Surpassing Targets

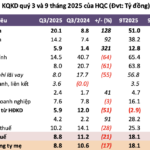

In Q3 this year, Saigon Thuong Tin Real Estate Joint Stock Company (TTC Land – stock code: SCR) achieved a net revenue of nearly VND 432 billion, 2.3 times higher than the same period last year. However, financial revenue decreased by half to VND 42 billion, and business management costs surged dramatically to nearly VND 160 billion, 97 times higher than the same period—primarily due to a provision of over VND 140 billion for bad debts. As a result, SCR’s net profit was just over VND 1 billion but still doubled compared to the same period last year.

TTC Land has exceeded 19% of its revenue plan and 25% of its pre-tax profit target for 2025.

For the first nine months, TTC Land achieved a net revenue of over VND 950 billion, 2.9 times higher than the same period last year. The growth driver for SCR came from the construction segment, which reached nearly VND 230 billion—50 times higher—and real estate, which reached nearly VND 314 billion—3.9 times higher. Net profit was over VND 32 billion—18 times higher than the same period last year. Thus, TTC Land has exceeded 19% of its revenue plan and 25% of its pre-tax profit target for 2025.

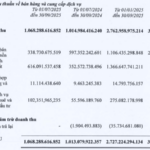

As of September 30, TTC Land’s total assets were nearly VND 13,019 billion, a 10% increase from the beginning of the year. Cash and cash equivalents increased by 81% to over VND 317 billion, and inventory rose by 7% to nearly VND 3,575 billion. Liabilities totaled over VND 7,523 billion, an 18% increase from the beginning of the year.

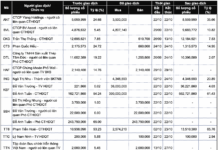

Thu Duc House Development Joint Stock Company (Thuduc House – stock code: TDH) recorded a net revenue of nearly VND 36 billion in Q3/2025, more than 5 times higher than the same period last year. Although net operating profit for the period was a loss of over VND 3 billion, a sudden gain of nearly VND 88 billion from other sources helped TDH avoid losses, resulting in a net profit of over VND 84 billion in Q3/2025—nearly 3 times higher than the same period last year.

For the first nine months of the year, TDH achieved a net revenue of over VND 61 billion, a 67% increase. Meanwhile, net operating loss was over VND 8 billion. Thanks to gains from other sources, TDH avoided losses and achieved a net profit of over VND 103 billion, exceeding 56% of the annual plan.

TDH avoided losses and achieved a net profit of over VND 103 billion, exceeding 56% of the annual plan.

Dat Xanh Real Estate Services Joint Stock Company (stock code: DXS) recorded a net revenue of over VND 864 billion in Q3/2025, a 49% increase compared to the same period last year. Real estate brokerage activities in a recovering market generated over VND 633 billion in revenue, a 74% increase. The brokerage segment contributed a gross profit of nearly VND 367 billion, equivalent to a gross margin of nearly 58%. Meanwhile, the segment selling apartments, townhouses, and land plots had a gross margin of 44%. After deducting expenses, DXS achieved a net profit of nearly VND 78 billion in Q3, 2.2 times higher than the same period last year.

For the first nine months of the year, DXS recorded a net revenue of over VND 2,300 billion (a 29% increase) and a net profit of nearly VND 334 billion (3.2 times higher than the same period last year).

As of September 30, DXS’s total assets were nearly VND 17,000 billion, a 13% increase from the beginning of the year. The largest component was short-term receivables, which increased by 14% to nearly VND 10,500 billion—accounting for 62% of total assets. Liabilities increased by 23% to nearly VND 8,300 billion.

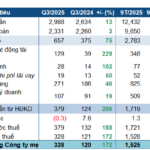

In Q3, Khang Dien House Investment and Trading Joint Stock Company (stock code: KDH) achieved a consolidated net revenue of nearly VND 1,100 billion, 4.4 times higher than the same period last year—primarily from real estate transfers.

After nine months, KDH has achieved over 84% of its profit plan.

KDH’s net profit in Q3 was nearly VND 236 billion, 3.4 times higher than the same period last year. This result helped KDH’s nine-month cumulative net profit reach nearly VND 557 billion, a 35% increase. Thus, after nine months, KDH has achieved over 84% of its profit plan.

Profits Multiply Tenfold

Nam Long Investment Joint Stock Company (stock code: NLG) announced its Q3 financial report with a net revenue of VND 1,877 billion, 5 times higher than the same period in 2024. Financial revenue increased by over 35% to VND 29 billion. After deducting expenses, the company recorded a net profit of nearly VND 146 billion, 24 times higher than the same period last year.

For the first nine months, net revenue reached nearly VND 3,941 billion (nearly 5 times higher than the same period), and profit after tax for the parent company’s shareholders was VND 354 billion (a nearly 24-fold increase). This result was primarily driven by handovers at Akari City (VND 967 billion), Can Tho II – Central Lake (VND 1,529 billion), and Southgate (VND 983 billion).

For the first nine months, CEO Group Joint Stock Company (stock code: CEO) achieved VND 990 billion in revenue (a 7% increase compared to the same period last year) and VND 148 billion in profit after tax (a 45% increase). After nine months, the company has completed 64% of its revenue plan and 81% of its profit plan for the year.

In the first nine months of this year, Phat Dat recorded over VND 964 billion in net revenue and over VND 201 billion in profit after tax.

In Q3 this year, Phat Dat Real Estate Development Joint Stock Company (stock code: PDR) recorded a net revenue of over VND 506 billion. Gross profit on separate and consolidated financial statements reached VND 249 billion and VND 250 billion, respectively, a significant increase from VND 1.3 billion in the same period last year.

For the first nine months, Phat Dat recorded over VND 964 billion in net revenue and over VND 201 billion in profit after tax, increases of over 450% and 31%, respectively, compared to the same period last year. Gross margin was approximately 49%.

Notably, PDR’s net cash flow from operating and financial activities turned positive, reaching nearly VND 91 billion—a significant change from the same period last year. Cash and cash equivalents at the end of Q3/2025 were VND 116 billion, more than four times higher than the beginning of the year.

DCM Profits Surge 2.7x Year-on-Year, Achieving 200% of Annual Plan in 9 Months

PetroVietnam Fertilizer and Chemicals Corporation (PVFCCo or Ca Mau Fertilizer, HOSE: DCM) reported robust earnings in Q3/2025, closely aligning with preliminary estimates. Over the first nine months, the company’s cumulative profit surged by 45%, surpassing its full-year target by an impressive 200%.

Vietnam Airlines Reports Record Profits: Over 600 Billion VND in Q3 Net Income

As of the end of Q3, Vietnam Airlines held a total of nearly VND 18.2 trillion in cash, cash equivalents, and term deposits, accounting for approximately 25% of its total assets.