group) on October 29th, ceasing to be a major shareholder as its ownership fell below 5%, equivalent to nearly 19 million shares. Based on the closing price of the same day, the fund earned approximately VND 9 billion from this transaction.

This divestment move occurred after Duc Giang announced its Q3/2025 business results with a net profit of over VND 752 billion, up 6% year-on-year, despite a slight decline in gross margin due to increased input costs. For the first nine months, DGC achieved VND 8.5 trillion in net revenue (up 14%) and VND 2.4 trillion in post-tax profit (up 7%), fulfilling 82% and 84% of its 2025 annual plan, respectively.

Following the positive results announcement, DGC shares recorded four consecutive sessions of increase from October 24th to 29th, rising from VND 91,000 to VND 94,400 per share, corresponding to a gain of over 3%.

Source: VietstockFinance

|

– 07:28 02/11/2025

Landmark Group Expands Workforce by 1,000 in 9 Months, Secures Over 2.9 Trillion VND in Personal Prepayments for Apartment Purchases

As of Q3/2025, Dat Xanh Group Corporation (HOSE: DXG) holds over VND 2.9 trillion in customer deposits for apartment pre-sales, nearly tripling the figure from the beginning of the year and marking a 70% increase from the previous quarter.