Song Hong Garment Joint Stock Company (MSH)

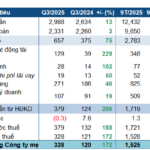

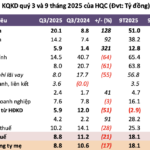

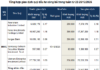

has released its Q3/2025 financial report, revealing a net revenue of VND 1,647 billion, a 6% decrease compared to the same period last year. However, a significant 13% reduction in cost of goods sold (COGS) led to a 32% surge in gross profit, reaching VND 350 billion.

Simultaneously, the company’s financial revenue increased by 32% year-over-year to VND 57 billion.

During the quarter, MSH recorded an VND 8 billion loss from its joint ventures and associates. Selling expenses and administrative costs rose by 6% and 38%, respectively, compared to Q3/2024.

As a result, MSH’s after-tax profit reached nearly VND 201 billion, a 54% increase from the same period in 2024, marking the highest profit in the company’s history.

In the first nine months of 2025, MSH’s cumulative net revenue reached VND 4,150 billion, an 8% increase, with after-tax profit soaring by 73% to VND 468 billion.

For 2025, Song Hong Garment aims for a revenue of VND 5,500 billion and pre-tax profit of VND 600 billion, representing 4% and 11% growth, respectively, compared to 2024. This profit target is the highest in the company’s history. After nine months, MSH has achieved 75% of its revenue target and 95% of its profit goal.

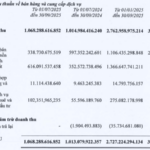

As of September 30, 2025, MSH’s total assets stood at VND 4,960 billion, a nearly 10% increase from the beginning of the year. Cash, cash equivalents, and deposits reached nearly VND 2,000 billion, a 29% jump.

On the liabilities side, total debt was VND 2,480 billion, primarily short-term. The company’s short-term and long-term financial debt amounted to VND 1,300 billion. Equity reached VND 2,450 billion, with undistributed after-tax profit exceeding VND 860 billion by the end of Q3.

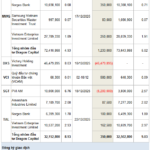

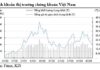

In the stock market, despite the VN-Index facing heavy selling pressure, MSH shares surged to their ceiling price on October 31st. The stock price climbed to VND 38,800 per share, reaching a nearly three-month high.

Vietnamese Private Conglomerate Surpasses $43 Billion in Assets

Billionaire Pham Nhat Vuong’s Vingroup boasts a staggering total asset value exceeding 1 quadrillion VND, reporting a remarkable 1.9x surge in profits compared to the same period last year.

Real Estate Businesses Reap Massive Profits

In just nine months this year, TTC Land has surpassed 25% of its pre-tax profit target for 2025. Meanwhile, Thuduc House achieved a net profit of over 103 billion VND, exceeding its annual plan by 56%. Other real estate leaders such as Dat Xanh, Nha Khang Dien, Nam Long, CEO, and Phat Dat are also on the brink of meeting their sales targets.

DCM Profits Surge 2.7x Year-on-Year, Achieving 200% of Annual Plan in 9 Months

PetroVietnam Fertilizer and Chemicals Corporation (PVFCCo or Ca Mau Fertilizer, HOSE: DCM) reported robust earnings in Q3/2025, closely aligning with preliminary estimates. Over the first nine months, the company’s cumulative profit surged by 45%, surpassing its full-year target by an impressive 200%.