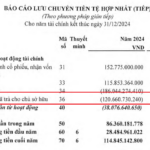

The recently released financial report reveals that in Q3, QCG made an additional payment of VND 800 billion to Sunny Island Investment Corporation (CTCP Đầu tư Sunny Island), the recipient of the Bắc Phước Kiển project transfer in Nhà Bè. By Q4, another VND 200 billion was disbursed. Consequently, QCG has paid a total of VND 1.1 trillion to this partner since the beginning of the year, reducing the outstanding balance to approximately VND 1.78 trillion.

On July 3rd, QCG submitted VND 500 billion to the Ho Chi Minh City Civil Judgment Enforcement Agency, followed by an additional VND 200 billion on October 24th. These payments stem from the legal dispute over the Bắc Phước Kiển project, a 65-hectare plot in Nhà Bè considered a “key asset” for QCG, which has been entangled in prolonged litigation.

Related-party payables surge in late Q3. Source: QCG’s Q3/2025 Financial Report

|

The project was initially transferred to Sunny Island between 2016 and 2017. Per the agreement, Sunny Island was to pay a total of VND 4.8 trillion in installments to acquire land-use rights. However, after disbursing VND 2.88 trillion, the partner halted payments, stalling the transaction. The case was later linked to Trương Mỹ Lan and Vạn Thịnh Phát Group.

At the 2024 Annual General Meeting, CEO Nguyễn Quốc Cường emphasized that Bắc Phước Kiển is a “critical” project, necessitating the full payment of VND 2.88 trillion to reclaim project documents, land titles, and legal rights. A year later, he noted that the recovery process is ongoing, with payments scheduled from Q3/2025 and expected completion by mid-2027.

According to Mr. Cường, the Bắc Phước Kiển residential area spans nearly 100 hectares with over 1.5 million square meters of floor space, connecting major routes to Cần Giờ, the Mekong Delta, and Long Thành Airport. He likened the project’s scale to “half of Phú Mỹ Hưng,” highlighting its long-term potential despite exceeding QCG‘s current investment capacity. As of May 2025, compensation has reached 85% of the area.

QCG is determined to reclaim the Bắc Phước Kiển project – Photo: Tử Kính

|

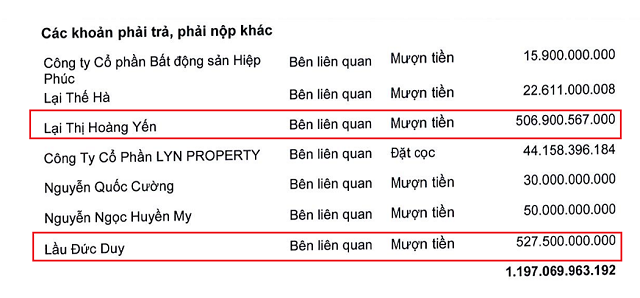

Alongside the substantial payments for project obligations, QCG has significantly increased borrowing from related parties. By the end of Q3, the company recorded personal loans exceeding VND 1.1 trillion, primarily from leadership associates. Notably, VND 507 billion was borrowed from Lại Thị Hoàng Yến, daughter of Chairman Lại Thế Hà, and over VND 527 billion from Lầu Đức Duy, brother-in-law of Nguyễn Quốc Cường.

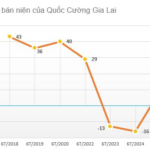

Personal borrowings by QCG surge. Source: QCG’s Q3/2025 Financial Report

|

In terms of operations, QCG‘s Q3 revenue dropped 37% to approximately VND 111 billion, primarily due to reduced apartment handovers. Net profit reached nearly VND 24 billion, a slight decrease year-on-year. Real estate contributed only VND 45 billion, down nearly 60% from Q3 last year.

For the first nine months, revenue totaled VND 354 billion, up 46%; pre-tax profit reached VND 46 billion, over four times higher than the same period last year and the highest since 2019. Nonetheless, these figures fall short of the annual targets of VND 2 trillion in revenue and VND 300 billion in pre-tax profit.

Previously, QCG‘s CEO mentioned plans to divest from the hydropower sector to fund judgment enforcement obligations, but no progress has been reported. Meanwhile, the first phase of the Marina Đà Nẵng project, expected to generate VND 700 billion in revenue this year, has only contributed nearly VND 222 billion in real estate revenue after three quarters.

As of Q3, QCG‘s total assets remained stable at VND 8.7 trillion. Cash and bank deposits stood at VND 154 billion, inventory at VND 1.17 trillion, and outstanding loans at approximately VND 360 billion.

| QCG’s 9-month net profit hits a 6-year high |

– 10:50 01/11/2025

Why Is Quoc Cuong Gia Lai Under Scrutiny for Going-Concern Uncertainties?

The audit has raised concerns about the company’s ability to continue operating, as its short-term debt doubles its short-term assets. Furthermore, the company’s involvement in the Phuoc Kien project has resulted in additional debt of VND 2,782.8 billion.

“QCG Makes a $100 Million Payment to Sunny Island, Profits in Second Quarter from Condo Handovers.”

The consolidated financial statements for the second quarter of 2025 of Quoc Cuong Gia Lai Joint Stock Company (HOSE: QCG) revealed a decrease in debt obligations to Sunny Island Investment Joint Stock Company by VND 100 billion, resulting in a remaining debt of VND 2.78 trillion. This financial liability stems from a dispute over the North Phuoc Kien residential project in Nha Be, dating back to 2016-2017.