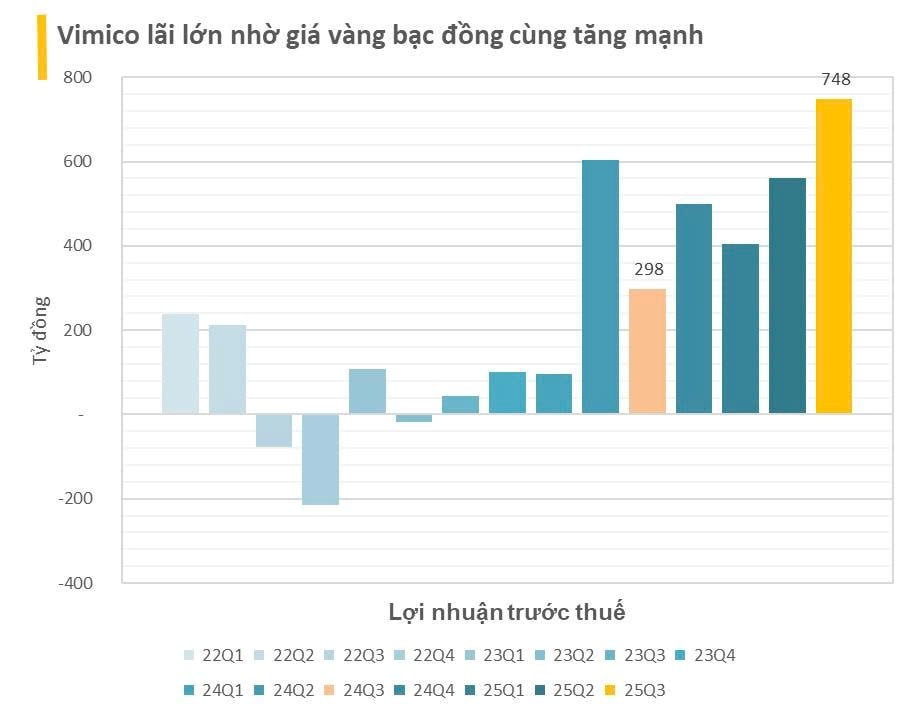

Vietnam’s leading mining company, TKV Mineral Corporation (VIMICO, stock code: KSV), has released its Q3 2025 Consolidated Financial Report, showcasing remarkable business growth.

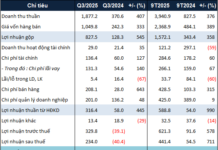

In Q3, VIMICO reported a consolidated after-tax profit (ATP) of nearly VND 594 billion (593,985,722,515), a staggering 148% surge compared to the same period in 2024 (VND 239 billion).

For the first nine months of 2025, KSV achieved VND 10,851 billion in net revenue, a 13% increase year-on-year. Thanks to a significant improvement in profit margins, the 9-month ATP rose by 74% to VND 1,368 billion, surpassing the VND 788 billion recorded in the first nine months of 2024.

Driven by the Surge in Copper and Gold Prices

According to VIMICO’s explanation, the profit surge is attributed to two key factors: increased sales volume and a sharp rise in the average selling prices of strategic products, aligning with the global uptrend in base and precious metal prices.

The growth in selling prices significantly enhanced KSV’s gross profit margin. In Q3 2025, the company’s gross profit reached VND 1,278 billion, a 112% increase from the VND 602 billion recorded in Q3 2024.

Key products contributing to the 9-month profit growth include:

Gold: Average selling price soared by 42.64% to VND 2,478.9 million/kg (up by VND 741 million/kg). Sales volume increased by 136 kg.

Silver: Average selling price rose by 30.46% to VND 22.7 million/kg (up by VND 5.3 million/kg). Sales volume increased by 266 kg.

Copper Sheets: Average selling price increased by 10.07% to VND 251.3 million/ton (up by VND 23 million/ton). Sales volume increased by 1,111 tons.

Zinc Ingots: Average selling price rose by 7.37% to VND 72.8 million/ton (up by VND 5 million/ton). Sales volume increased by 596 tons.

Despite the overall positive picture, some VIMICO subsidiaries reported losses, including Cao Bang Steel JSC (accumulated 9-month loss of over VND 200 billion) and Lai Chau Rare Earth JSC (loss of VND 7.78 billion).

As of September 30, 2025, the company’s total assets reached VND 10,286 billion.

In terms of capital structure, VIMICO demonstrated a clear effort to reduce financial leverage. Total liabilities decreased from VND 5,601 billion to VND 5,319 billion. Short-term loans and finance lease liabilities plummeted by 47%, from VND 2,186 billion (beginning of the year) to just VND 1,149 billion.

TKV Mineral Corporation, a subsidiary of the Vietnam National Coal and Mineral Industries Group (Vinacomin), is the country’s leading enterprise in the extraction, processing, and refining of base and precious metals such as copper, zinc, lead, gold, and silver. The company also manages and operates the Dong Pao mine, the largest rare earth reserve in Vietnam.

For 2025, the company plans to produce 60,716 tons of copper ore, 30,000 tons of copper cathode, 173,681 tons of iron ore, 806 kg of gold, and 2,751 kg of silver.

On the stock market, KSV shares closed at VND 160,000 per share on October 31, a 12% decline compared to October 21.

Gold Prices for SJC and Ring Gold Remain Steady on November 1st

Domestic gold prices on November 1st remained unchanged compared to the previous session’s closing price.

Gold Prices Surge on October 30th Afternoon, Approaching 148 Million VND per Tael

Gold prices made a surprising surge in the afternoon of October 30th, climbing by 1.2 to 1.3 million VND per tael compared to the morning’s 9:00 AM record.