Understanding Vietnam’s Social Insurance Pension Scheme

According to the new regulations, female workers will receive a monthly pension equivalent to 45% of their average social insurance contribution, corresponding to 15 years of contributions, with an additional 2% for each extra year, up to a maximum of 75%.

For male workers, the monthly pension starts at 45% of the average social insurance contribution after 20 years of contributions, increasing by 2% annually, also capped at 75%.

In cases where male workers have contributed for 15 to 20 years, their monthly pension will be 40% of the average contribution, rising by 1% for each additional year.

The 2024 Social Insurance Law, effective from July 1, 2025, introduces a new pension calculation method for male workers with 15 to 20 years of contributions, in addition to the existing provisions for female workers.

As per Articles 66 and 72 of the 2024 Social Insurance Law, the monthly pension is calculated as follows:

Monthly Pension = (Pension Rate) × (Average Monthly Contribution)

For workers under the state-regulated salary system, the average monthly contribution is calculated based on the following periods:

- Before January 1, 1995: Average of the last 5 years’ contributions.

- January 1, 1995 – January 1, 2000: Average of the last 6 years’ contributions.

- January 1, 2001 – December 31, 2006: Average of the last 8 years’ contributions.

- January 1, 2007 – December 31, 2015: Average of the last 10 years’ contributions.

Thus, a female worker retiring in 2025 with 32 years of contributions will receive a pension at 75% of her average monthly contribution.

A male worker with the same contribution period will receive a pension at 69%.

Female workers with over 30 years of contributions are eligible for an additional allowance.

Under the 2014 Social Insurance Law, workers with contributions exceeding the years required for a 75% pension rate receive a one-time allowance upon retirement.

The allowance is calculated at 0.5 months of the average monthly contribution for each year beyond the 75% threshold.

The 2024 Social Insurance Law, effective July 1, 2025, updates this provision. Male workers with over 35 years and female workers with over 30 years of contributions will receive this allowance.

From July 1, 2025, the eligibility for the one-time allowance is:

- Over 35 years for male workers.

- Over 30 years for female workers.

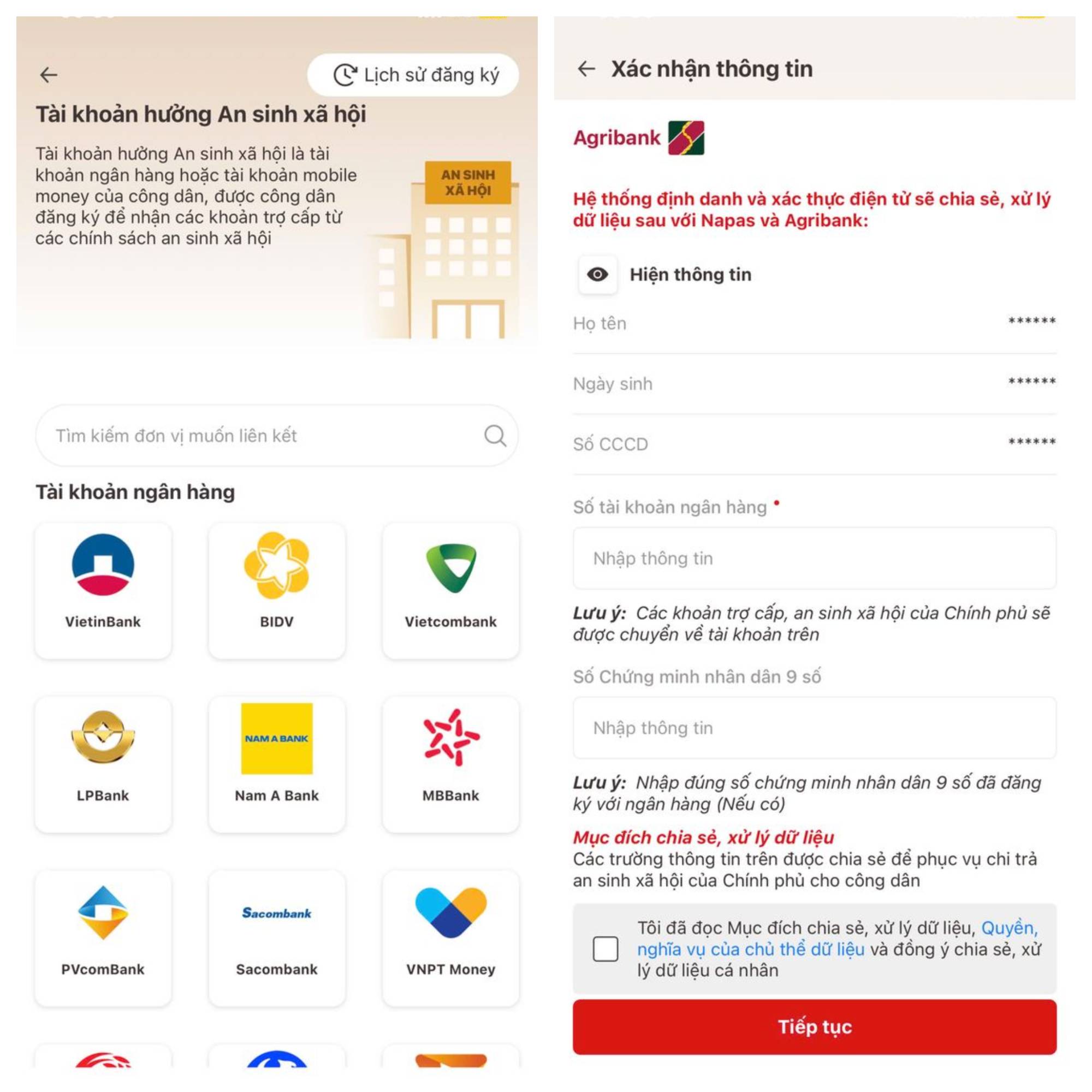

Linking Social Security Accounts on VNeID for Pension Receipt

The Social Security Account is a bank or mobile money account registered by citizens to receive social security benefits.

VNeID’s Level 2 authentication now includes a “Social Security” section for linking personal accounts. Once approved by the Ministry of Public Security, pensions can be received through this account.

Here’s how to link your Social Security Account on VNeID:

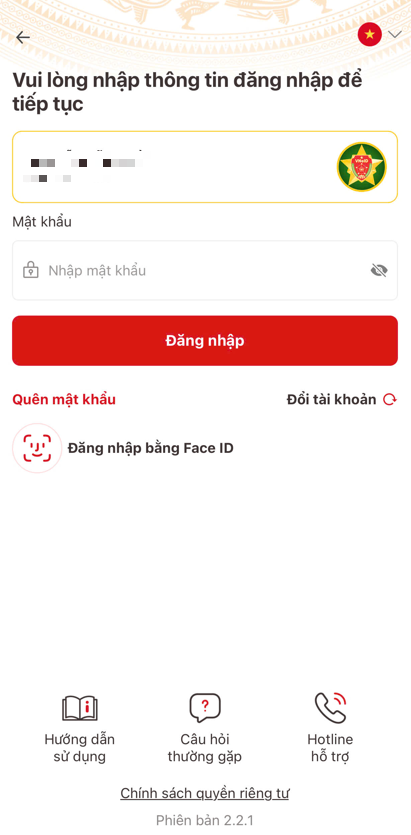

Step 1: Log in to VNeID

Login Screen

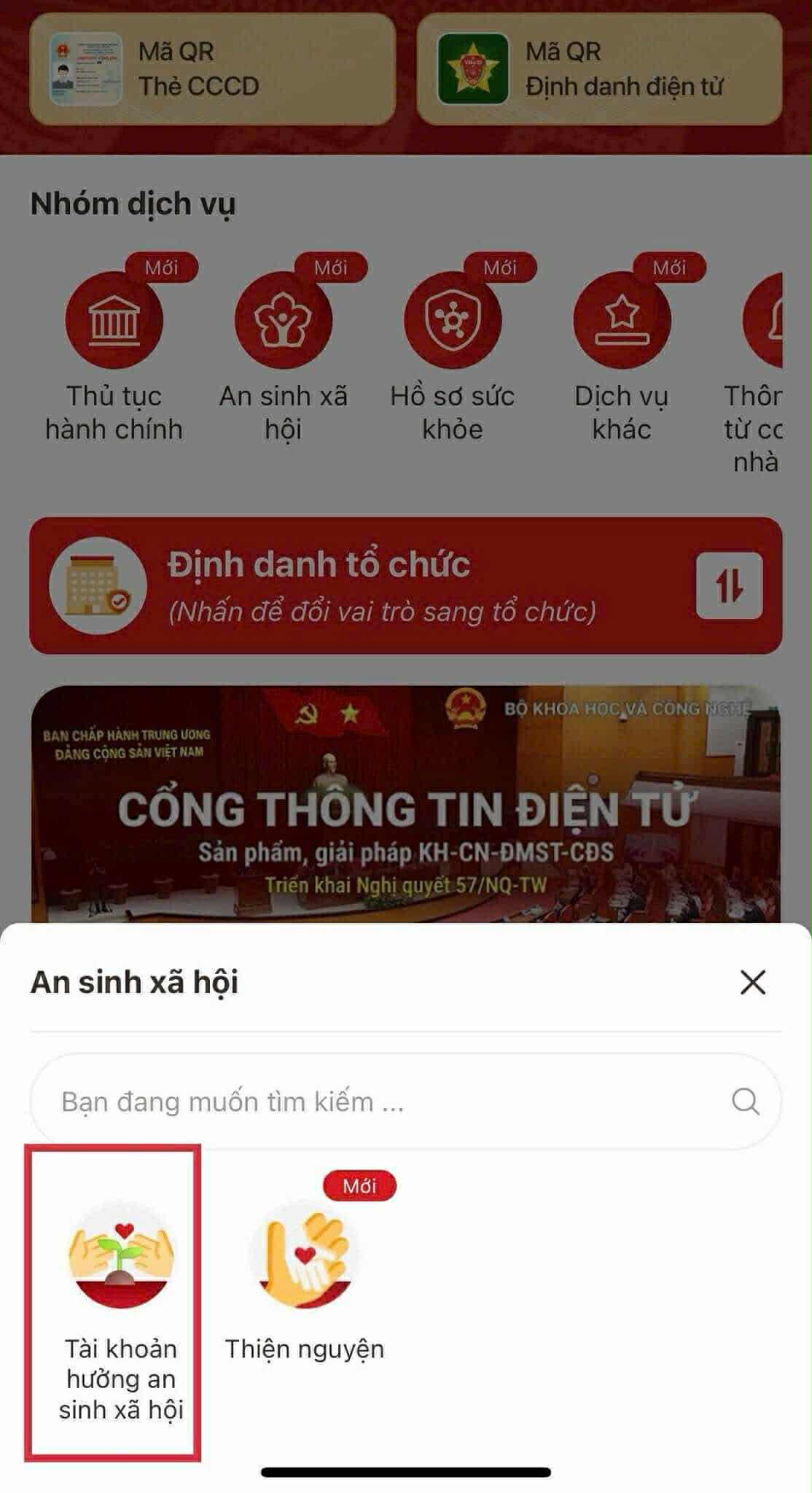

Step 2: Select “Social Security”

Social Security Menu

Step 3: Choose “Social Security Benefit Account”

Benefit Account Selection

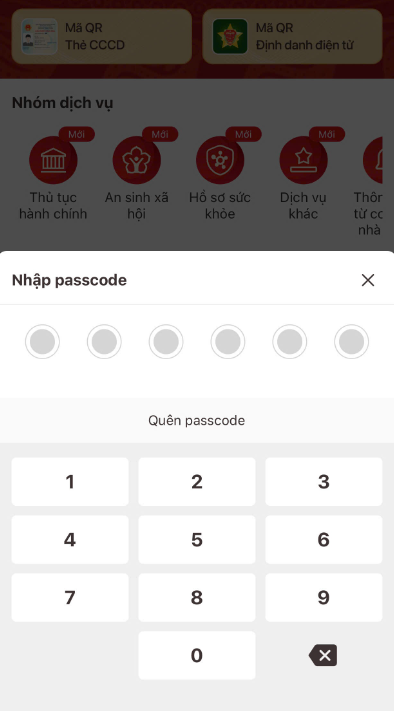

Step 4: Enter 6-digit passcode

Passcode Entry

Step 5: Select bank or mobile money account and enter details.

Account Details Entry

Complete all fields and agree to the data processing terms, then click “Continue” to submit your request.

Step 6: Confirmation

Request Submitted

Maximize Your Retirement: Unlock Monthly Pension Benefits with 24 Years of Social Insurance Contributions

Workers who participate in compulsory social insurance for 24 years will be eligible for monthly pension benefits as per the 2024 Social Insurance Law, with rates ranging from 53% to 63% of their salary.

“Unraveling the Mystery of Retirement Benefits: Navigating the Complex World of Social Security.”

Introducing the intricacies of the Social Insurance Law of 2014, Articles 56 and 74, which outline the calculation of retirement benefits for employees. The law stipulates that an individual’s pension is determined by multiplying the entitlement ratio by the average of their monthly salary and social insurance contributions. This intricate process ensures a secure future for retirees, with their pension serving as a foundation for their golden years.